Deflation on the Ethereum network is rising, with the value hitting a record high in the six months following The Merge. The ETH supply has dropped by nearly 63,000 ETH.

Deflation on the Ethereum network is ramping up as the supply has dropped to a record low six months after The Merge. Since the milestone event happened just under six months ago, the ETH supply has dropped by nearly 63,000. The current supply stands at about 120.45 million ETH.

The currency burn rate of the market’s second-biggest token is 1,233K ETH over the last 30 days. Supply growth, meanwhile, is at -0.45% over 30 days.

At these rates, the Ethereum supply is projected as 118.1 million by the year 2025. Issuance rewards for stakers will stand at around 4% per year, trumping the burn rate for non-stakers, which is 1.8% per year. The supply should also have a pearl of 120.6 million ETH at current levels over the next two years.

Most of the burns come from ETH transfers, though DeFi giants also contribute greatly.

With respect to the latter, Uniswap, Tether, and Blur top the board.

It’s a positive sign for Ethereum, which has undergone some major changes over the past few years. The token’s switch to Proof-of-Stake has accelerated its goals to becoming the major smart contract network on the market, and no other project comes close in terms of success.

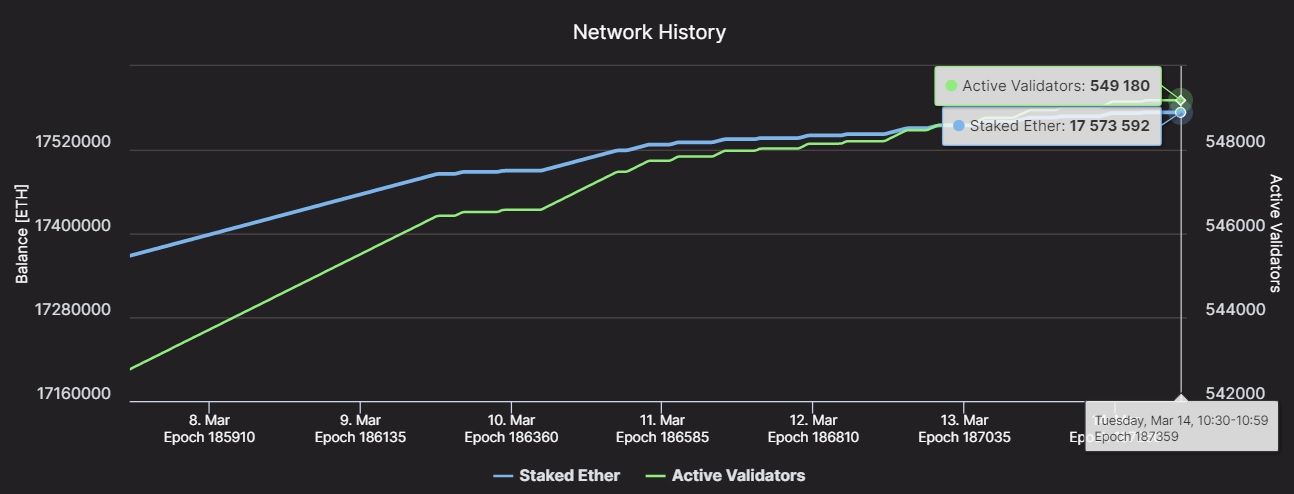

More Than 17.5M ETH Staked

The amount of staked ETH has steadily grown over the months, crossing $28 million in mid-February. At that point, Ethereum’s supply had already shrunk by about $40 million since The Merge.

A large portion of the staked ETH comes from liquid staking solutions. Lido Finance and Coinbase are at the top of this list, with the former serving as a go-to service for many. Lido accounts for about 31.3% of beacon chain depositors and Coinbase 11.7%.

Ethereum Gains Momentum for Shanghai Upgrade

The interest in Ethereum is only increasing as the Shanghai upgrade is expected to arrive soon. The upgrade will allow stakers to unlock their staked Ether, which is a major feature. Shanghai should arrive in the first half of 2023 and may even happen in April.

The network will also experience a fork through Capella, which upgrades the network’s Beacon Chain consensus layer. It introduced features related to validator withdrawals.