Filecoin (FIL) briefly rose to a monthly high of $4.80 during yesterday’s intraday trading session. This comes after leading asset management firm Grayscale announced the launch of its Grayscale Decentralized AI Fund LLC.

Although it has since shed most of these gains, buying pressure remains significant in the FIL market.

SponsoredFilecoin’s Brief Rally to a Monthly High

Yesterday, Grayscale launched its decentralized AI coins fund. BeinCrypto reported that the fund features five top-weighted AI-based crypto assets, including Filecoin (FIL), Near (NEAR), Render (RNDR), Livepeer (LPT), and Bittensor (TAO).

Following the announcement, FIL soared to $4.80, marking its highest price in the past month. However, the altcoin’s price has been corrected. Exchanging hands at $4.54 as of this writing, its value has since plummeted by 6%.

Despite this decline, buying pressure persists in the FIL market. Its price movements assessed on a 12-hour chart confirm that market participants continue to favor accumulation over distribution.

A major indicator of this is that FIL’s price still exceeds its 20-day exponential moving average.

An asset’s 20-day EMA measures its average price over the past 20 trading days. When the price trades above this level, the uptrend is strong as the shorter-term price action is starting to outperform the average of the past 20 days. Traders and investors alike often view this as a signal to increase accumulation.

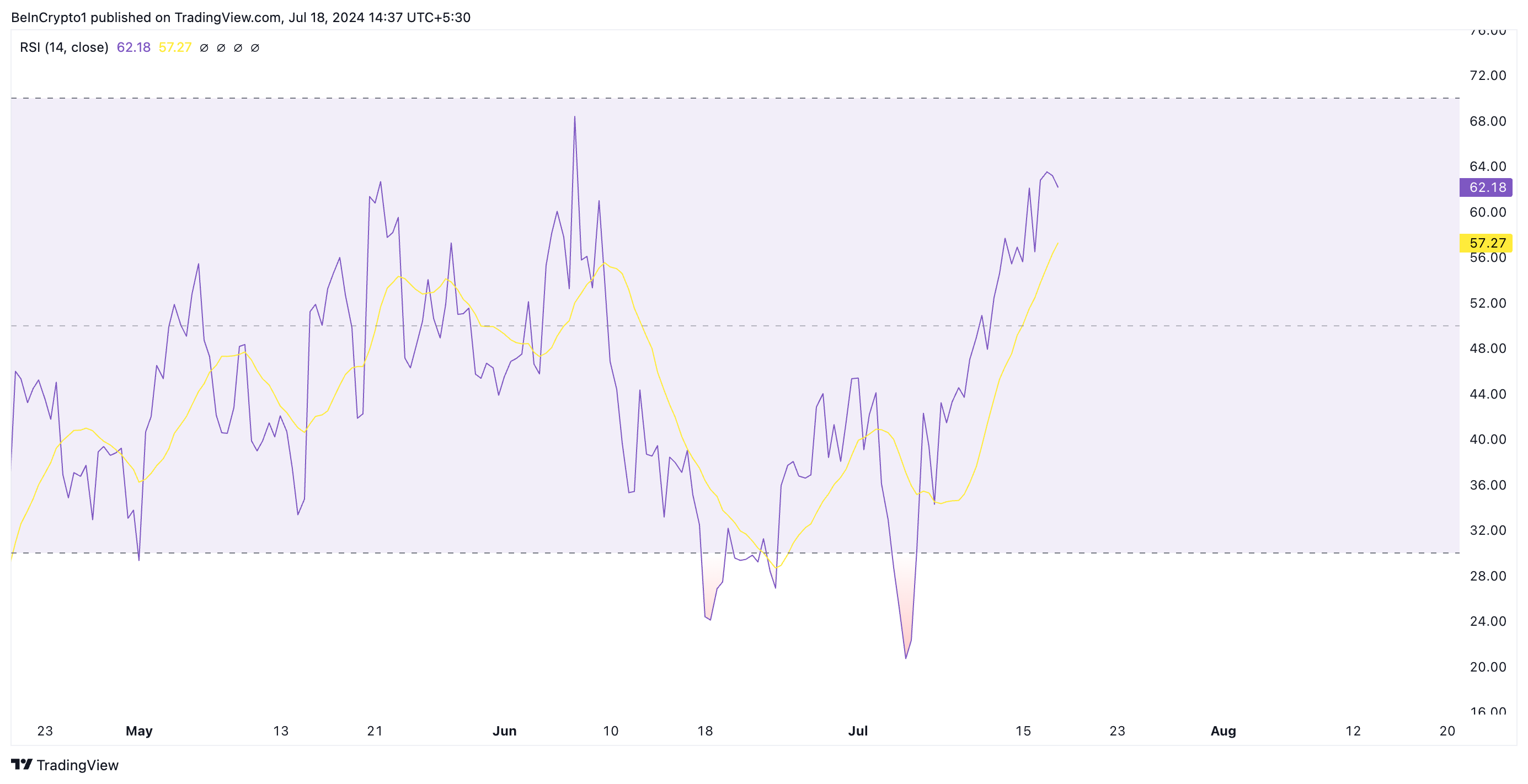

FIL’s rising Relative Strength Index (RSI) confirms the sustained uptick in FIL’s demand despite its recent price pullback. As of this writing, the indicator’s value is 62.18.

Read More: Filecoin Staking: How To Get Started

An asset’s RSI measures its oversold and overbought market conditions. With an RSI value of 60.76, the demand for FIL currently outweighs its selloffs.

SponsoredFIL Price Prediction: Altcoin Might Reclaim the Monthly High

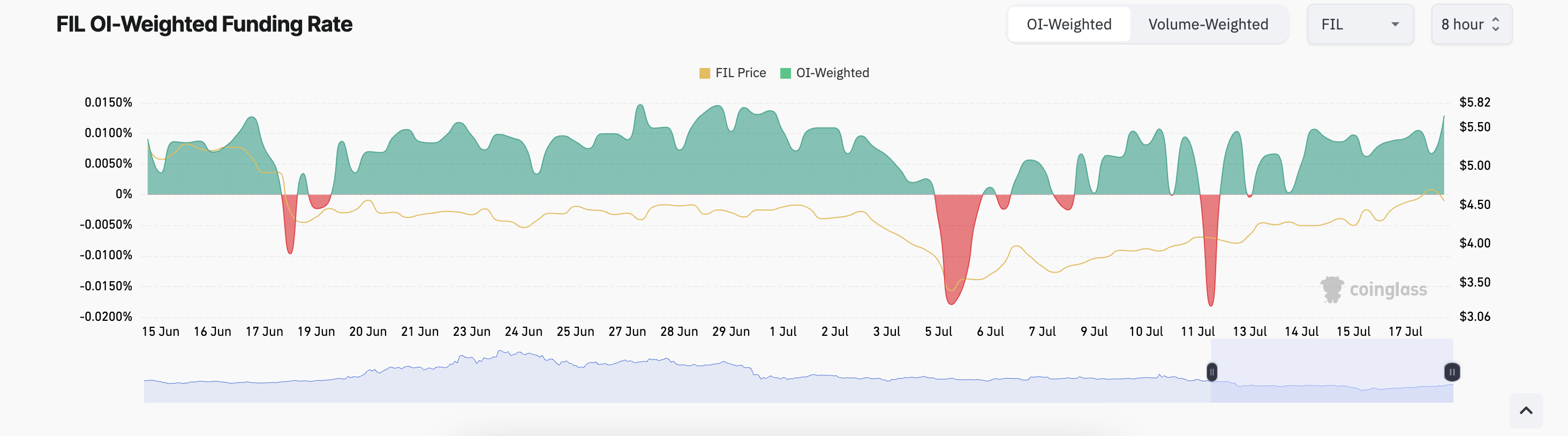

Yesterday’s surge in FIL’s price also led to an uptick in activity in its derivatives market. With increased activity underway at press time, the altcoin’s derivatives market trading volume has risen by 11% in the past 24 hours.

It is key to note that an uptick in an asset’s derivatives trading volume often indicates market sentiment. For example, if most trading volume consists of long positions, it could signal bullish sentiment. This is the case for FIL, as gleaned from its funding rate, which has remained positive since July 13.

Funding rates are a mechanism used in perpetual futures contracts to ensure an asset’s contract price stays close to its spot price. When they are positive, it means more traders are buying the asset expecting an increase than those buying and hoping for a decline.

If bullish sentiment persists and demand for FIL increases, it could reclaim the $4.80 price level and rally beyond it.

Read More: Filecoin (FIL) price prediction 2024/2025/2030

However, if sentiment shifts to bearish and profit-taking activity gains momentum, the altcoin’s price may drop to $3.25.