While Ethereum Classic (ETC) is trading inside a short-term bullish pattern, it has yet to show any decisive bullish signs.

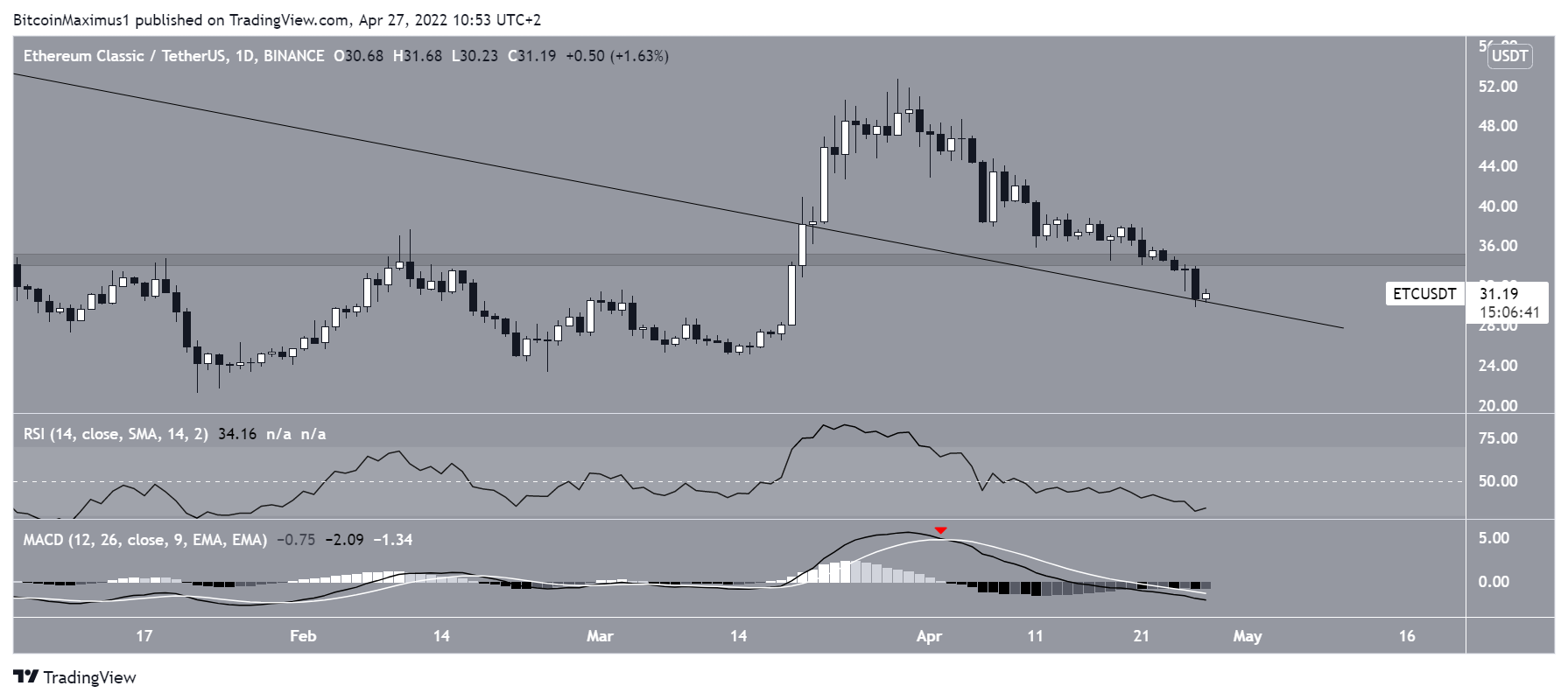

ETC has been decreasing underneath a descending resistance line since Sept 6. The downward movement led to a low of $21.20 on Jan 22.

The price has been moving upwards since, and managed to break out from the descending resistance line on March 20. This led to a high of $52.99 on March 26. But, the price has been falling since.

During the decrease, ETC broke down below the $34.50 area, which is now expected to provide resistance.

On April 26, the price reached a low of $29.88, potentially validating the previous descending resistance line as support (green icon).

Bearish ETC readings

Despite the possibility of a bounce, technical indicators in the daily time frame are bearish. This is visible by the decreasing MACD and RSI.

The MACD has made a bearish cross (red icon) and has decreased well into negative territory. Both of these are considered signs of a bearish trend. Similarly, the RSI has decreased below 50 and is mired in a downtrend.

Therefore, daily time frame indicators are bearish.

Short-term movement

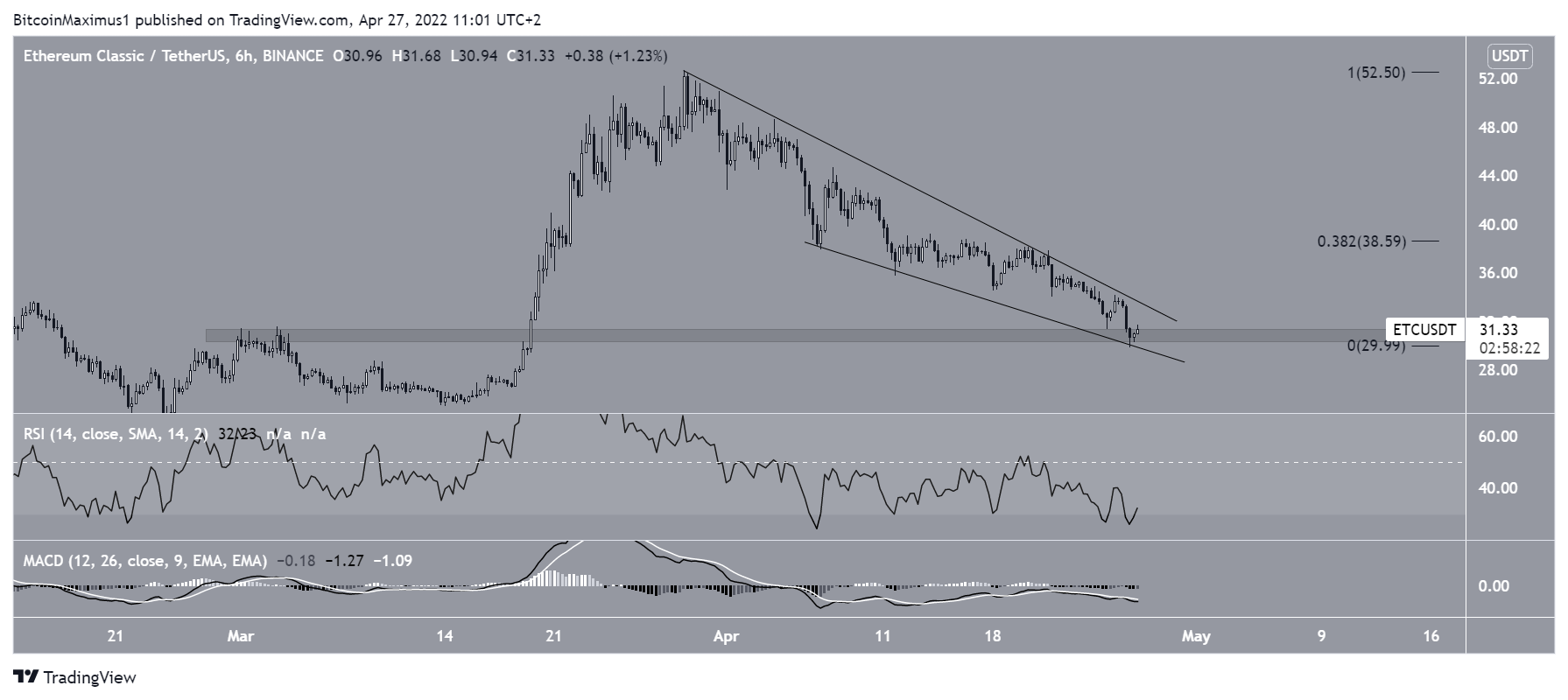

Cryptocurrency trader and investor @livercoin tweeted a chart of ETC, stating that the price could soon break out from a descending resistance line.

However, since the tweet, ETC has failed to break out from the line and has been rejected by it instead.

The descent has taken the shape of a descending wedge, which is considered a bullish pattern.

Additionally, ETC has reached the minor $31 horizontal support area.

If a breakout were to occur, the next closest resistance would be at $38.60. This is the 0.382 Fib retracement resistance level. Despite this, there are no bullish signs in place.

For Be[in]Crypto’s latest Bitcoin (BTC) analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.