The crypto market, particularly Bitcoin, has seen a downturn as Treasury yields rise and hopes for May’s Federal Reserve interest-rate cuts fade.

This change aligns with new data, igniting concerns over persistent inflation and dampening the previously bullish crypto market sentiment.

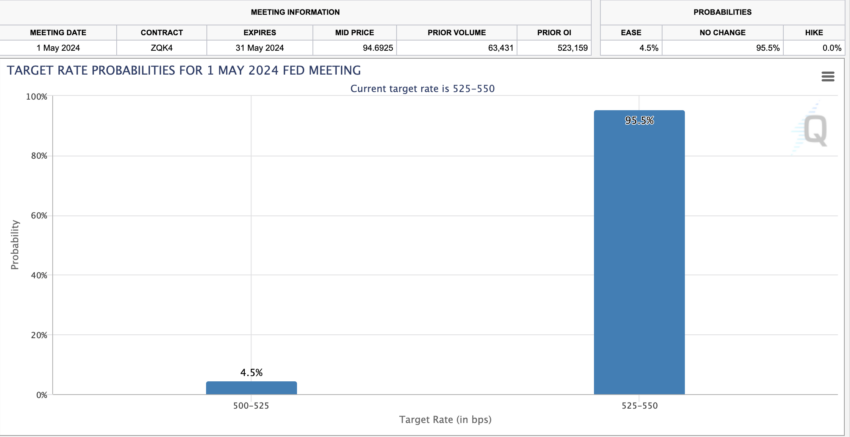

95% Probability of Fed Keeping Interest Rate Unchanged in May

On Tuesday Bitcoin’s value decreased, falling around 7% from its recent high, to trade near $65,000. This decline highlights Bitcoin’s sensitivity to shifts in interest rate expectations and broader monetary policy.

“Bitcoin continues to struggle to hold a level above its old high, and the whole crypto sector rolled over when interest rates jumped,” Wall Street Investor Louis Navellier said.

Consequently, the market’s reaction to economic indicators is reshaping investment flows.

Read more: How to Protect Yourself From Inflation Using Cryptocurrency

Moreover, the crypto market faces pressure from substantial outflows from Bitcoin ETFs. Notably, the Grayscale Bitcoin Trust (GBTC) reported a withdrawal of $302.6 million on Monday, contributing to a total outflow of $15.07 billion.

The market downturn extends beyond Bitcoin to include previously favored tokens like Pepe and Dogwifhat (WIF), leading to a significant decline in smaller digital assets. This marks their largest downturn in approximately two weeks.

Market analysts are now focusing on the Federal Reserve’s forthcoming decisions. Data from the CME group suggests a 95% likelihood that the Fed will maintain target rates in the May Fed meeting.

“The changed views about the Fed are having an impact across crypto, where there has been a selloff as the week gets underway,” renowned trader Stefan von Haenisch said.

However, the future might hold a silver lining for cryptocurrencies. Analysts from Deutsche Bank, including Marion Laboure and Cassidy Ainsworth-Grace, speculate that a rate cut in June could reinvigorate the market.

They argue that reduced rates would enhance risk appetite and market liquidity, encouraging investment in alternative assets like cryptocurrencies. Moreover, in December 2023, the Fed hinted at three rate cuts in 2024.

Read more: TradFi Explained: Exploring Key Elements of Traditional Finance

While the near-term outlook seems challenging, changes in the Fed’s monetary policies may yet offer a resurgence in the crypto market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.