Fantom (FTM) caught the attention of the broader market this week as its price rallied by 13%, making the altcoin one of the top gainers.

This surge comes as the Layer-1 blockchain progresses toward its transition to Sonic, a platform designed to support decentralized application development with a layer-2 bridge that connects to Ethereum (ETH).

Indicators Reveal Fantom as an Undervalued Gem

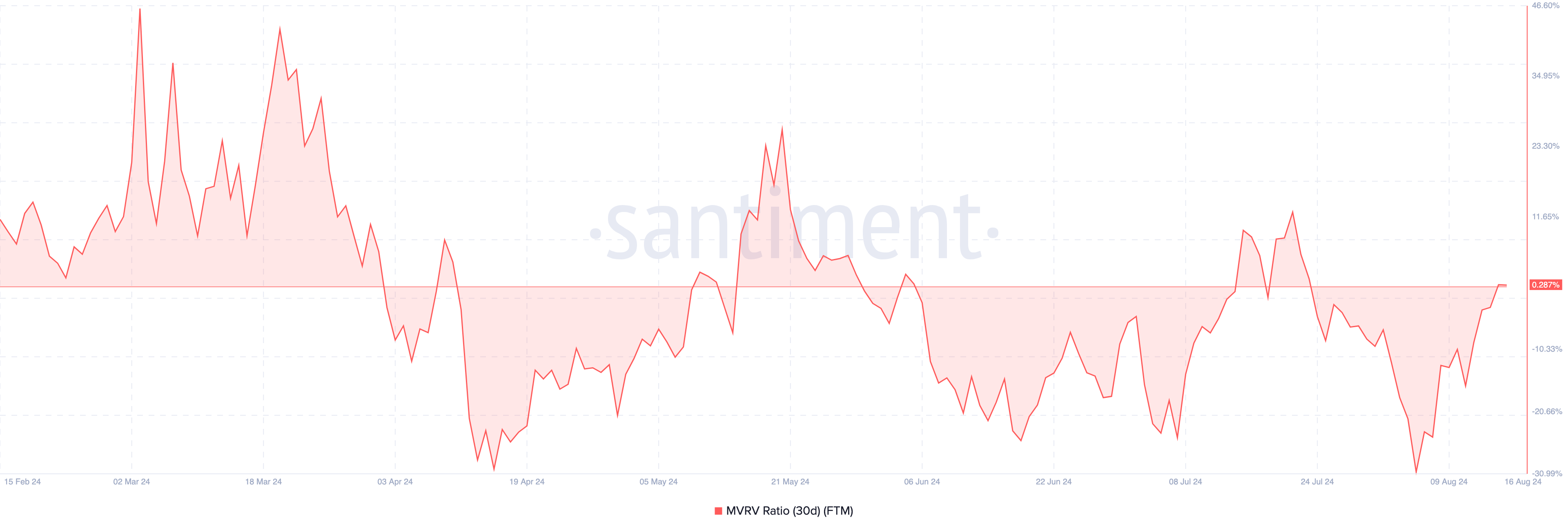

On August 5, FTM’s price dropped to $0.26 following a broader market crash. During this period, the 30-day Market Value to Realized Value (MVRV) ratio was -30.88%.

The MVRV ratio gauges market profitability, with an increase indicating rising unrealized profits. Conversely, a negative ratio suggests that if all holders were to sell, the average return would be a loss.

Currently, on-chain data from Santiment shows that the recent price rally has pushed the MVRV ratio back into positive territory. Historically, when Fantom’s MVRV ratio returns to positive levels, it often continues to climb, indicating potential for further gains.

Read more: 9 Best Fantom (FTM) Wallets in 2024

Given these factors, it’s reasonable to suggest that FTM’s price might be undervalued. If the token follows its historical pattern, it could climb above $0.40 in the short term.

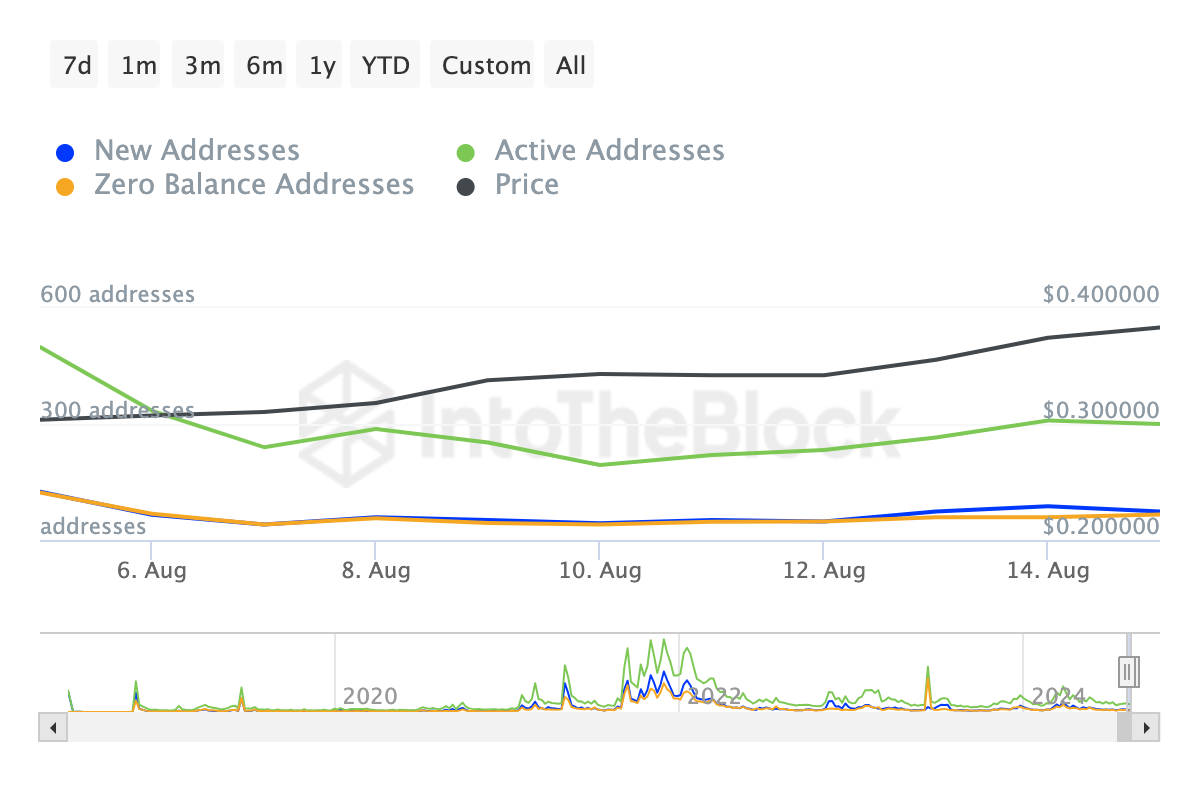

Supporting this outlook are Fantom’s active, new, and zero-balance addresses, which have seen growth over the last seven days, according to IntoTheBlock. This increase indicates rising user engagement on the blockchain, confirming that the price surge isn’t occurring in isolation but is backed by active participation.

If this trend continues, it could further strengthen the bullish case for FTM.

Meanwhile, Sonic Labs, previously known as Fantom Foundation, shared a sneak peek of Sonic listing. According to the post on X, Sonic, which FTM will transition into with the ticker “S,” has been pre-listed on CoinMarketCap.

This development also suggests that the plan to launch Sonic in the fourth quarter 4 may actually come to pass. Furthermore, the approaching event may drive optimism and higher demand for FTM.

FTM Price Prediction: $0.43 Looks Like the Next Target

An analysis of technical indicators suggests that FTM’s price could keep rising. The Moving Average Convergence Divergence (MACD) indicator, in particular, remains positive.

The MACD tracks the relationship between two Exponential Moving Averages (EMAs) to determine trend direction and identify optimal entry and exit points. A positive MACD reading signals increasing momentum, which could play a key role in sustaining FTM’s price growth.

Read more: Fantom (FTM) Price Prediction 2024/2025/2030

Should the reading continue to rise, so will FTM’s value. If this is the case, the price of the token may hit $0.43. However, the cryptocurrency may face rejection around the $0.40 psychological zone. If this happens, FTM will likely drop to $0.35.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.