With all attention focused on the premise of a spot Bitcoin ETF, the steady increase in collateral locked on Ethereum layer-2 networks has gone unnoticed. L2 TVL has reached an all-time high this week, but will ETH prices start to move yet?

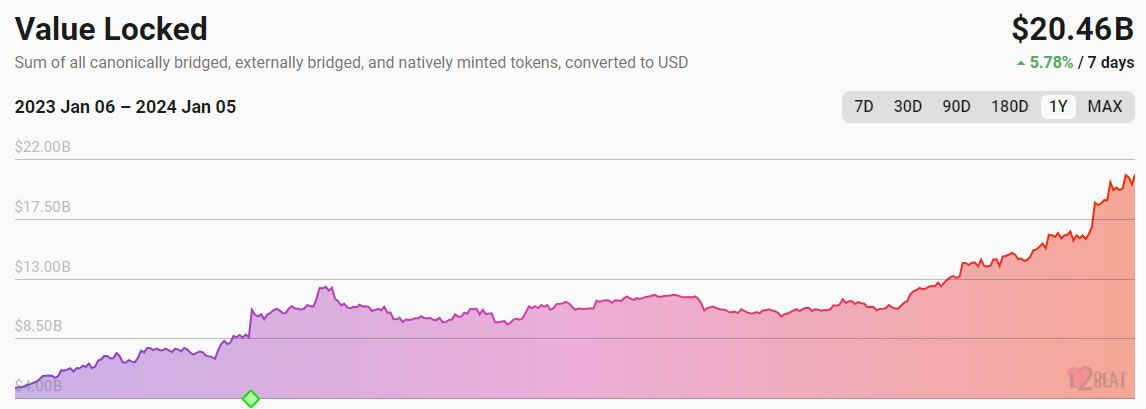

According to layer-2 ecosystem platform L2beat, the total value locked across all platforms hit a record $21.16 billion on Jan. 3.

Ethereum Layer-2 Surging

To put this into perspective, this is the same amount that was locked in all decentralized finance (DeFi) protocols in January 2021.

Moreover, layer-2 TVL has surged 34% over the past month to its current level of $20.8 billion, just off the peak.

Over the past year, L2 TVL has surged a whopping 333% from around $4.8 billion in early January 2023.

By comparison, DeFi markets have gained just 38% in terms of TVL over the same period, according to DeFiLlama.

Arbitrum One is the market leader with around $10 billion in TVL giving it a market share of almost 50%. Optimism (OP Mainnet) is second with $5.8 billion TVL and a market share of 28.7%

The rest of the layer-2 platforms are comparatively small with Metis Andromeda and Base occupying third and fourth with around $750 million TVL each.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

On Jan. 4, analyst Metaquant called this a rotation from alternative layer-1 blockchains back into Ethereum and layer-2. Ethereum competitors Solana and Avalanche have been surging in recent weeks but they have started to cool now.

In addition to the L2 TVL peak, daily active addresses, layer-2 fees, and layer-2 stablecoin market capitalization have also been steadily increasing, he noted.

Moreover, ETH prices have been lagging as attention was elsewhere, he said before adding:

“Once [ETH] price goes up, everyone will move again on Ethereum and L2s,”

Ethereum L2 TVLs have surpassed other layer-1 chains combined, reported analyst “Josh”. “Remember, they will buy back their ETH,” he added.

ETH Price Outlook

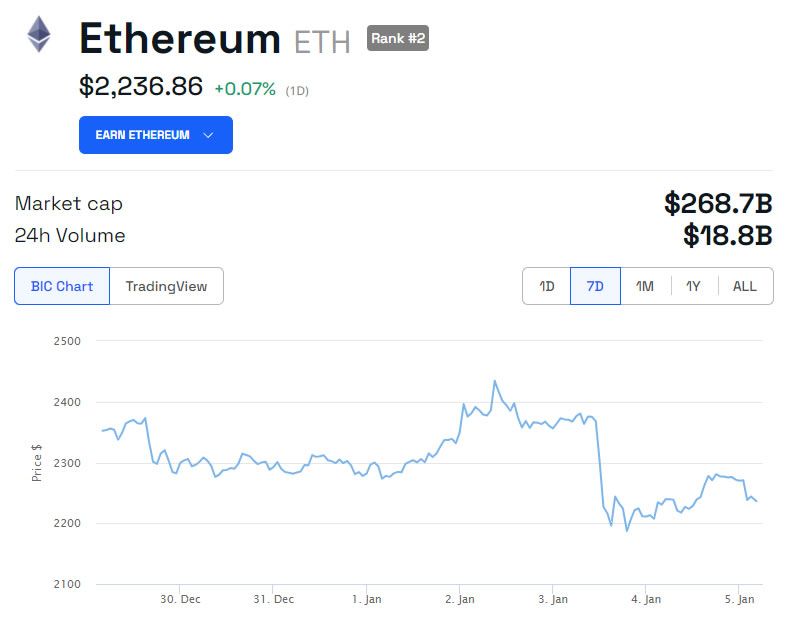

Ethereum prices haven’t moved much over the past 24 hours remaining at $2,245 at the time of writing.

The asset has hit resistance at $2,430 twice in the past fortnight and has failed to break it. Moreover, ETH has now fallen back 8% from that high.

Ethereum remains down 54% from its November 2021 all-time high of $4,878. However, the long-term outlook for the asset in 2024 is bullish.