As Bitcoin hits $30,000, experts are considering what this bullish news has in store for the crypto sector.

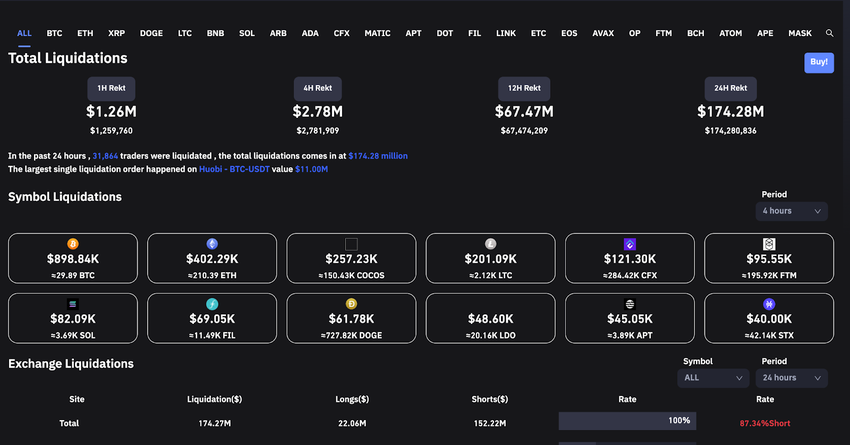

Bitcoin (BTC) has reached the $30,000 price range for the first time since June 2022. According to data from Coinglass, a 7% pump liquidated over $174.2 million worth of trades in the past 24 hours.

Out of the total liquidation amount, 87.34% was liquidated from short positions. And a total of 31,864 traders were liquidated.

Additionally, MicroStrategy, one of the largest BTC holders, is in profit after 10 months of holding Bitcoin at unrealized losses of millions. According to Saylor Tracker, a website that tracks the Bitcoin holdings of MicroStrategy, the company holds 140,000 BTC at an average price of $30,129. It has an unrealized profit of $7.8 million.

Bitcoin at $50,000 in Next Six Months?

Gaurav Dahake, the Chief Executive Officer at BNS exchange, told BeInCrypto that they are extremely bullish for 2023.

He explains,

“We are only 12 months away from the Bitcoin halving event, which has in the past propelled Bitcoin’s momentum as also seen in the last three cycles. BNS remains highly optimistic about Bitcoin’s long-term potential, and we consistently advise investors to adopt a systematic investment plan (SIP) approach towards it.”

Dahake predicts BTC hitting $50,000 this year. He says, “We anticipate this rally to persist for a few more quarters and remain confident that Bitcoin will surpass the $50k milestone within the next six months.”

Parth Chaturvedi, the Crypto Ecosystem Lead at CoinSwitch, is also bullish for the upcoming Bitcoin halving. He told BeInCrypto,

“If we look at BTC’s historical price cycles, we are almost a year away from the next halving of rewards, which typically marks the start of a bull run lasting for at least a year post-halving. We can expect further growth in Bitcoin prices.”

Check out BeInCrypto’s on-chain analysis on BTC price post-2024 halving here.

A Viable Alternative in Current Climate

Bitcoin has been the best-performing asset class of 2023, up by over 80% this year. While there has been chaos in global macroeconomics, with notable banks collapsing.

Dahake believes that the rally indicates “how investors have come to view Bitcoin as a viable alternative in the current climate. Its popularity is growing alongside traditional assets like gold and silver worldwide.”

He adds, “This bull run further underscores the faith investors have in the resilience of global macroeconomics, particularly that of the United States.”

Chaturvedi also supports the narrative that Bitcoin is a viable alternative. He says, “Despite the banking challenges being faced by crypto companies in the US, the surge in Bitcoin prices persists, and it is truly “decoupling” from traditional finance.”

On the other hand, Fakhul Miah, the CEO of CreDa and Head of Growth for Elastos, believes that: “The Bitcoin price surge above $30k anticipates the likeliness of easing monetary policy by the Fed and other central banks due to the recent banking stress.”

Got something to say about this article or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or Twitter.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.