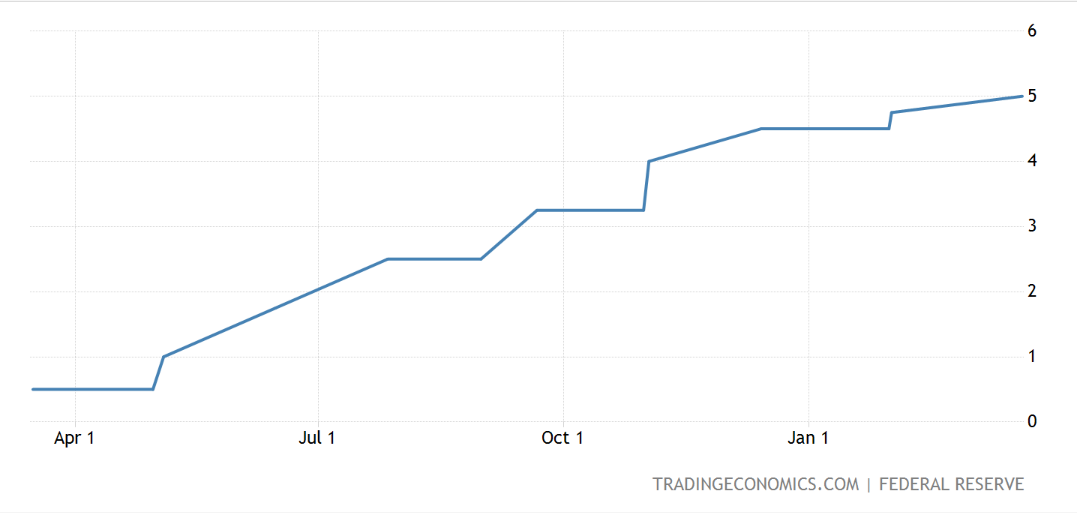

The Federal Reserve has increased the federal funds rate by 25 basis points, causing the S&P 500 to rise 0.3% and the Dow to increase by one-tenth of a percent.

The latest increase takes the interest rate between 4.75% and 5%, with the Fed predicting that failures of several U.S. banks would induce a slowdown in spending and economic growth.

Fed Changes ‘Ongoing Increases’ Narrative

After the news, Bitcoin rose slightly from $28,400 to $28,585, while ETH increased from $1799.21 to $1,811.01.

Notably, the central bank changed its position on the pace and aggression of further increases, suggested Chairman Jerome Powell at an appearance before Congress earlier this month. Replacing the phrase “ongoing increases” with “additional policy firming” suggests that the central bank may pause increases at future meetings.

The Fed also predicted slower U.S. economic growth in 2023.

Notably, the interest rate decision was taken without considering the U.S. Personal Consumption Expenditure Index, the Fed’s preferred inflation gauge, for Feb. 2023. The PCE will be released on March 31, 2023.

Powell’s Semiannual Monetary Policy Report to Congress on March 8, 2023, suggested that a tight U.S. labor market could result in continued aggressive monetary policy tightening that would increase the central bank’s terminal rate. The terminal rate is the interest rate that would take inflation down to the Fed’s 2% target.

Bank Failures Tie Hands of Federal Reserve

The Federal Reserve started increasing interest rates in the U.S. about a year ago, with four consecutive increases of 0.75% sparking rumors of a recession.

Powell said the recent collapses of Silicon Valley and Signature Bank also influenced the size of the 25 basis point hike.

The Federal Deposit Insurance Corporation placed both banks into receivership earlier this month amid a flurry of withdrawals that tested the firms’ risk management.

Shortly after Powell’s press conference, U.S. Treasury Secretary Janet Yellen said the FDIC would not provide a higher limit to backstop bank deposits.

After Yellen’s speech, Bitcoin dropped to roughly $27,000 before rebounding to $27,505. ETH fell to $1,728 but has since recovered to $1,747.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.