KuCoin Token (KCS) has broken out from a descending resistance line. It reached the 0.618 Fib retracement resistance level at $14.

Curve DAO Token (CRV) is following a descending resistance line. It is in the process of moving above the $2.05 horizontal resistance area.

Synthetix Network Token (SNX) has broken out from a descending resistance line. It is approaching the $15.68-$18.07 resistance area.

SponsoredKCS

KCS has been decreasing alongside a descending resistance line since April 10, when it reached an all-time high price of $20.

The downward movement continued until May 19, when a low of $4.395 was reached. On June 22, KCS created a higher low and proceeded to break out from the descending resistance line.

It is currently trading inside the $14 resistance area, which is the 0.618 Fib retracement resistance level.

Technical indicators are bullish. The ACD has crossed into positive territory, The RSI has crossed above 70 and the Stochastic oscillator has made a bullish cross.

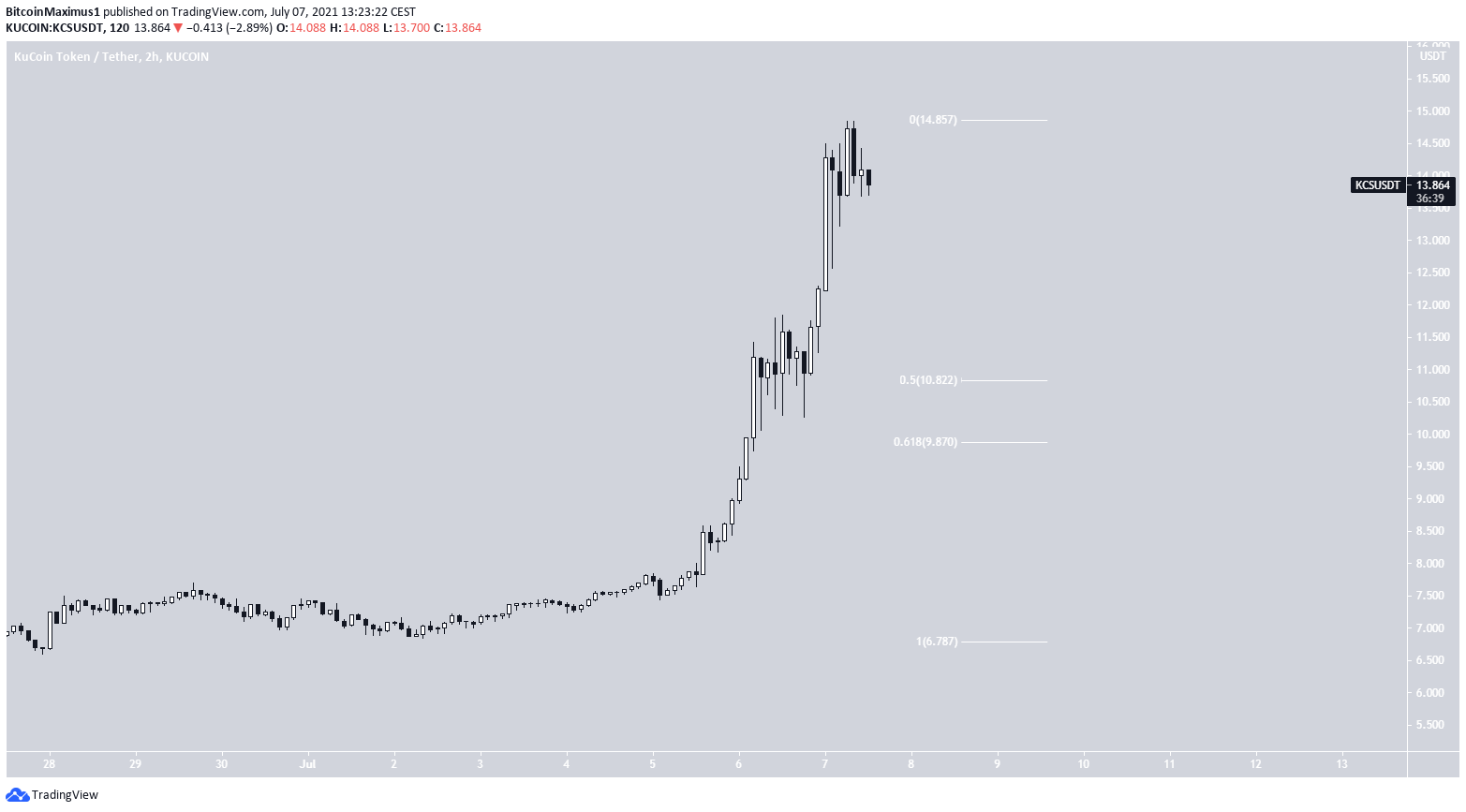

The shorter-term two-hour chart shows that the movement has become parabolic. If a short-term rejection occurs, the $9.8-$10.8 area is likely to act as support. This is the 0.5-0.618 Fib retracement support level.

Highlights

- KCS has broken out from a descending resistance line.

- There is resistance at $14.

CRV

CRV has been following a descending resistance line since April 16, when it reached a high of $4.65. While following the line, it proceeded to reach a low of $1.05 on May 23. The low was made right at the 0.786 Fib retracement support level at $1.25.

On June 22, it created a higher low and resumed its upward movement. Currently, it is in the process of breaking out from the previously mentioned resistance line.

Technical indicators are bullish, supporting the possibility of a breakout. The MACD is nearly positive, the RSI has crossed above 50 while the Stochastic oscillator has made a bullish cross.

If a breakout transpires, there would be resistance at $2.85, the 0.5 Fib retracement resistance level (white).

Sponsored

A look at the short-term chart shows that the increase looks like a completed bullish impulse, while the ensuing downwards movement resembles an A-B-C corrective structure.

Currently, the token is in the process of moving above the crucial resistance area of $2.05. Doing so could trigger a sharp upward movement.

Highlights

- CRV is following a descending resistance line

- It is facing resistance at $2.05.

SNX

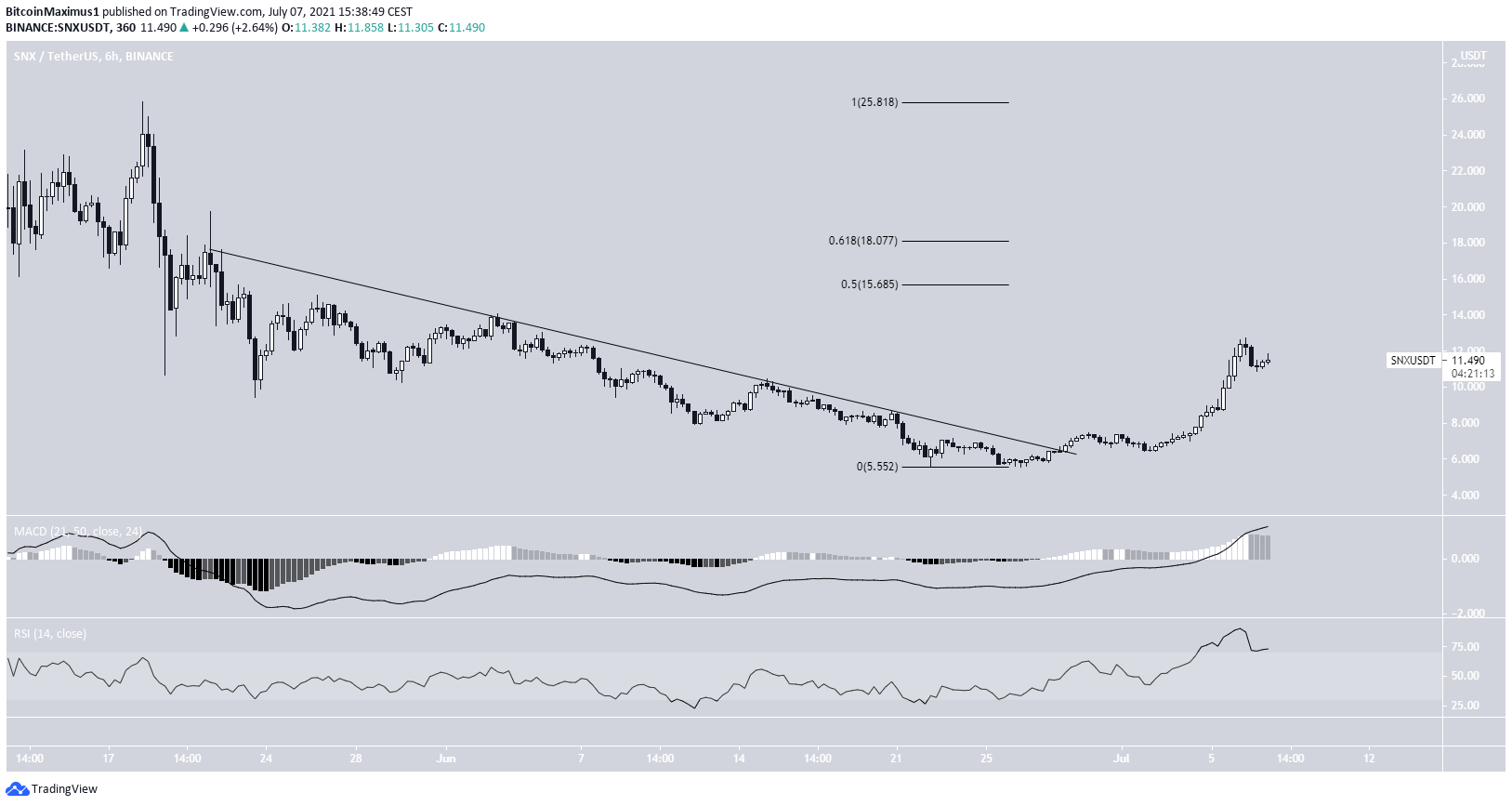

On June 22, SNX reached a low of $5.55. It began an upward movement shortly afterwards and broke out from a descending resistance line.

The rate of increase greatly accelerated on July 2. So far, SNX has reached a high of $12.74. The main resistance area is found at $15.68-$18.07. This is the 0.5-0.618 Fib retracement resistance area.

Despite showing some weakness, the six-hour MACD & RSI are still bullish. Therefore, the token is expected to reach this area.

Highlights

- SNX has broken out from a descending resistance line.

- There is resistance between $15.68-$18.07.

For BeInCrypto’s latest bitcoin (BTC) analysis, click here.