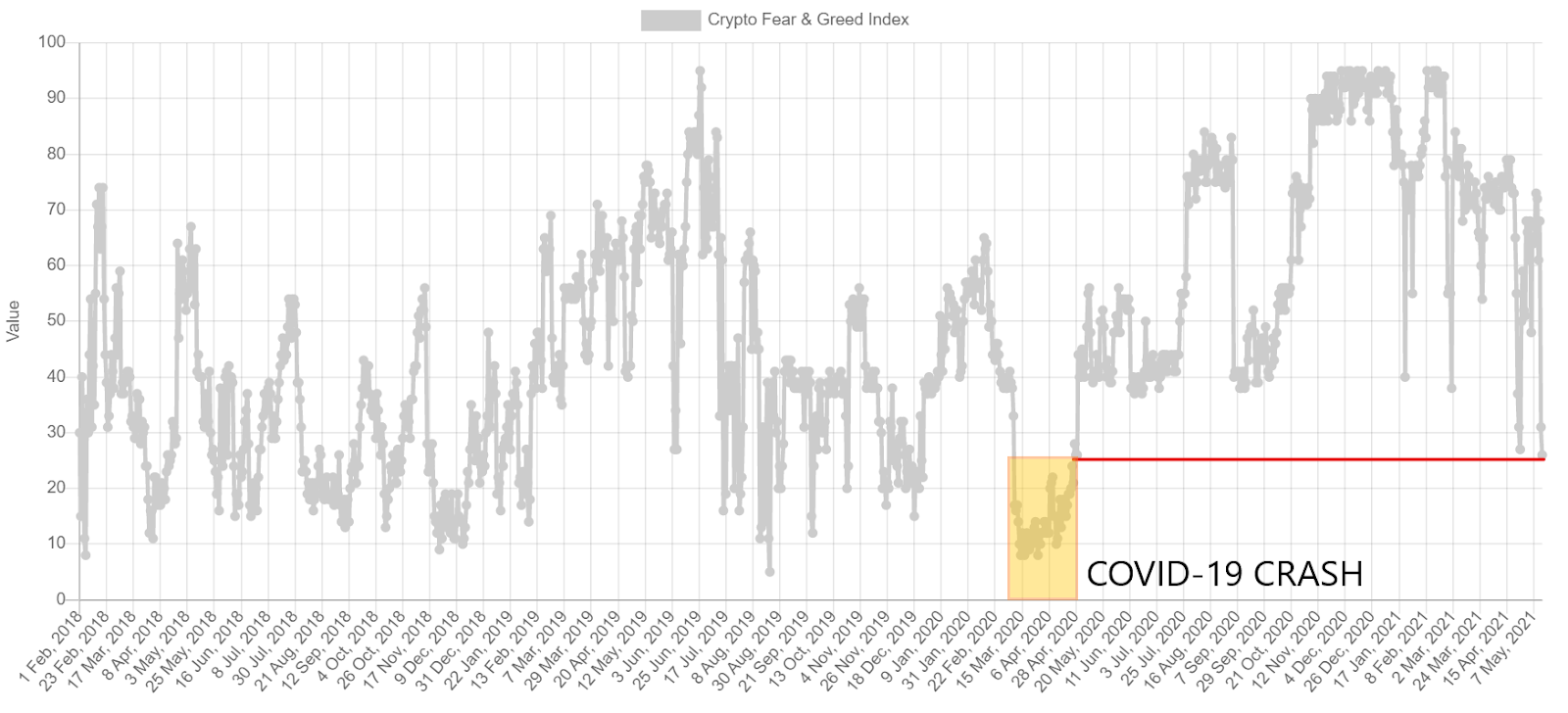

The Fear and Greed Index for Bitcoin showed the lowest value in more than a year, pointing to a fear level of 26 yesterday. The last time such pessimistic sentiment was recorded was in March and April 2020, during the market crash caused by the first wave of the COVID-19 pandemic.

Contrary to the bearish sentiment, the cryptocurrency macro analyst PlanB released an updated chart of its stock-to-flow model yesterday. According to him, the bull market has reached half of its run, and after a period of consolidation, it will face another 5x move up.

Fear and Greed Index the lowest in over a year

Yesterday, the popular Bitcoin sentiment indicator, the Fear and Greed Index, gave its lowest reading in over a year. The value of the indicator reached 26, which is interpreted as a strong indicator of fear in the market.

The last time the index recorded such low values in the period of March-April 2020 (orange rectangle), at the very beginning of the COVID-19 pandemic. Its direct result was the crisis in most financial markets, including the crypto space. Bitcoin then found a low at $3,782.

To be precise, the last time the value of 26 on the Fear and Greed Index was recorded on April 29, and the orange coin was then trading at $7,600.

Today, the price of Bitcoin is around $50,000, but according to our indicator, the sentiment is the same.

On the one hand, it can be interpreted as a radical change in the sentiment of cryptocurrency market participants, which could signal a major market trend reversal. On the other hand, the Fear and Greed Index has often served as an inverted signal in line with Warren Buffett’s popular maxim: “Be fearful when others are greedy and greedy when others are fearful.” Therefore, a low value of the indicator may be a signal of an impending purchasing opportunity.

PlanB dissipates FUD

An interesting retort to the growing bearish sentiment is yesterday’s tweet of PlanB, one of the best-known Bitcoin analysts. He published an updated S2FX chart, the structure of which more closely resembles the 2013 cycle than the 2017 cycle.

According to PlanB, the internal driving force of Bitcoin, generated by its four year halving cycles, has given 5x gains in the last six months. The analyst emphasizes that this happened despite the ubiquitous FUD (Fear, Uncertainty, and Doubt), examples of which he lists:

Moreover, he underlines that both his stock-to-flow model and on-chain data indicate that we are somewhere in the middle of the current cycle. Just recently, BeInCrypto wrote that indeed many key indicators of on-chain analysis are currently experiencing a reset.

Finally, he sums up that there is a good chance that the coming 6 months will bring another 5x gains.

Conclusion

The current polarization of market sentiment is interesting. Bitcoin’s price action and some technical indicators still point to an ongoing correction. Some even, like the recently described Pi Cycle Top, indicated that the top of the current cycle had already been reached.

However, looking at the history of Bitcoin cycles, on-chain analysis and the stock-to-flow model based on halving dynamics, there are strong arguments that the bull run will continue. And it will be a parabolic continuation.