Since breaking down from a long-term consolidation pattern, Ethereum (ETH) has struggled to sustain an upward movement and create a bullish structure.

ETH has been falling since reaching an all-time high price of $4,868 in Nov. After bouncing this Jan, the price created a lower high in March (red icon) and has been falling at an accelerated rate since.

The downward movement has so far led to a low of $1,700 on May 12.

An important development is that the price has broken down from an ascending parallel channel which had previously been in place since May 2021. A breakdown from such a long-term structure could cause a similarly long-term drop.

Furthermore, the RSI has decreased below 50, in what is considered a sign of a bearish trend.

Mixed readings

The daily chart provides a mixed outlook. On May 8, the price broke down from a descending parallel channel.

Afterward, it validated it as resistance twice, more specifically on May 31 and June 7 (red icons).

However, the RSI has generated a bullish divergence (green line), whose trendline is still intact.

So, while the price action is bearish, the readings from the RSI are bullish.

A closer look at the six-hour time frame shows that ETH is trading inside a symmetrical triangle. While this is considered a neutral pattern, it is occuring after a downward movement.

As a result, it is possible that it will lead to the continuation of the downward movement.

ETH wave count analysis

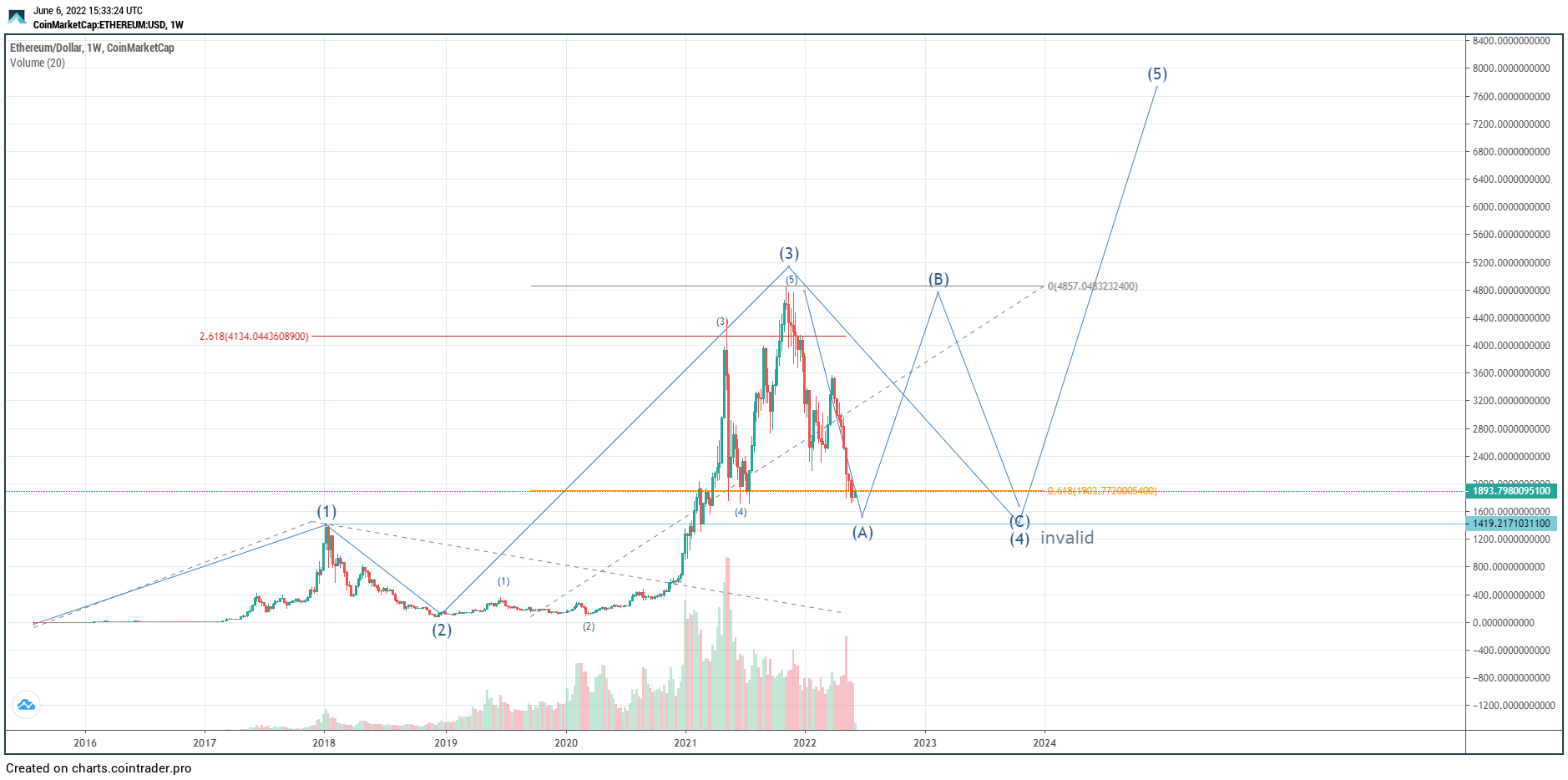

Cryptocurrency trader @TheTradingHubb tweeted a chart of ETH, stating that the price could soon complete wave A of a long-term A-B-C correction.

While this is a possibility, it is not yet certain of the A wave is complete.

If the short-term A:C (white) waves have a 1:1 ratio, this would lead to a low of $876 prior to the reversal.

Furthermore, the exact shape of the ensuing retracement is not yet determined.

For Be[in]Crypto’s latest bitcoin (BTC) analysis, click here

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.