Fantom (FTM) has seen a significant decline in new demand in the past few months. This decline in network usage connotes a drop in the demand for its native token, FTM.

Due to this, while the rest of the market logged gains in the last month, the value of FTM trended downward.

New Users Shun Fantom

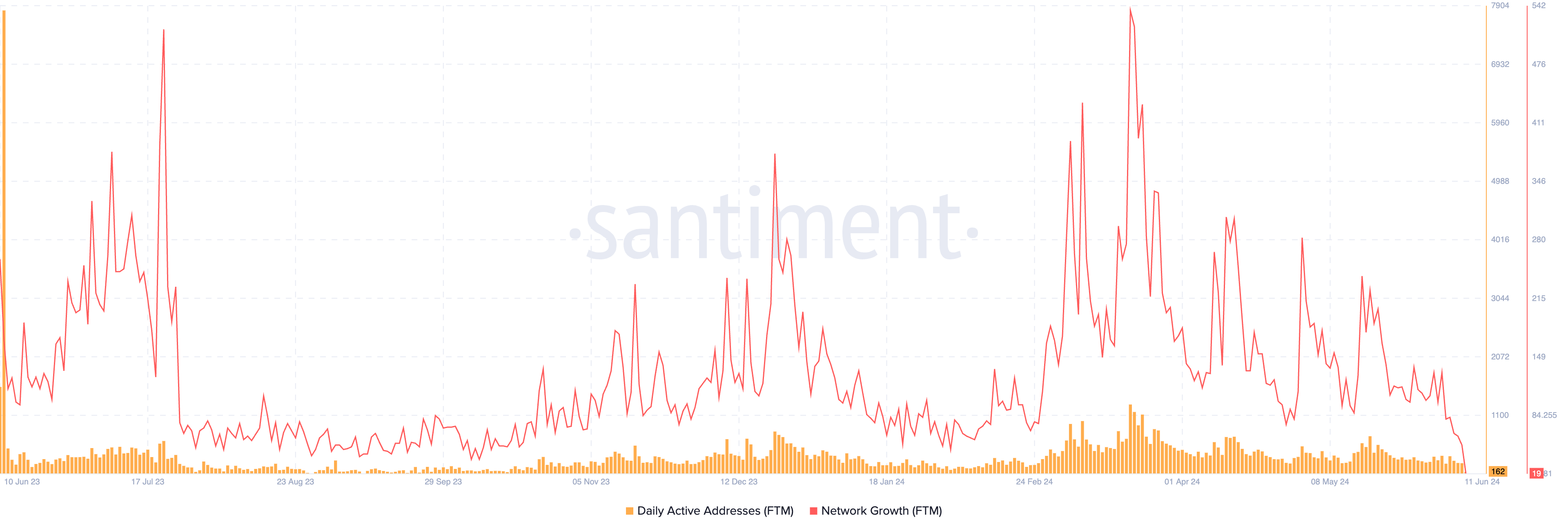

The number of new addresses created daily to trade FTM rallied to a year-to-date (YTD) peak of 537 on March 19. On the same day, the number of unique addresses involved in at least one transaction involving the altcoin totaled 1280.

However, after climbing this high, the daily count of new FTM addresses has since declined. As of June 10, only 51 new addresses were created on the Fantom network, the blockchain’s lowest count since the beginning of the year.

The last time Fantom’s daily new address count was this low was September 2023.

Read More: What Is Fantom (FTM)?

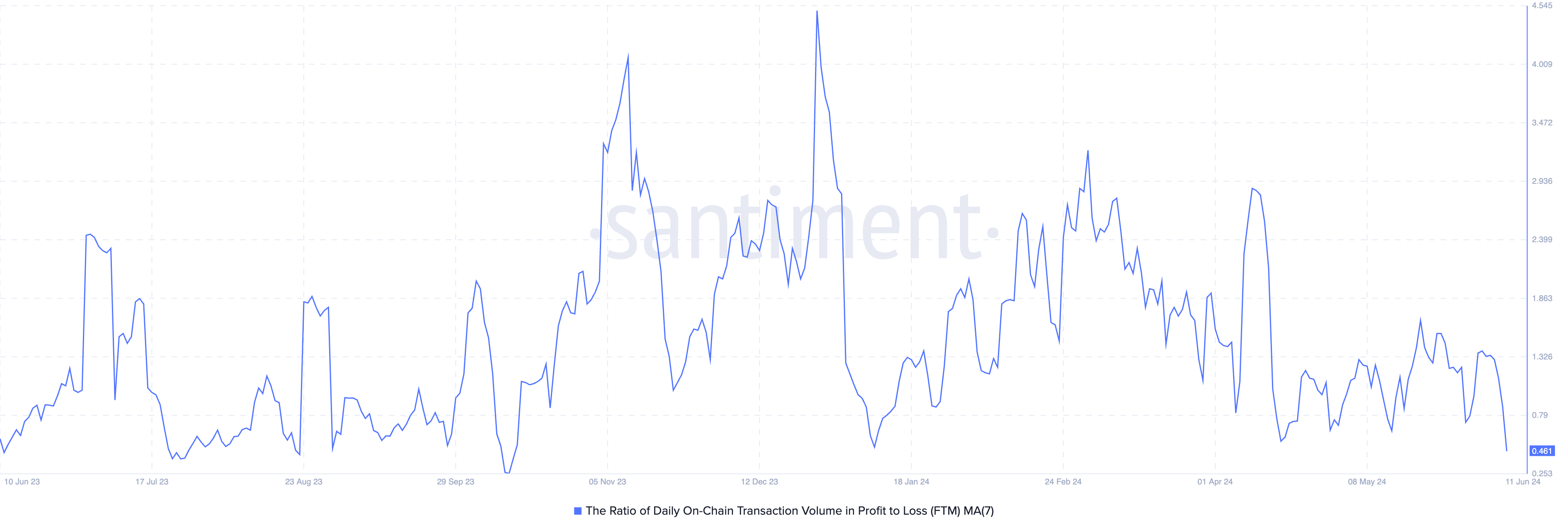

The decline in the daily number of FTM’s new addresses and the resulting drop in the token’s value is partly attributable to the recent low volume of profitable transactions.

An assessment of the FTM’s daily ratio of transaction volume in profit to loss using a seven-day moving average confirmed this. As of this writing, this was 0.44.

This suggests that for every FTM transaction that ended in a loss in the last month, only 0.44 transactions returned a profit. This means that the number of profitable transactions is lower than those that produce gains.

FTM Price Prediction: A Dip Below $0.60?

At press time, FTM’s Relative Strength Index (RSI) rested at 34.74, far from its 50-neutral line. This indicator helps traders identify overbought or oversold conditions in a market by measuring the speed and change of an asset’s price movements.

It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and may be due for a pullback, while values below 30 indicate that the asset is oversold.

At 34.74, FTM’s current RSI suggests a significant decline in buying pressure.

If this trend continues, FTM will slip under the $0.60 price level to exchange hands at $0.51.

However, if this is invalidated and buying pressure gains momentum, the bulls may be able to initiate a rally toward $0.70.