Ethereum (ETH) is down nearly 10% from its local top. Hence, a whale chose to buy the dip and withdrew 3,600 ETH worth $8.9 million from Binance.

The broader crypto market, including the flagship crypto asset – Bitcoin, is struggling in January. However, some whales are utilizing the opportunity to accumulate these crypto assets at a lower cost.

Ethereum Whale Goes Back to Accumulation Mode

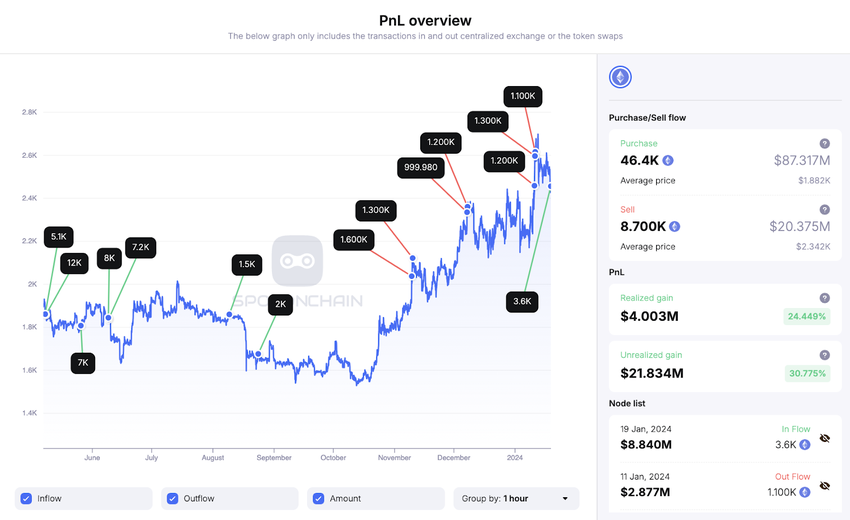

On Friday, a wallet address – 0x347 withdrew 3,600 ETH from Binance. The screenshot below from Spotonchain shows that the whale has a track record of accumulating ETH during the market lows and selling the asset almost near the top.

As a matter of fact, the whale had been accumulating throughout 2023 lows before the price started rallying. Spotonchain shared that they withdrew 42,800 ETH from Binance at an average cost of $1,834 from May 8, 2023 to August 24, 2023.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

While the broader market rallied in the last quarter of 2023, the whale distributed their assets. Finally, on Friday, they started buying Ethereum again.

Not to mention, the whale holds a whooping 31,700 ETH, worth nearly $78 million. So far, they have booked $17.25 million in profits, while they still have an unrealized profit of $16.403 million.

Strong Staking Activities

After approving the spot Bitcoin exchange-traded fund (ETF) on January 10, the anticipation for a spot Ethereum ETF increased. However, the anticipation faced a setback when the US Securities and Exchange Commission (SEC) delayed its decision on Fidelity’s application.

Moreover, Nansen analyst Martin Lee exclusively told BeInCrypto that there has been a slight decline in the smart money wallet’s ETH holdings in the last seven days. But Lee believes it doesn’t necessarily indicate that the smart money is selling their ETH.

“We see increases in holdings of rETH, WETH, aSTETH, aETHWETH.

With the rise of liquid staking protocols and now, restaking ones such as Eigenlayer, more sophisticated actors are often staking their ETH to increase yield,” Lee told BeInCrypto

Indeed, there is a strong interest in Ethereum staking activities. On Thursday, BeInCrypto reported that Ethereum staking achieved a new all-time high with 24% of its total supply staked.

Read more: A Comprehensive Guide on Tracking Smart Money in the Crypto Market

Furthermore, major Ethereum network upgrades are scheduled in the first quarter of 2024. Earlier this week, Ethereum core developers deployed the Dencun upgrade on the Goerli testnet.

On the mainnet, the Dencun upgrade will allow temporary storage and access of off-chain data by Ethereum nodes, aiming to alleviate storage demands.

.