Ethereum (ETH) price has a shot at initiating a rise since the investors support a similar outcome.

The altcoin could note some resistance following a breakout as profits saturate, but until then, it has a chance of recovering.

Ethereum Investors Remain Hopeful

Ethereum’s price stands to benefit from the optimism its investors are exhibiting. Even though the altcoin has been observing bearishness following its decline from $3,800 to $3,580, ETH holders are looking toward gains.

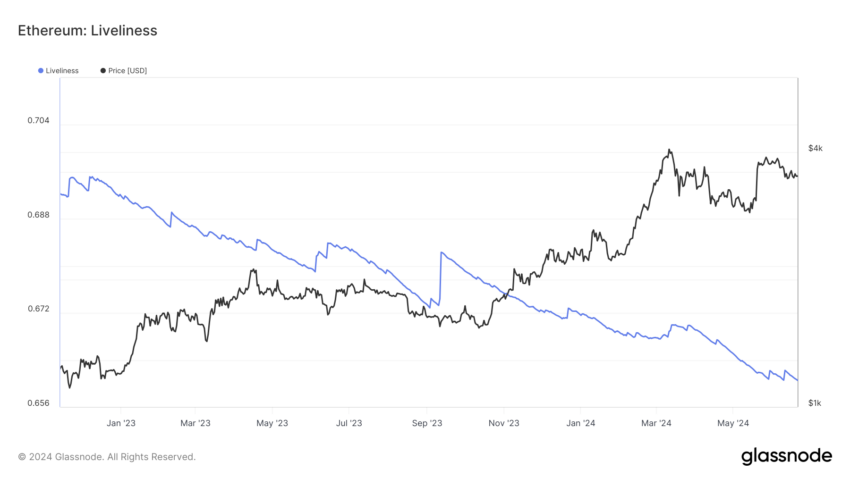

This is visible in the liveliness of the asset. The Liveliness indicator is showing a downtick, indicating a bullish sentiment among investors. This suggests that many are opting to HODL their Ethereum, which could contribute to a potential price increase.

Read More: How to Invest in Ethereum ETFs?

In fact, despite this bullish sentiment, only 87% of the circulating supply is currently in profit. This figure is significantly lower than the market top threshold of 95%, indicating that there is still substantial room for growth.

The current profit percentage suggests that Ethereum has not yet reached its peak, leaving space for further price appreciation. Investors holding onto their Ethereum are likely anticipating this upward movement.

With the combination of a lower Liveliness indicator and a significant portion of the circulating supply not yet in profit, Ethereum’s price has the potential to break out of its current consolidation phase.

ETH Price Prediction: Possible Recovery Ahead

Ethereum’s price trading at $3,492 is consolidated for now but is looking to breach $3,582. Securing the latter as a support level would enable a bounce to $3,700. Reclaiming this level as a support floor would enable the altcoin to recover its recent losses.

This would also result in Ethereum’s price securing the 50% Fibonacci Retracement line as support.

Read More: Ethereum (ETH) Price Prediction 2024/2025/2030

However, if the breakout fails and the altcoin remains consolidated, ETH could continue moving sideways. Should the broader market’s bearishness lead to a dip below the support of $3,459, the bullish thesis would be invalidated. ETH could thus slip to 38.2% Fib line at $3,336.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.