Germany officially has its first Bitcoin treasury firm, as aifinyo is taking up MicroStrategy’s mantle in Europe. The firm wants to buy 10,000 bitcoins by 2027, which would cost $1.1 billion at today’s prices.

The firm already partnered with UTXO to receive its first investment, and it has a solid plan to keep stacking BTC. Still, the whole sector is wobbling under regulatory and stock dilution concerns, which may cut these ambitious plans short.

Germany’s First Bitcoin Treasury

Corporate BTC acquisition has become a massive industry trend in 2025, and it shows no signs of stopping. Digital asset treasury (DAT) firms are continuing to buy Bitcoin, and a new company from Germany is trying to move at a breakneck speed.

According to the firm’s press release, aifinyo is now Germany’s first publicly-traded Bitcoin DAT. The firm announced a $3.5 million investment from UTXO Management, which will be part of a long-term partnership.

Aifinyo will buy Bitcoin exclusively, centering the company’s valuation around BTC acquisitions.

“We’re building Germany’s first corporate Bitcoin machine. Every invoice that aifinyo’s customers pay, will now generate Bitcoin for shareholders. No speculation, no market timing – just systematic accumulation of a deflationary asset,” claimed Stefan Kempf, aifinyo co-founder and Board Chairman.

Its ambition, however, is especially noteworthy. This “German MicroStrategy” aims to purchase 10,000 bitcoins by 2027, requiring over $1.1 billion at today’s prices.

Aifinyo will lean on the initial investment and its preexisting cash reserves, planning to expand “into business accounts and credit cards” next year to create new income streams.

Late to the Party?

Still, this all seems pretty precarious. The firm claimed that Germany is an attractive region to establish a Bitcoin DAT, thanks to its regulatory friendliness.

However, the whole treasury strategy is showing huge red flags, with analysts worrying it could cause a macroeconomic risk to crypto.

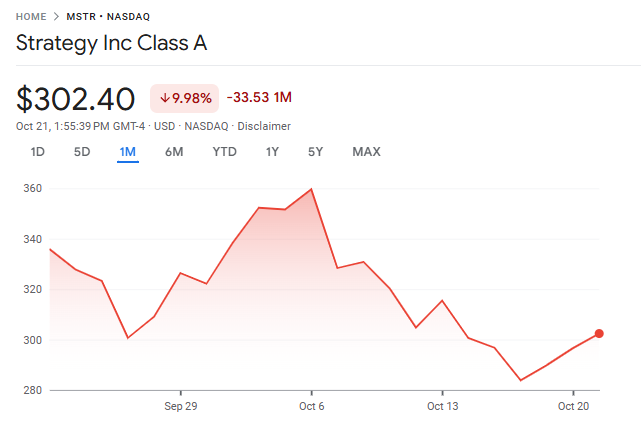

MicroStrategy, the leading Treasury firm, has drastically shrunk its purchases after stock dilution fears. Some firms have developed more investor-friendly approaches, which may or may not be scalable, but the problem is endemic to all DATs.

If aifinyo wants to stockpile BTC fast, it might not have the luxury of a stabler approach.

Moreover, even if this German company can both rapidly acquire Bitcoin and please its shareholders, those aren’t the only concerns. US regulators have started a massive probe into DAT companies over insider trading concerns.

To be clear, this crackdown happened in the US, which is explicitly trying to reduce crypto enforcement. German and European regulators are notoriously more hard-nosed when it comes to Bitcoin, and a company like aifinyo might make an attractive target in the future.

In other words, there are a lot of variables right now. aifinyo might be able to pioneer a revolutionary strategy in a new continent, or it might be a latecomer to the party. However, its commitment shows that DAT acquisition isn’t slowing down yet.