JPMorgan says Ethereum must come under a new category or be classified as a commodity to insulate it from overregulation.

In a research note on Thursday, JPMorgan strategist Nikolaos Panigirtzgolou said regulating Ethereum (ETH) as an alternative asset would see it strike a middle ground between commodity and security regulatory regimes.

SEC Documents Cast Doubt on Status

The strategists argue that the uncertainty around ETH has prevented the Securities and Exchange Commission (SEC) from including it in a list of crypto assets it deems securities.

The agency revised its previous list in its recent lawsuits against Binance and Coinbase.

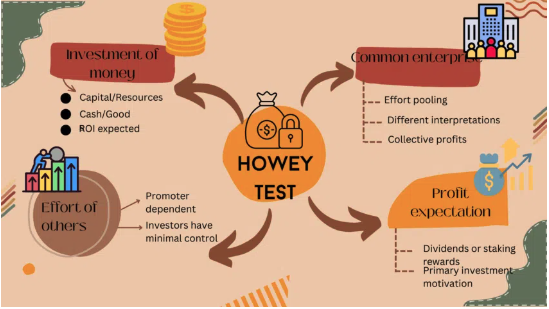

SEC documents from 2018 suggested that Ethereum occupied a regulatory no man’s land because it was sufficiently decentralized. Therefore, it did not fit the definition of a security according to the Howey Test.

Read here about the SEC’s plan to give control of crypto to Wall Street.

Republican representative Patrick McHenry agreed last year that cryptos could not be classified as either commodities or securities.

The lawmaker subsequently suggested a third regulator. McHenry chairs the House Financial Services Committee seeking to amend existing laws to accommodate stablecoins.

Coinbase also proposed a new regulator in 2021. The SEC requested an extension to answer Coinbase’s petition inquiring whether the agency would issue new crypto regulations.

Ethereum Cannot be a Commodity, Argues Saylor

Senators Cynthia Lummis and Kirsten Gillibrand suggest ETH is a commodity. They argue an entity should register the token with the US Commodity Futures Trading Commission rather than the SEC.

Bitcoin bull Michael Saylor, on the other hand, argues that Ethereum’s initial coin offering, management team, and hard forks prove its changeability and naturally disqualifies it from being a commodity.

A commodity, he argued, cannot have its properties changed, nor does it have an issuer.

According to the MicroStrategy chairman, if developers can alter the token’s issuance pattern through code changes, the token passes the Howey Test and is a security.

SEC Chair Gary Gensler argued in an interview with New York Magazine that all cryptocurrencies except Bitcoin are securities.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.