Inflows into Ethereum (ETH) digital investment products have now reached the highest value since March. This new record suggests that ETH’s price may continue recovering as it has within the past week.

ETH’s price as of this writing is $3,338, representing a 4.12% increase in the last 24 hours. But will the altcoin price continue to move northward?

More Money for Ethereum Is More Profits for Holders

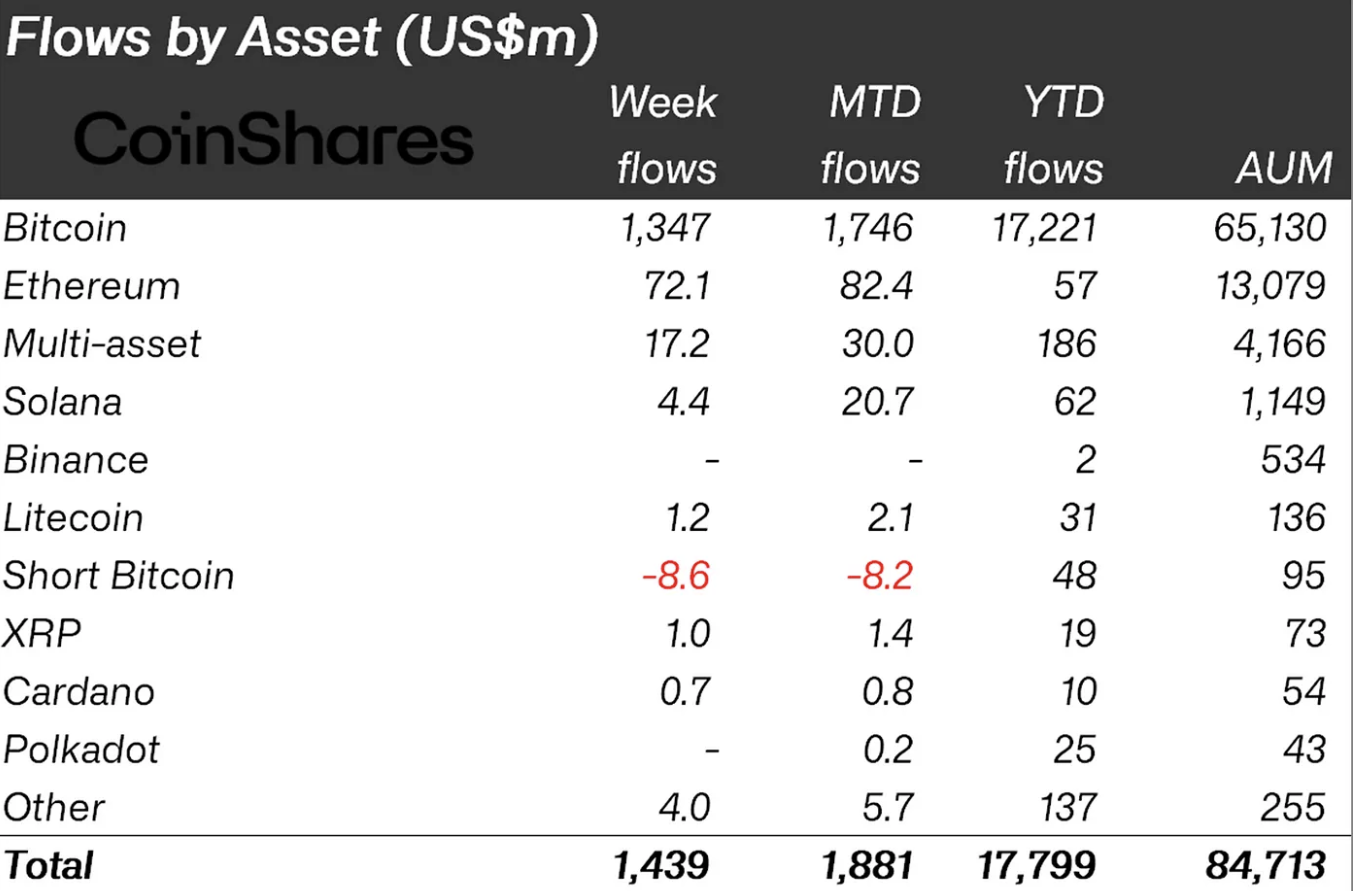

According to CoinShares, the crypto weekly inflows totaled $1.44 billion. This value makes it the fifth largest the product has seen since its inception. As expected, Bitcoin (BTC) had the lion’s share.

However, with $72 million, Ethereum has been able to register consistent inflows over the past few weeks while hitting the highest figure in four months.

“A wide range of altcoins saw inflows, most notable being Ethereum, which saw US$72m inflows last week, being the largest inflows since March and likely in anticipation of the imminent approval of the spot-based ETF in the US.” James Butterfill, CoinShares Head of Research, wrote.

Recently, BeInCrypto reported that a number of analysts expect the spot Ethereum ETFs to launch this week.

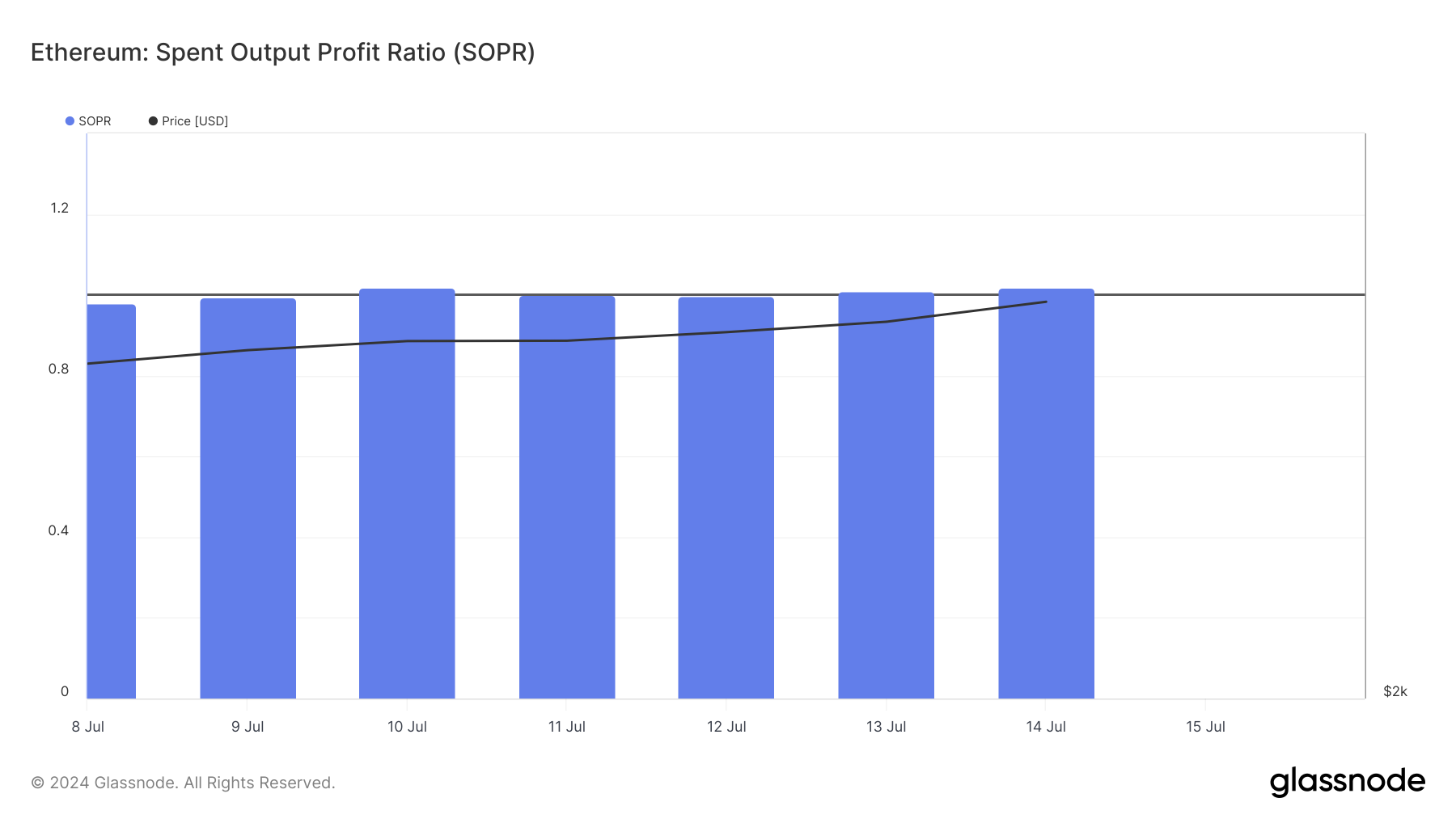

In addition, according to Glassnode, ETH holders have begun to experience some form of respite. This is because of the indications revealed by the Spent Output Profit Ratio (SOPR).

The SOPR examines market spending behavior, providing insights into profits and losses over a period of time. When the value of the SOPR is 1, moved coins are sold for profit on a particular day.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

But when it is lower than 1, it implies sell-offs at a loss, and if it is exactly 1, it means holders are selling at the breakeven point.

As shown above, Ethereum’s SOPR is 1.01 at press time. If sustained, successive peaks will indicate that the spent coins are moved back into circulation, increasing the probability of a price rally.

ETH Price Prediction: $3,300 Holds, But How About $4,000?

Like the SOPR, Ethereum’s Open Interest (OI) gives signs that suggest that the price will increase as the value is $7.72 billion.

OI refers to the sum of the value of open contracts in the market. When it increases, it means that market participants are increasing their exposure to a coin. However, a decrease implies that participants are closing their net positions.

From a trading and historical perspective, a rise in OI backs an increase in ETH’s spot value. Therefore, if interest in the cryptocurrency continues to jump, so will the price. If this remains the case, ETH could reach $3,474 in the short term.

Further, if inflows into the ETFs reach $1 billion, as has been predicted in some corners, ETH may retest $4,000.

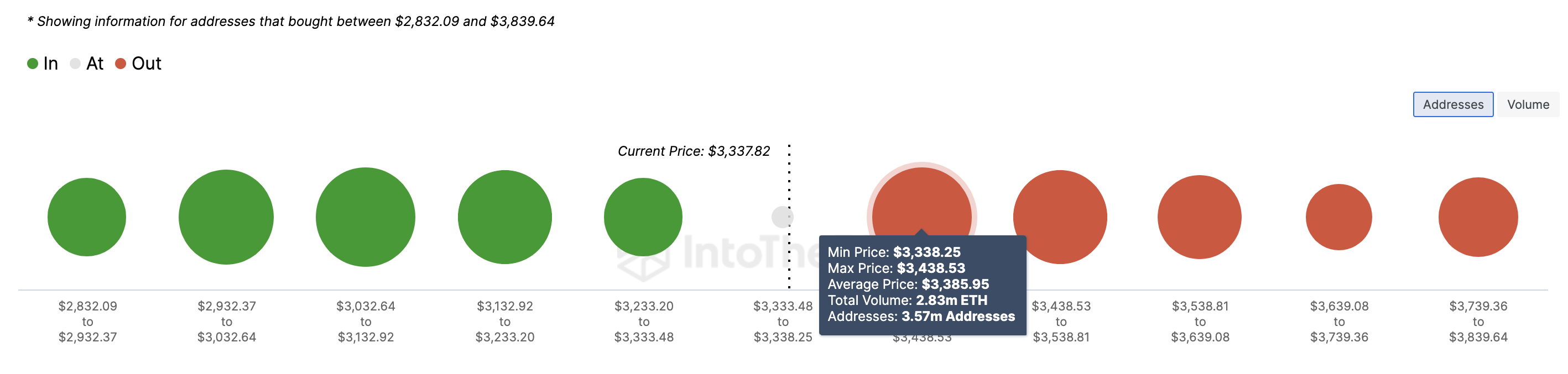

However, the In/Out of Money Around Price (IOMAP) shows that there is a chance of invalidation. The IOMAP classifies addresses based on those making money, those out of money, and those at the breakeven point.

If the number of addresses in the money is higher, the price region will provide support. But if it is the other way around, crypto will face resistance.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

At press time, we noticed that 3.57 million addresses bought 2.83 million ETH at an average price of $3,385. Meanwhile, 2.04 million purchased 1.15 million of the cryptocurrency around $3,282.

Since there is a larger number of addresses out of the money, it means Ethereum will find it challenging to break through $3,385.

This is because once ETH reaches this value, some holders may decide to sell. If this happens, the price of Ethereum may drop below $3,300 and even go as low as $3,233.