Ethereum (ETH) price is noting a sharp decline at the time of writing, but it is actually validating a bullish pattern.

Supported by the market conditions, the second biggest cryptocurrency on the planet has a shot at $4,000.

Ethereum Investors Remain Bullish

Ethereum’s price dipped to $3,000 in the last 24 hours, but this validated a key test of the upper trend line of a descending wedge. The altcoin’s potential for gains is backed by the fact that optimism among ETH holders is still alive.

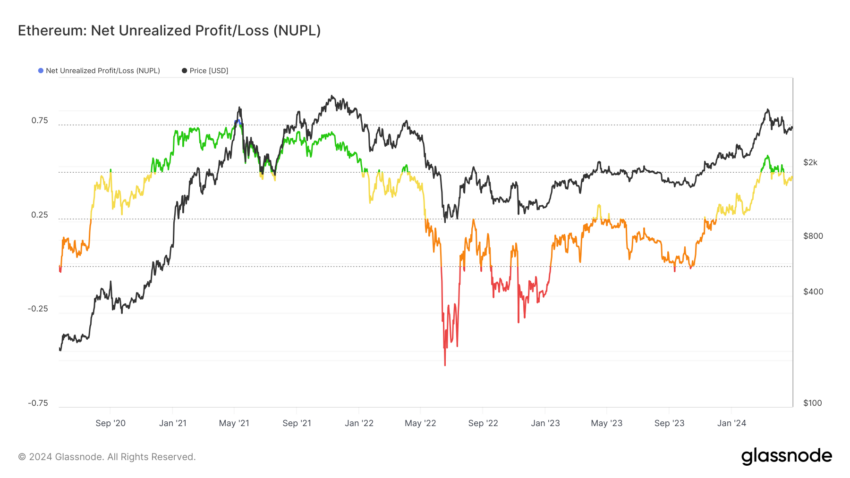

As evident from the Net Unrealized Profit/Loss (NUPL) indicator, the ETH holders still hold substantial gains. This fuels their optimism of a rally as they stand in the same sentimental zone.

Historically, ETH price has rallied more so than often when it is present in this zone. The same is expected this time as well.

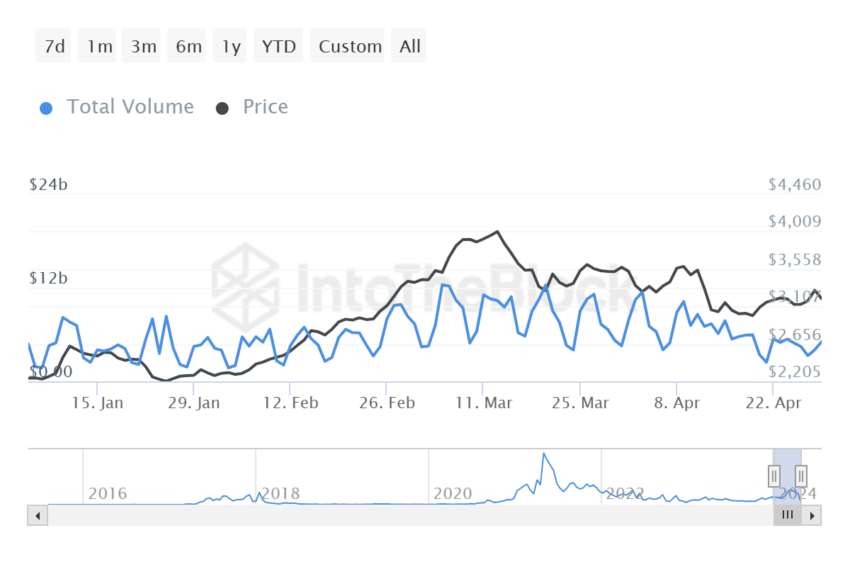

On the other hand, Ethereum whales have been slowing down their asset movement. Overall, the total transactions in a single day were $11.05 billion to $5.09 billion on Tuesday.

Generally, whale movement is considered bearish as it could potentially hit at corrections. However, given ETH’s price is low, activity suggests optimism.

ETH Price Prediction: Reversal Likely

Ethereum’s price at $3,000 holds the $2,991 price point as a support floor moving within the descending wedge. This bullish chart pattern is characterized by converging trendlines with lower highs and lower lows. This indicates a potential trend reversal when the price breaks out of the wedge formation to the upside.

According to the pattern, the target for ETH is $4,000, which would mark a 27% increase in price. Practically speaking, the chances of Ethereum’s price hitting $4,000 in the next month is unlikely. However, a breakout from this pattern could increase the price to $3,582.

This would mark a 13.6% rise for ETH, encouraging further participation from investors.

Read more: Ethereum (ETH) Price Prediction 2024 / 2025 / 2030

On the other hand, if Ethereum’s price falls through the $2,991 support floor, it could see a drawdown to the lower trend line at $2,894. Losing this support floor could invalidate the bullish thesis, pushing ETH further below $2,800.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.