As Ethereum reaches its five year birthday, on-chain metrics have never been stronger. The recent price rally is also good news for those that have been buying ETH over the past year or so.

Ethereum prices are at their highest level for over a year, but looking at the longer-term picture shows that ETH could still be severely undervalued. The last time ETH was above $300 was in June and July 2019 and only remained there for 18 days.

The year that followed extended Ethereum’s bear market, dropping prices to a low of $90 during the mid-March COVID-crash. Since then it has slowly climbed higher, gaining 250% since that dip.

Those that bought and held during the crypto boom two-and-a-half years ago are still likely to be in the red since Ethereum is still 77% down from its all-time high.

ETH Addresses More Profitable this Time Around

Recent research by IntoTheBlock has shed some light on the profitability of Ethereum addresses when compared to Bitcoin. Using an indicator called Historical In/Out of the Money (HIOM), we can analyze on-chain positions based on the average cost for a token of a given address. The research has revealed that over 73% of Ethereum holders are now in the green. DeFi industry analyst Camila Russo picked up on the findings in her latest Defiant newsletter, comparing the HIOM values to the last time ETH was over $300. Back then, just 13.5 million addresses were ‘in the money,’ 42% less than the current figure of 31.86 million. The figure of 73.24% Ethereum addresses in the money was taken at an ETH price of $321. The total number of Bitcoin addresses holding BTC is 30.83 million according to the research.In other words, more addresses are making money in Ethereum than the total number of addresses holding Bitcoin.The findings suggest that millions of new ETH addresses bought the asset below $300, and many of those would have got in below $200, which is where it has been accumulating for about three months of this year.

Transactions High, But So is Gas

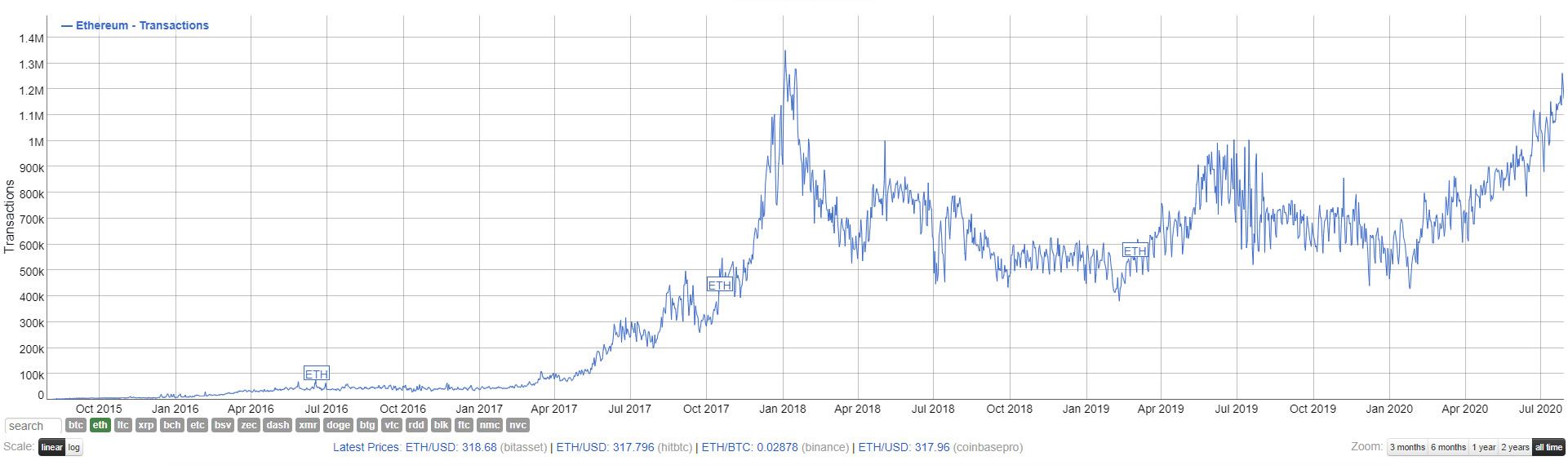

On-chain metrics for the five-year-old network are also the strongest they have ever been. The number of daily transactions on Ethereum has reached its highest level since January 2018. The figure has reached 1.26 million, however, IntoTheBlock reports the figure is slightly higher at 1.34 million.

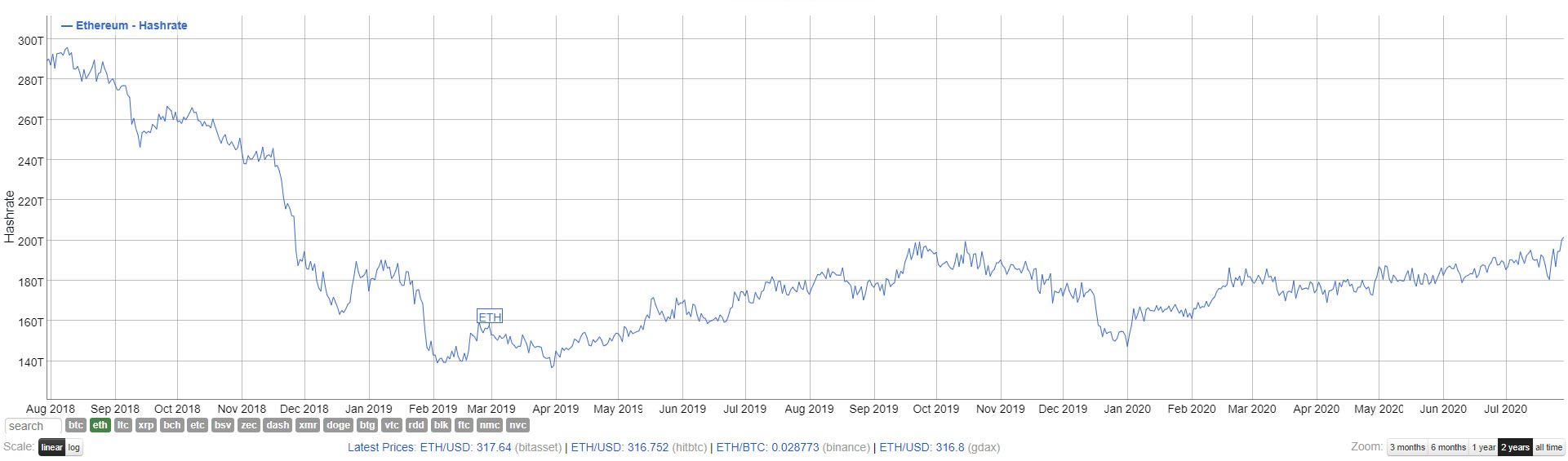

Meanwhile, $ETH miners are having a field day, recording the highest revenue levels (in USD) since Q3 2018. The % of revenue that currently comes from fees is in a league of its own. The average between Apr 2018 to Apr 2019 was ~3%. It’s now touching 30%.High network fees and hash rates are of little concern to holders, and IntoTheBlock reports that they have increased by over 10 million in the past twelve months. The metrics define a ‘holder’ as any address containing any amount of ETH for at least one year. The report concludes with the assertion that Ethereum is undervalued due to high demand, primarily driven by DeFi.

Overall, these on-chain metrics suggest that Ethereum is currently undervalued, at least in relation to its valuation a year ago.

Latest DeFi Developments

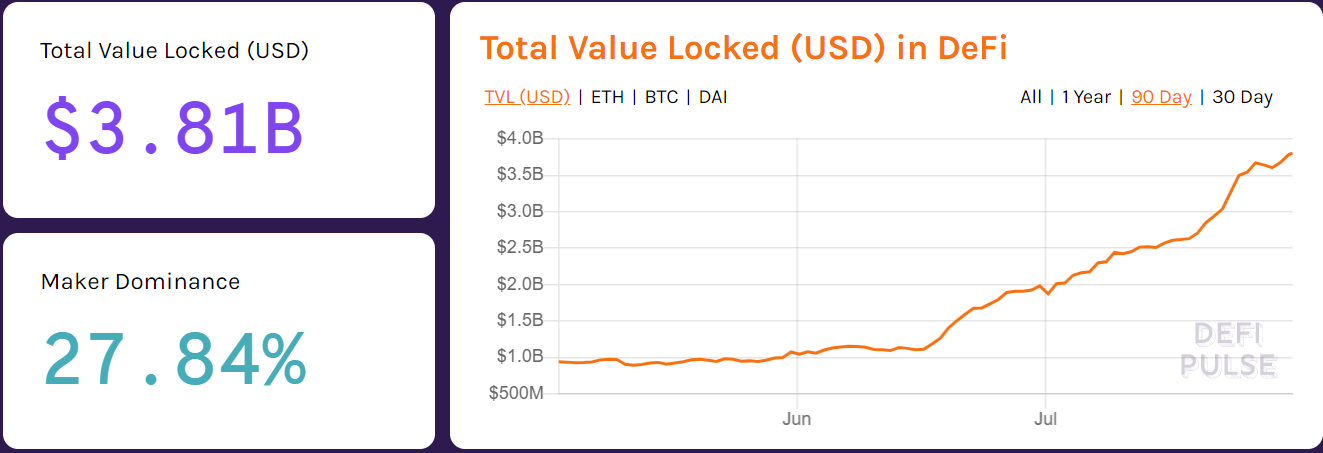

After a quick breather, DeFi markets are marching higher again in terms of total value locked which has hit a new all-time high of $3.81 billion.

We warned about this. Reflexivity cuts both ways. You cannot have ever increasing supply inflation and not a consequence on price. This is how the protocol was built.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored