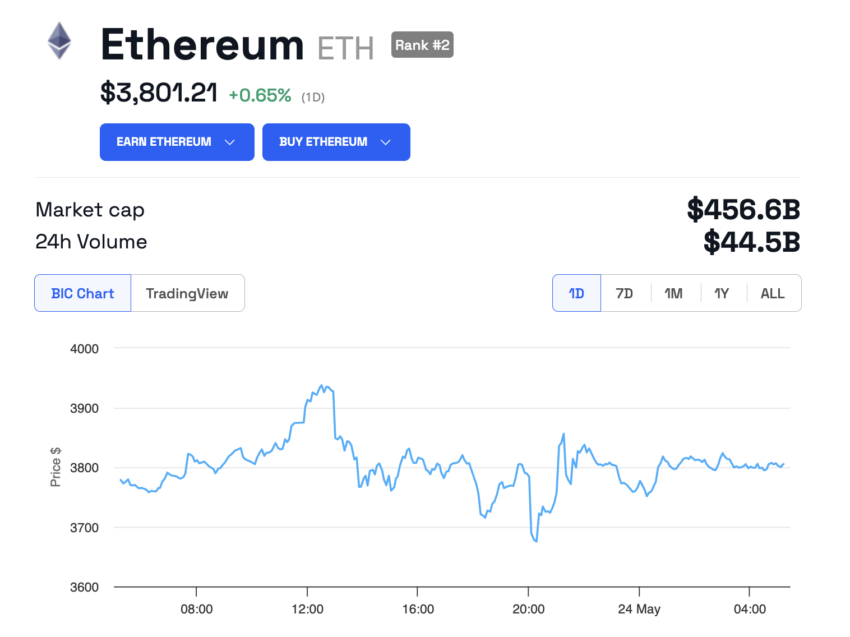

Despite the US Securities and Exchange Commission (SEC) granting historic approvals for eight Ethereum-based exchange-traded funds (ETFs), Ethereum has not breached the $4,000 mark.

Following the SEC’s decision, Ethereum’s (ETH) price spiked to nearly $3,900 but quickly receded to approximately $3,720. As of this writing, the price has somewhat stabilized, hovering around $3,800.

Ethereum ETFs: Sell the News?

Ethereum, ranking second in market capitalization among cryptocurrencies, recorded a modest 0.65% increase in the last 24 hours. Over the previous week, however, it gained more than 28%, reflecting some market optimism. Despite these gains, the anticipated push past the $4,000 threshold has yet to materialize.

Read more: How to Invest in Ethereum ETFs?

Crypto analyst Jason Pizzino weighed in on the developments.

“The Ethereum ETF has been approved. However, that wasn’t enough to pump the price past $4,000. The ETH/BTC pair also saw a weaker than expected rally,” Pizzino said.

This cautious approach from traders suggests they might view the recent news as a “sell-the-news” event. This phenomenon occurs when prices fall after major announcements as investors capitalize on the news spike.

The reaction within the broader Ethereum ecosystem was mixed. Pepe, for instance, reached a new all-time high of $0.00001576 immediately following the ETF approvals but then declined by over 8%. Arbitrum (ARB) also fell more than 3% after its initial increase. Conversely, Lido DAO (LDO) bucked the trend, advancing over 12% in the last 24 hours.

This pattern of “sell-the-news” has been previously observed, notably after the SEC approved spot Bitcoin ETFs. Post-announcement, Bitcoin’s price plunged over 20%, dropping to a low of around $38,000 before it recovered.

The SEC’s recent approvals marked a significant shift from its earlier reticence. Amidst circulating rumors of impending approvals, fund managers hurriedly revised their filings and made crucial amendments, anticipating a favorable decision.

Read more: Ethereum ETF Explained: What It Is and How It Works

ETFs simplify the investment process for ordinary investors by allowing them to purchase shares that trade on stock exchanges and track the price of the underlying assets. For traditional investors, these funds provide a regulated, straightforward entry into the crypto market, eliminating the need for technical knowledge related to direct purchases, sales, and storage of crypto assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.