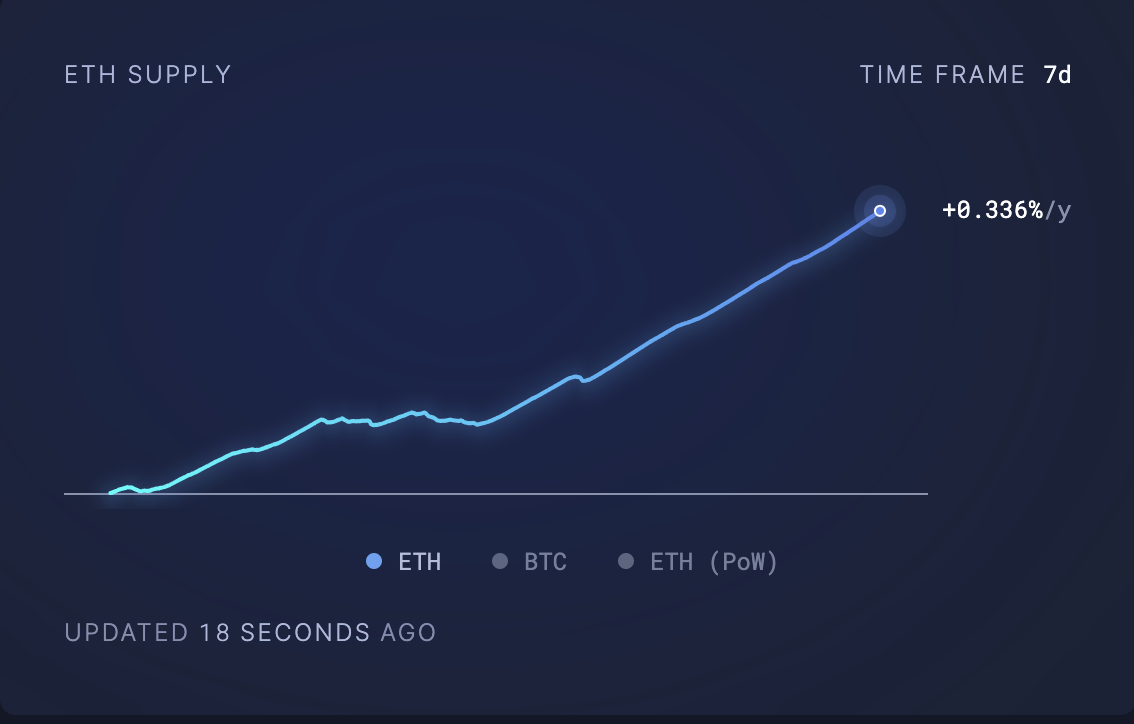

Over the past week, 7,728 Ethereum (ETH) tokens worth above $20 million at current market prices have been added to circulation. This has pushed the altcoin’s circulating supply to a six-month high of 120.39 million ETH. The surge in circulating supply could exert downward pressure on Ethereum’s price if demand does not keep pace with the influx of new coins.

This analysis outlines key price levels that holders should monitor as this happens.

Ethereum Experiences Decline in Usage

Ethereum’s circulating supply refers to the number of ETH coins available to the public. It does not include coins that are locked, reserved, or otherwise unavailable for trading.

According to data from Ultrasound Money, 7,728 ETH coins worth more than $20 million at current market prices have been added to circulation over the past seven days. This surge in ETH’s circulating supply typically happens when user activity on the Layer 1(L1) network drops.

Read more: Ethereum ETF Explained: What It Is and How It Works

On-chain data from Artemis confirms this decline. Over the past week, the daily count of unique on-chain interaction on Ethereum has plunged by 3%.

Due to this fall in transaction count on Ethereum, its network fees have also plummeted. According to the data provider, this has fallen by 43% during the period in review.

When Ethereum’s daily transaction count drops, it signifies a decrease in network activity and usage. This reduced demand for the network can negatively impact ETH’s price, and this has played out over the past few days.

While the 3% drop in ETH’s value over the past 24 hours mirrors the general market decline, the drop in user activity on the Ethereum network also plays a role, as it directly impacts the demand for the leading altcoin.

ETH Price Prediction: Why Network Activity Must Improve

Ethereum is currently trading at $2,619, hovering just above key support at $2,579. If market activity slows further and demand for the altcoin weakens, the bulls might struggle to hold this support. Ethereum’s price could decline toward the next major support level at $2,264 in such a scenario.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

On the other hand, an increase in Ethereum’s network activity could boost demand for the altcoin, positively impacting its price. If this occurs, Ethereum’s price could rebound and rally toward $3,336.