In the cryptocurrency market, the moves of key players can send waves across the industry, sparking curiosity and concern among investors. A recent significant transaction by an Ethereum co-founder has caught the eye of many, raising questions about its impact on ETH’s price.

As many wonder what this could mean for the cryptocurrency, blending expert analysis with market trends can offer insights into Ethereum’s trajectory.

Is Ethereum Bound for a Price Correction?

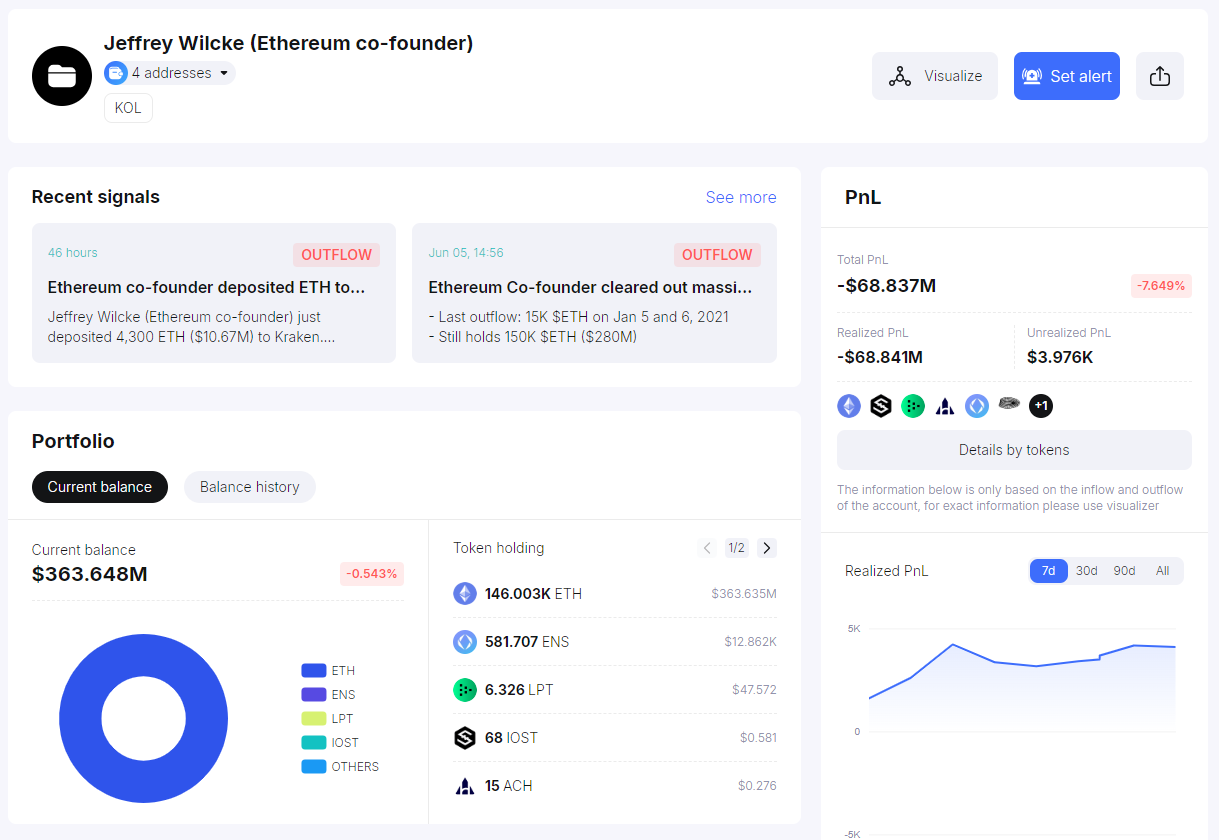

Ethereum co-founder Jeffrey Wilcke transferred a 4,300 ETH, valued at $10.7 million, to the cryptocurrency exchange Kraken. Priced at $2,482 per ETH at the time of the transaction, this significant sale has sparked speculation about the potential for an upcoming price correction.

Back in June, Wilcke deposited 22,000 ETH into Kraken, then worth $41.1 million, at a price of $1,870 per ETH. The timing of this deposit preceded a steep downturn in the market, which now leads many to wonder if history is about to repeat itself.

Despite the increasing selling pressure, some experts remain optimistic about Ethereum’s trajectory. Adrian Zduńczyk, a noted technical analyst, argues that Ethereum’s current market behavior is a only hiccup in its broader bullish trend. Following a “positive gigantic breakout,” Ethereum has been navigating through a phase of consolidation.

This pattern emerged from an ascending triangle, with its lower boundary at $880 and a breakout point at $2,140, setting Ethereum on a course towards an anticipated target of $3,400.

“Ethereum is chopping around following a positive gigantic breakout that happened over the pattern of ascending triangle stretching between $2,140 and $880 at the bottom. This ascending triangle puts [Ethereum] in a expected target of $3,400,” Zduńczyk said.

Zduńczyk’s analysis suggests that while Ethereum’s recent price movements have been somewhat sluggish, especially when compared to the rest of the market, the foundational strength of its bullish pattern remains intact. The ascending triangle, a classic bullish signal, indicates a continuation of the uptrend, notwithstanding temporary fluctuations.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

This transaction by Wilcke, therefore, might not necessarily herald a price correction of the magnitude seen last year. Market dynamics, including investor sentiment, broader economic factors, and technical indicators like those pointed out by Zduńczyk, play a critical role in determining the path of cryptocurrencies like Ethereum.