A recent report reveals that Konstantin Lomashuk and Vasiliy Shapovalov, co-founder of Lido—the largest liquid staking protocol in Ethereum (ETH)—fund a competitor of Ethereum’s restaking protocol EigenLayer.

According to a source familiar with this matter, Symbiotic is the protocol that will receive Lido co-founder’s backing. It will get support through the Cyber Fund.

Symbiotic Also Gains Backing from Paradigm

In addition to Lido’s co-founders, Symbiotic has support from Paradigm, a well-known venture capital (VC) firm in the crypto industry. Paradigm is also one of Lido’s main investors.

The report further reveals that Paradigm initially approached Sreeram Kannan, co-founder of EigenLayer, to invest in the project. However, Sreeram Kannan rejected Paradigm’s offer and accepted investment from Andreessen Horowitz (a16z) instead.

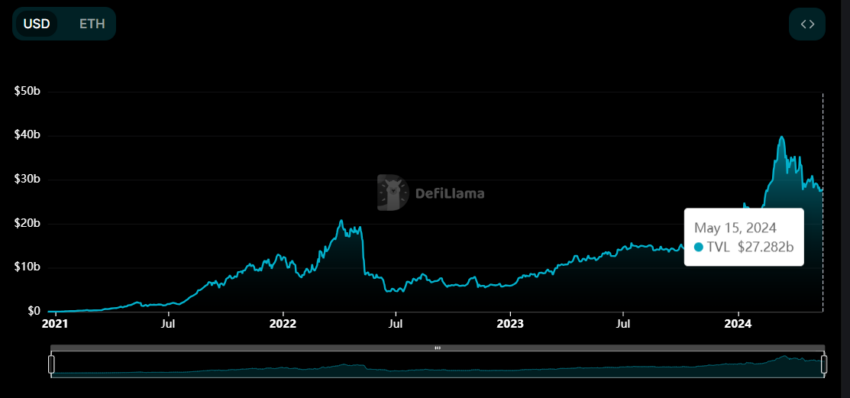

Since its introduction in October 2020, Lido has become a breakthrough in the decentralized finance (DeFi) sector. It developed a protocol that allows users to stake their ETH and receive Lido Staked ETH (stETH) tokens, which can be used for various things.

Lido has proven so popular that it is now Ethereum’s largest DeFi protocol. According to DeFiLlama data, Lido now has a total value locked (TVL) of $27.28 billion.

Read more: The Ultimate Guide to Lido Staked ETH (stETH)

Meanwhile, EigenLayer is currently the second largest DeFi protocol with a TVL of $14.29 billion. Since EigenLayer achieved this figure relatively quickly, its presence may threaten Lido. Therefore, it is plausible that Lido plans to back EigenLayer’s competitor to maintain its dominance.

How is Symbiotic Different from EigenLayer?

The report also explained how Symbiotic works. This protocol will be permissionless, providing a flexible mechanism for decentralized networks to coordinate node operators and economic security providers.

“Symbiotic will offer a way for decentralized applications, called actively validated services, or “AVSs,” to collectively secure one another. Users will be able to restake assets that they’ve deposited with other crypto protocols to help secure these AVSs,” the report reads.

Unlike EigenLayer, Symbiotic will enable users to deposit any assets based on Ethereum’s ERC-20 token standard directly into its protocol. This means Symbiotic will be directly compatible with stETH and thousands of other crypto tokens that use the ERC-20 token standard.

Meanwhile, EigenLayer currently accepts ETH assets, several ETH-linked liquid staking tokens (LST), and native EIGEN tokens. However, Symbiotic will not accept ETH deposits at all. Instead, it allows users to stake using stETH and other popular assets that are not natively compatible with EigenLayer.

However, it remains to be seen when Symbiotic will launch. Some sources said this project would be released at the end of 2024.

Indeed, restaking is one of the most interesting crypto narratives in 2024. A recent report from CoinGecko noted that EigenLayer’s restaking contributed to the Ethereum ecosystem’s achievement in Q1 2024.

In the quarter, restaking on EigenLayer increased by 36%, with a total of 4.3 million ETH being restaked. The majority of restaked ETH was held by Liquid Restaking Protocols (LRTs), which amounted to 2.28 million ETH.

Read more: Ethereum Restaking: What Is It And How Does It Work?

The allure of restaking extends beyond Ethereum. BeInCrypto previously reported that Jito, a liquid staking protocol on Solana, was rumored to create its restaking services.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.