Be[In]Crypto takes a look at the price movement of seven different cryptocurrencies, including Ethereum (ETH), which has just broken out from a descending resistance line.

BTC

Since June 2021, the $40,500 horizontal area has been intermittently acting as both resistance and support for BTC. Initially, it rejected BTC twice (red icons), before turning to support and initiating two bounces (green icons).

However, since the final breakdown (red icon) on Jan 21, the area has not been respected, as BTC is moving freely above and below it.

ETH

It is possible that ETH has been trading inside an ascending parallel channel since Jan 24. The resistance line of the channel is currently at $3,500.

On March 14, ETH broke down from a short-term descending resistance line and validated it as support three days later (green icon).

Currently, the price is moving above the middle of the channel. If successful, an upward movement towards the resistance of the channel at $3,500 would be likely.

XRP

XRP has been decreasing underneath a descending resistance line since Nov 30. The line has rejected the price four times (red icons), most recently on March 22.

Since resistance lines get weaker each time they are touched, an eventual breakout from it would be the most likely scenario.

If a breakout occurs, the next closest resistance would be at $1.

ADA

ADA has been decreasing underneath a descending resistance line since reaching an all-time high price on Sept 2.

While the downward movement continued, both the RSI and MACD generated considerable bullish divergences (green lines).

ADA is currently in the process of breaking out from this line.

If the breakout continues, the closest resistance would be between $1.65 and $1.92. This is a resistance created by the 0.382 to 0.5 fib retracement resistance areas.

NEAR

NEAR has been moving upwards since Feb 24. The increase led to a high of $11.94 on March 1. Since then, the price has been trading inside a symmetrical triangle.

While the triangle is considered a neutral pattern, it is being created after an upward movement. Therefore, a breakout from it would be the most likely scenario.

If one occurs, the closest resistance area would be between $13.70 and $14. This is the 0.5 fib retracement resistance level and a horizontal resistance area.

It also coincides with the height of the triangle projected to the breakout level.

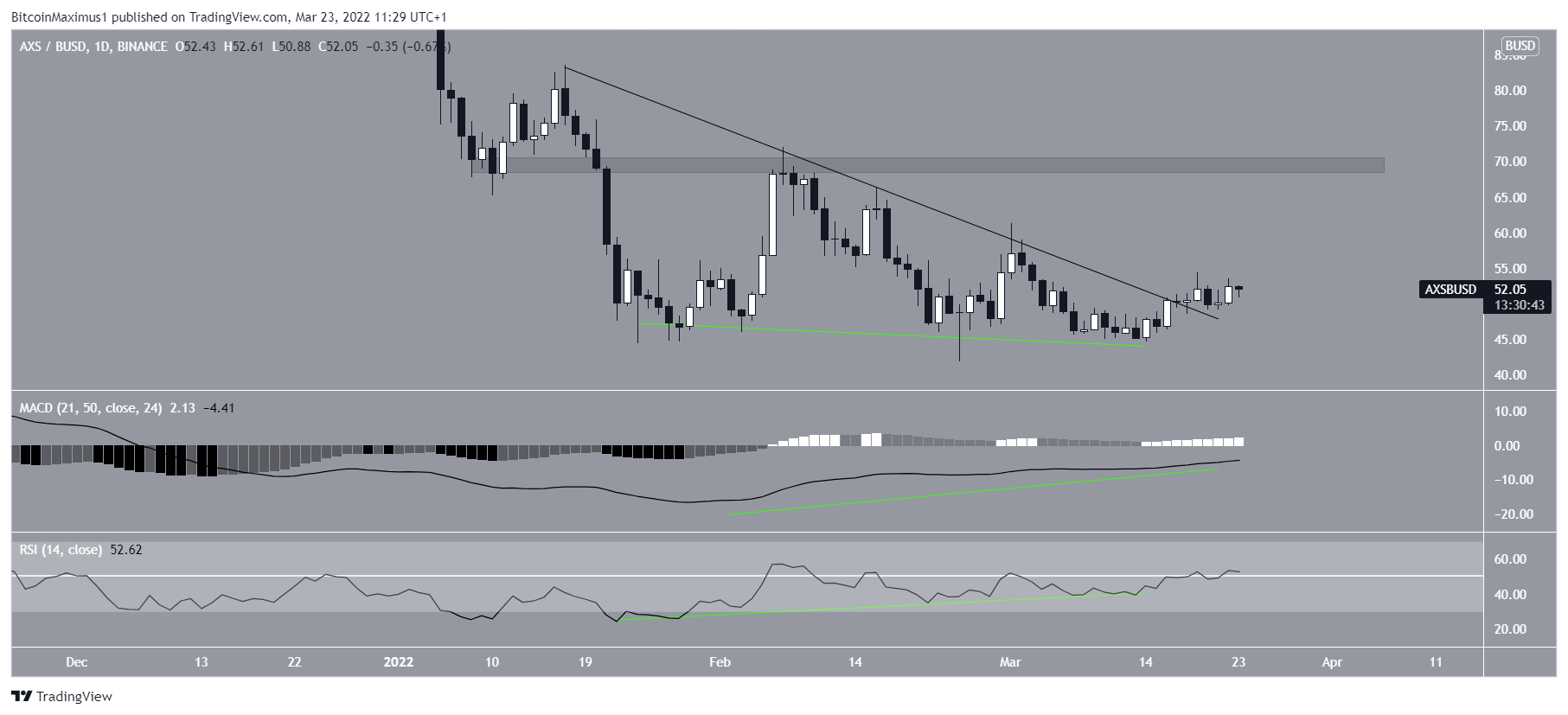

AXS

AXS had been decreasing alongside a descending resistance line since Jan 17.

However, after generating bullish divergences, the price broke out from the line on March 18.

If the upward movement continues, the next closest resistance area would be at $69.

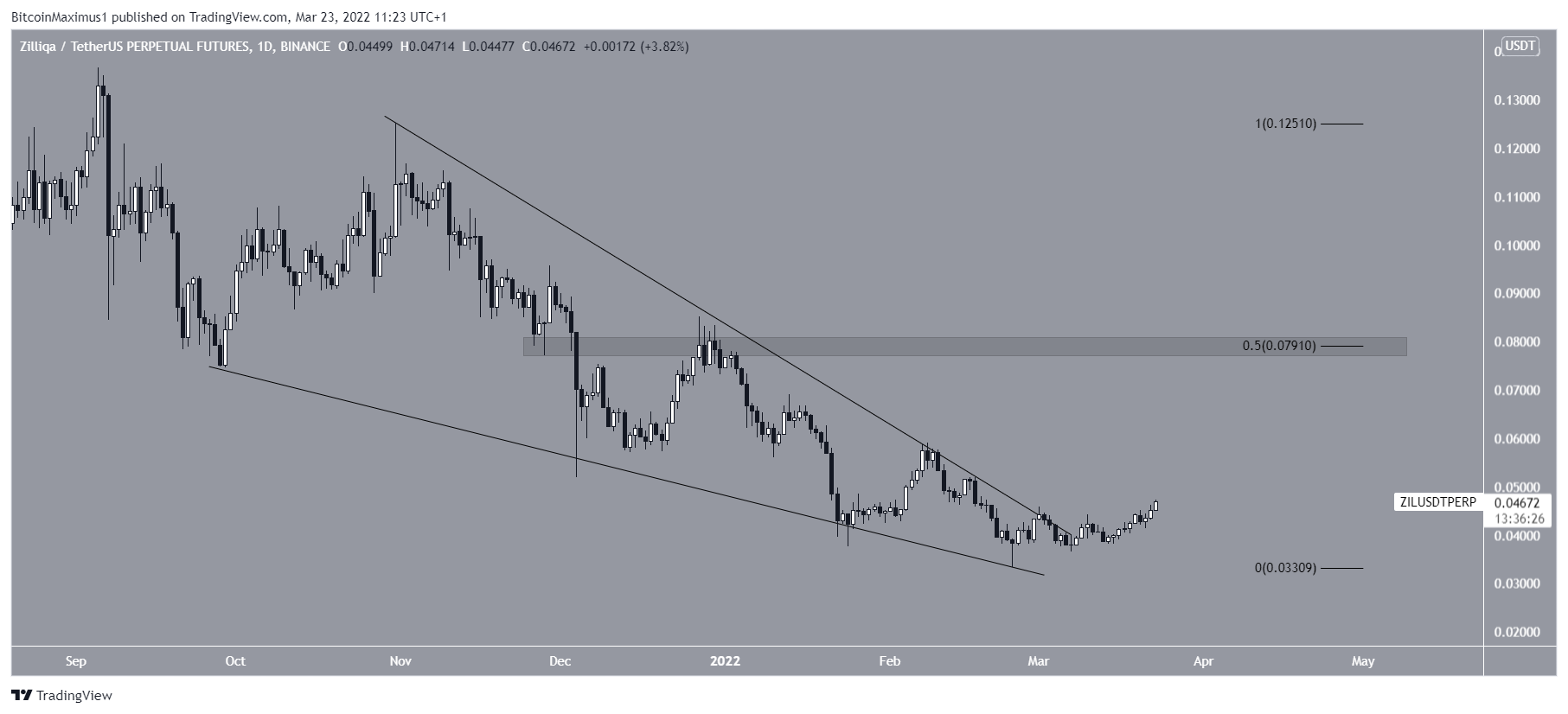

ZIL

ZIL had been decreasing inside a descending wedge since Sept 28. On Feb 24, it bounced and created a long lower wick. It proceeded to break out from the wedge on March 8.

The next closest resistance area is at $0.079. This is a horizontal resistance area and the 0.5 fib retracement resistance level.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.