Fantom’s (FTM) price fell through the crucial support of the 61.8% Fibonacci Retracement, which left the altcoin vulnerable to further losses.

The FTM holders are also not too supportive of a recovery, as they may look to sell their holdings.

Fantom Investors Could Offload

Fantom’s price is showing short-term declines, but this could deeply impact investors’ mindsets, and they could move to sell. This is because they are rather active on the network despite the lower price for the last 72 hours.

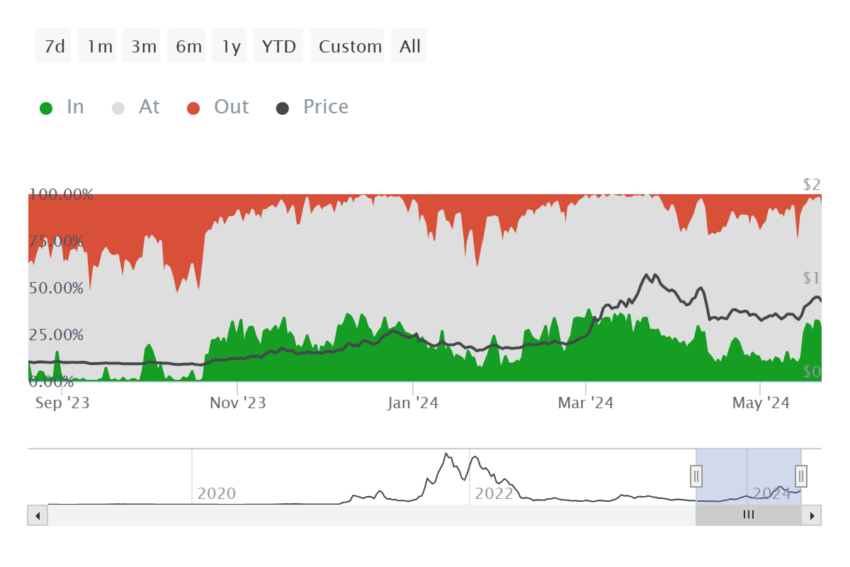

Upon observing active addresses by profitability, it can be observed that the investors in profit have sizeable dominance. More than 25%, and at times over 30%, of the participating addresses happen to be in profit.

This is concerning because the high participation from these investors during bearish conditions suggests potential selling. Profit-taking could be the likely motivation, and should FTM holders offload their assets, Fantom’s price could take a hit.

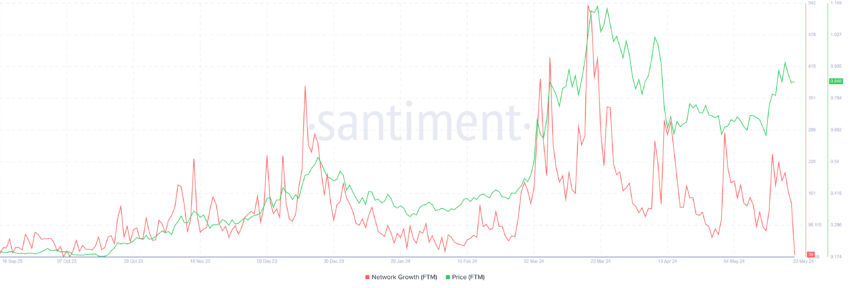

This sentiment is further substantiated by the lack of incentive that potential investors are noting at the moment. The downtick noted in network growth suggests that Fantom is losing traction in the market.

Read More: What Is Fantom (FTM)?

The metric measures the rate at which new addresses are formed, and in the case of FTM, this rate is at an eight-month low. This shows that the altcoin would need a major push to attract new investors; until then, the outcome could be bearish.

FTM Price Prediction: Resistance Block Resists Recovery

Fantom’s price attempted to breach the 78.6% Fib retracement at $0.95 but failed. To make it worse, it also fell through the 61.8% Fib level, which is known as the bull market support floor. A test of the same would have enabled recovery for FTM.

However, a dip below it, along with the intensifying bearishness, suggests Fantom’s price might fall to lows of $0.78. This price marks the lower limit of the resistance block FTM is in, with $0.88 being the upper limit.

Read More: Fantom (FTM) Price Prediction 2024/2025/2030

At this point, the upper limit has not been tested as a support floor for almost two months. Thus, the chances of FTM closing above it successfully are meager.

But if Fantom’s price manages to bounce off from the 50% Fib level, it could attempt a breach of $0.88. Successfully closing the above would invalidate the bearish thesis, enabling further recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.