Ethereum (ETH) price witnessed a fate similar to the rest of the crypto market when the altcoin slipped below $3,000. This, however, has only further validated the bullish pattern ETH has been stuck in.

Closing in on a potential breakout in the next few trading sessions, the altcoin is exhibiting the ideal conditions for accumulation.

Ethereum Selling Slows Down

Investors need to exhibit optimism for a substantial bounce back in Ethereum’s price, as seen in parts of the recent shift in behavior.

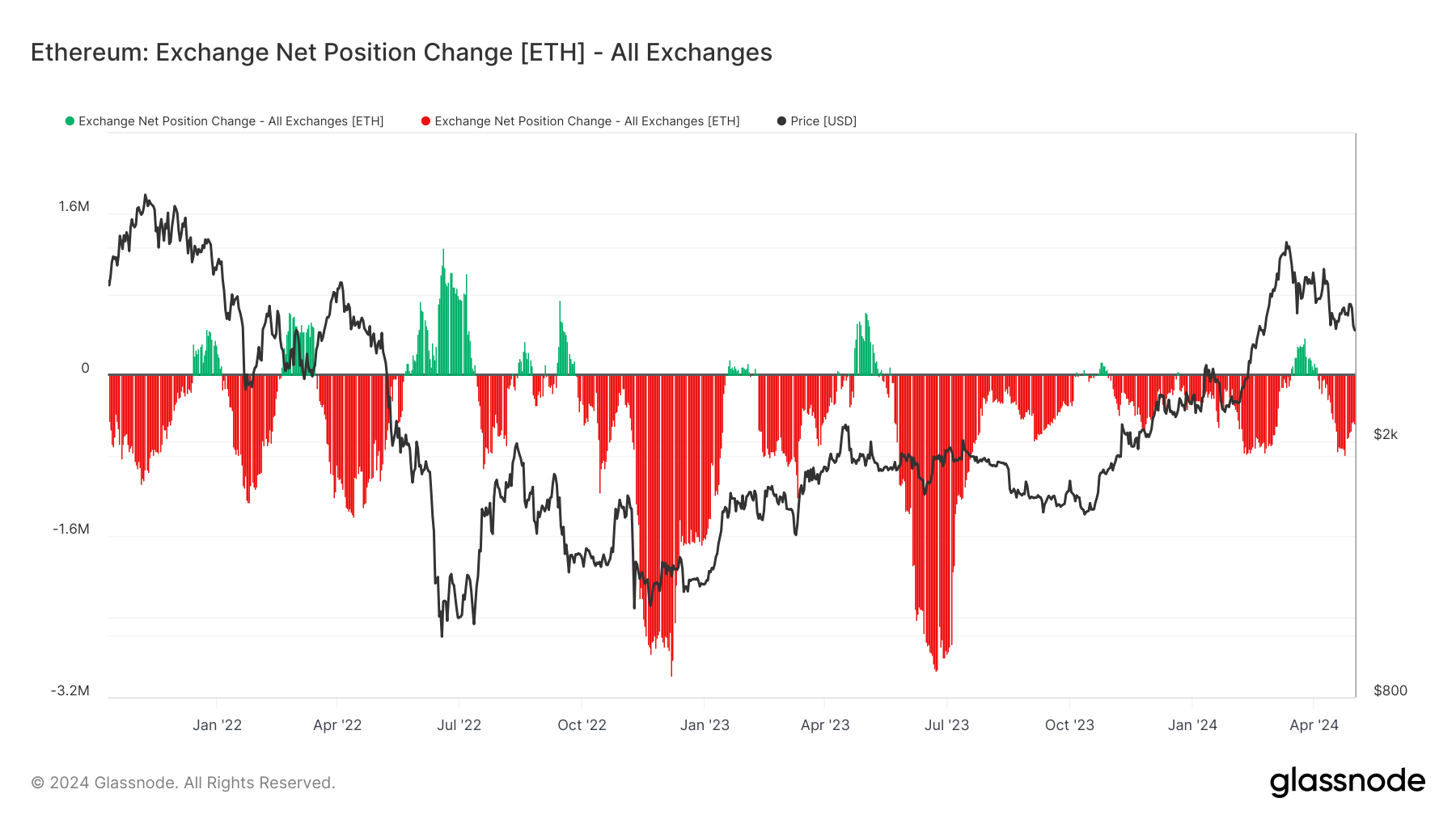

The exchange net position change shows that ETH outflows have halted in the last 24 hours as investors refrain from profit-taking. Historically, such slowdowns succeed in a surge in price, after which selling continues.

Given the selling has taken a back seat for now, Ethereum has a shot at bouncing back to reclaim $3,000 as support.

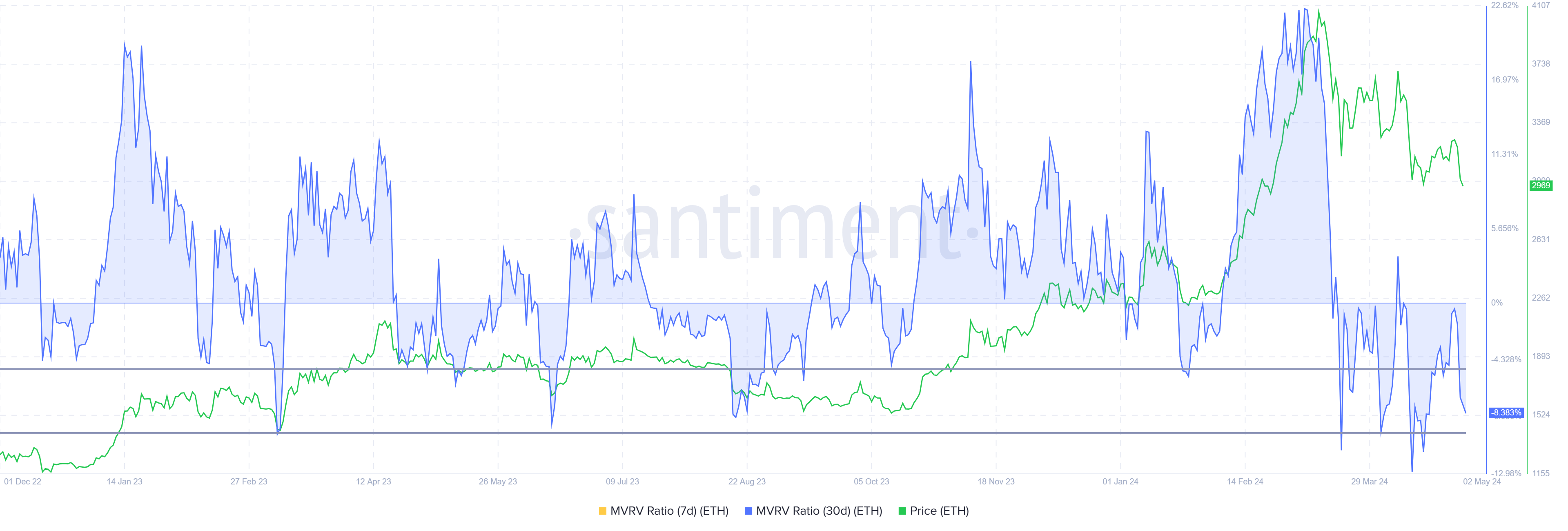

Derived from the Market Value to Realized Value (MVRV) ratio, which assesses investor profit or loss, Ethereum’s price could see an uptick.

Ethereum’s 30-day MVRV is sitting at -8%, which signals losses and potentially prompts accumulation. Historically, ETH recovery has occurred within the -4% to -10% MVRV range, labeled as an opportunity zone.

If investors choose to make the most of it and stock up on ETH, the altcoin could note a stronger recovery.

ETH Price Prediction: 27% Rally

Ethereum’s price trading at $2,945 is bouncing back from the lower trend line of a descending wedge. ETH has been stuck in this pattern for the last two months. The decline below $3,000 only validated the bullish reversal pattern further.

The likely move from here is an uptick to break through the upper trend line. This would enable ETH to note a potential 27% rally, placing the target price of Ethereum at $4,000.

Read More: Ethereum (ETH) Price Prediction 2024/2025/2030

On the other hand, the volatility of the investors’ optimism could threaten the potential of a rally if the broader market cues turn bearish. Failure to reclaim $3,000 could push ETH below $2,800, invalidating the bullish thesis and sending the altcoin to $2,740.