The Ethereum (ETH) price broke out from a long-term descending resistance line that had been in place since the all-time high.

ETH is the native token of the Ethereum blockchain, created by Vitalik Buterin. After Bitcoin (BTC), it is the largest cryptocurrency by market capitalization. The ETH price has increased rapidly since March 10 (green icon), when it reached a low of $1,368. The increase caused a reclaim of the $1,690 resistance area and led to a new yearly high of $1,841. Moreover, it caused the RSI to break out from its bearish divergence trend line (green line).

These are both signs of a bullish trend and support an increase as long as the price does not close below the $1,690 horizontal area. If that occurs, ETH could fall to the ascending support line at $1,400.

Ethereum (ETH) Price Long-Term Outlook Supports Increase

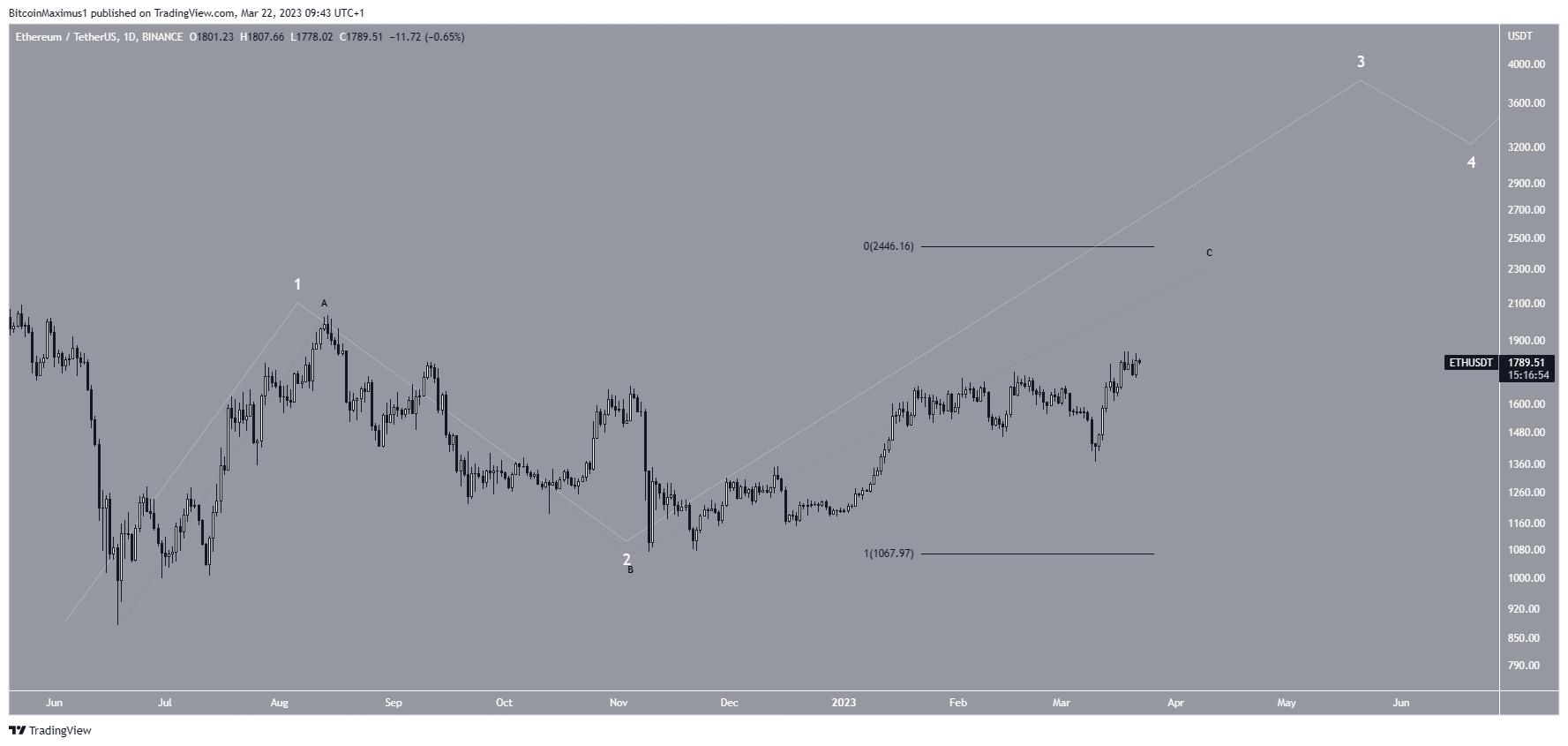

The ETH price had fallen under a descending resistance line since reaching an all-time high price of $4,868 in November 2021. The downward movement culminated with a low of $881 in June 2022. The price has increased since.

After deviating below the $1,370 horizontal area twice (red circle), the price reclaimed the area and validated it as support during the week of March 6-13, creating a long lower wick (green icon).

The next week, the Ethereum price broke out from the descending resistance line mentioned above. At the time of the breakout, the line had been in place for 490 days. Breakouts from such long-term structures often lead to significant upward movements. Moreover, the weekly RSI broke out above the 50 line, another bullish sign.

If the increase continues, the next resistances would be at $1,980 and $2,400, the latter being the 0.382 Fib retracement resistance.

Wave Count Aligns With Bullish Readings

The Ethereum price wave count also supports the continuation of the increase. While it is uncertain if the upward movement is part of an A-B-C structure (black) or a five-wave increase (white), both indicate that an upward movement toward at least $2,450 is expected. This would give waves A:C a 1:1 ratio and would align with the previously outlined Fib resistance area.

Then, the reaction once the price gets there will likely be crucial in determining if the ETH price will increase toward a new all-time high or if it will decrease.

To conclude, the most likely ETH price forecast is an increase toward at least $2,450. However, a close below $1,690 would invalidate this bullish outlook and could cause a fall to $1,400.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.