Ethereum (ETH) reached a then-all-time high price of $1,871 on Feb. 13 but had been struggling to move upwards since then.

Ethereum has now broken out from a short-term resistance. Both technical indicators and the price action suggest that more highs are in store.

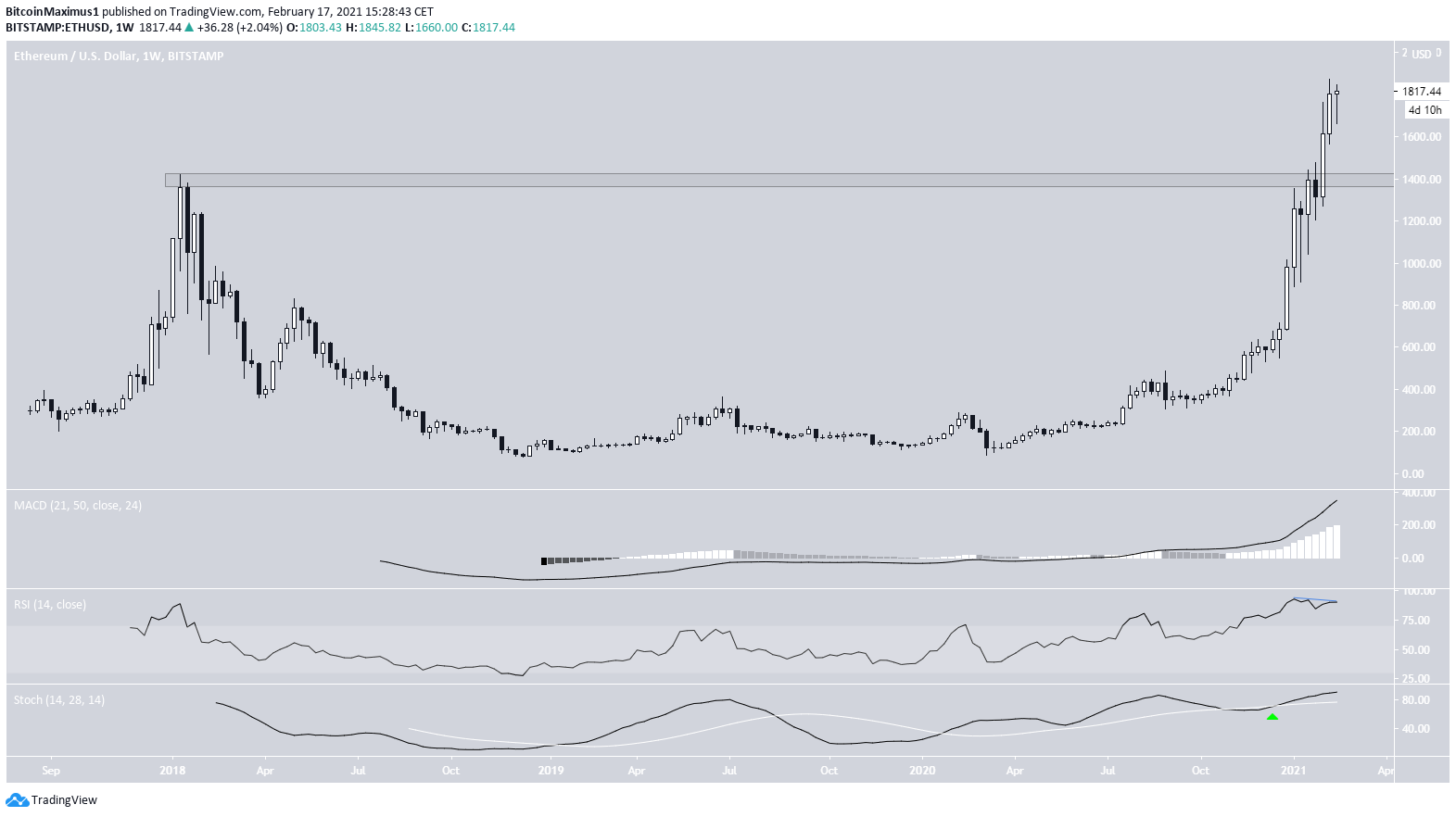

Long-Term Ethereum Movement

The weekly chart shows that ETH has broken out above the $1,400 area, which previously acted as the all-time high resistance. So far, ETH has reached a high of $1,900 and has yet to re-test the $1,400 area as support.

Despite some bearish divergence in the weekly RSI (which is still unconfirmed), both the MACD and Stochastic oscillator are increasing. These are signs that the trend is still bullish.

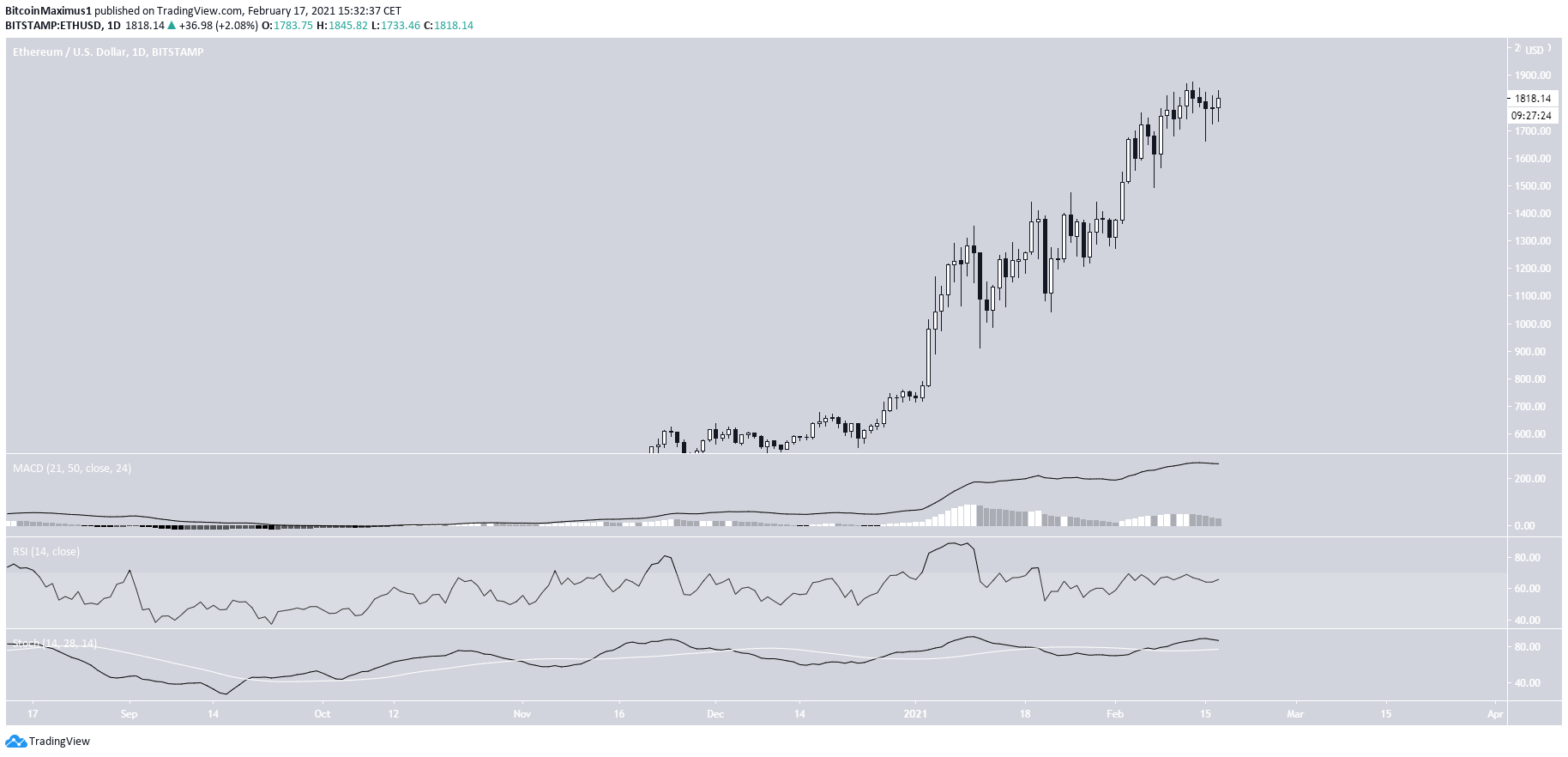

Future Movement

Technical indicators in the daily chart are similar. While they show some loss of momentum, they are still bullish.

However, there is no structure whatsoever in the current price movement, which looks very parabolic.

Therefore, while the trend is still bullish, ETH could be approaching the top of its move.

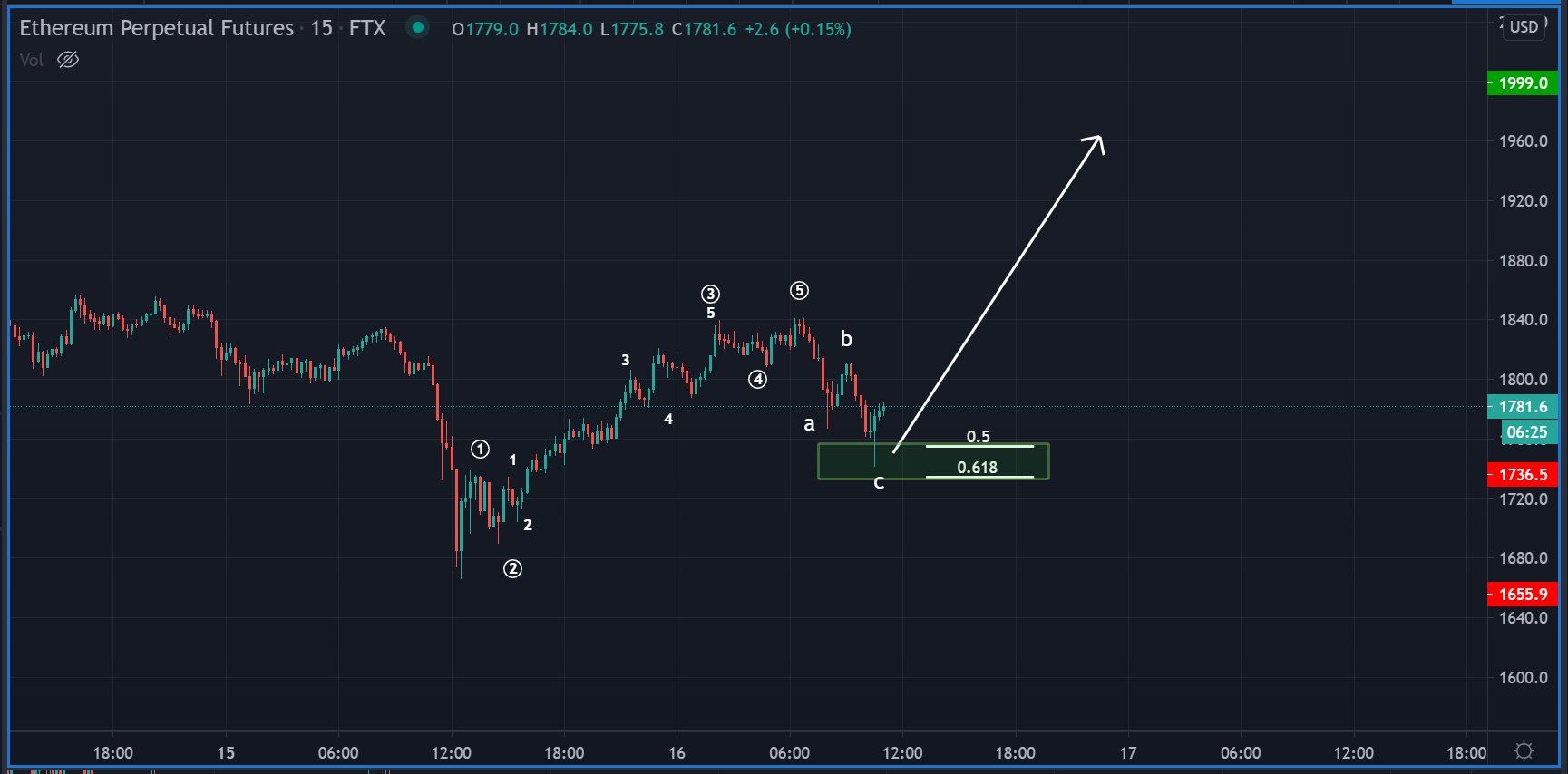

The two-hour chart shows a breakout from a descending resistance line and its validation as support after (green arrow).

Interestingly, the breakout coincides with an RSI movement above 50 and a MACD movement above 0.

Therefore, ETH is expected to increase in the short-term.

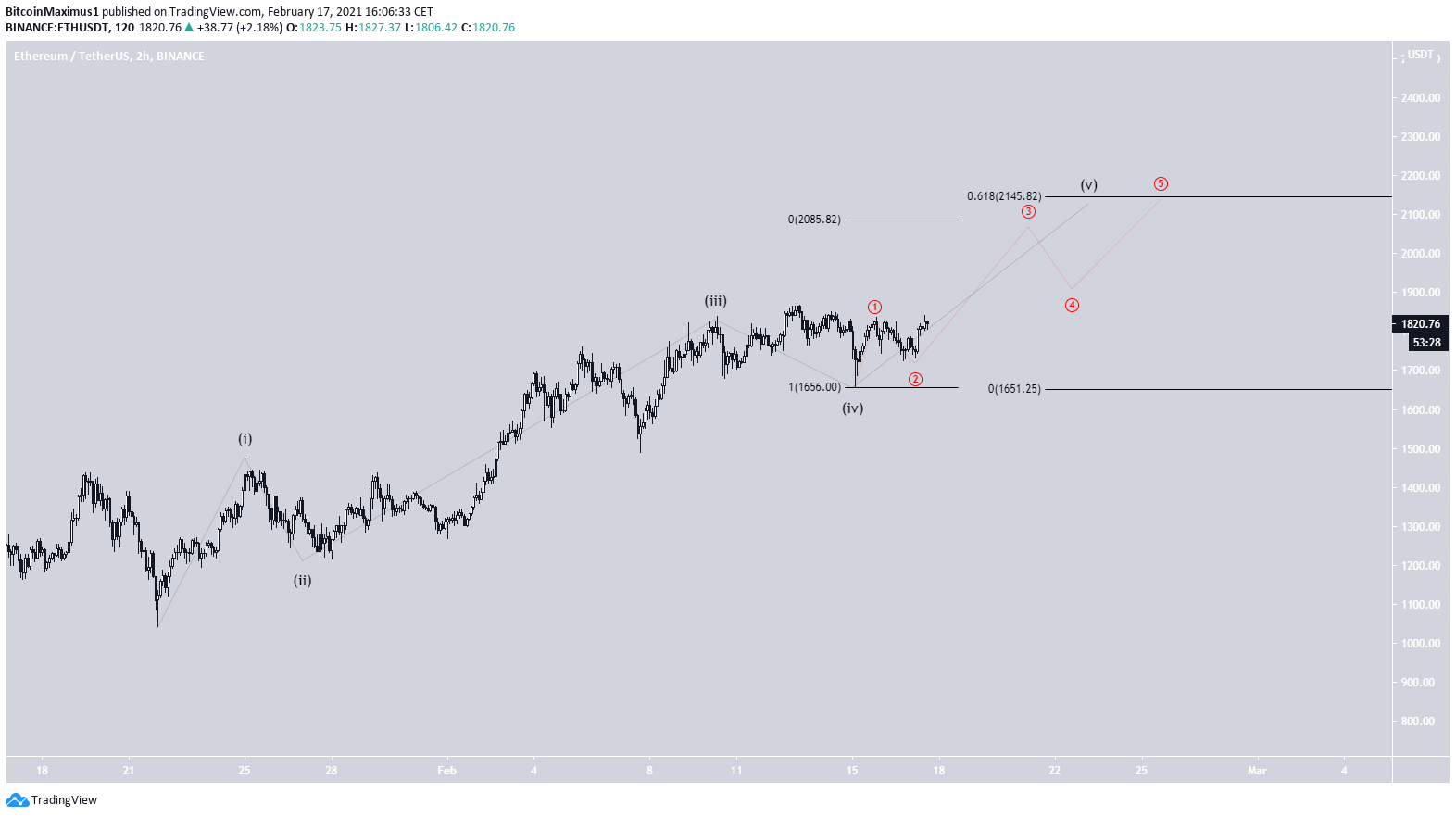

Wave Count

Cryptocurrency trader @Smartcontracter outlined an ETH chart, stating that the price has completed its correction and should soon increase above $2,000.

The wave count suggests that ETH is in the fifth and final wave (white) of a bullish impulse that began with the March 2020 lows.

The sub-wave count is shown in black, suggesting that ETH is nearing a top.

The most likely target for the top of the move is found at $2,250.

A closer look at the movement shows that the fifth and final sub-wave has just begun, and gives a slightly lower target between $2,085-$2,145.

Therefore, ETH is expected to continue increasing towards these levels before potentially breaking down.

ETH/BTC

The ETH/BTC chart is less bullish than its USD counterpart. While it’s approaching a strong support area at ₿0.036 (0.5 Fib retracement level and previous resistance area), technical indicators are decisively bearish.

The MACD is decreasing below 0, the RSI is decreasing below 50, and the Stochastic oscillator has made a bearish cross.

Therefore, while it’s possible that ETH bounces at the current support area, there are no signs that it will continue moving much higher.

Conclusion

ETH/USD is expected to increase towards the range of $2,080-$2,250 before beginning a corrective phase.

The trend for ETH/BTC is not clear, but some type of bounce at ₿0.0345 is expected.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here