Ethereum remains the sleeping giant during the recent Bitcoin and crypto market rally since it has not enjoyed the gains that its big brother has. Analysts and advocates have been postulating that the asset remains undervalued at current prices.

Ethereum prices have been moving in the recent rally but not as much as Bitcoin which is commanding the space again. As a result, ETH remains down 54% from its all-time high and analysts view it as undervalued.

Ethereum Undervalued

Since the rally began in mid-October, Ethereum has made around 30%. Comparatively, Bitcoin has skyrocketed 55% over the same period, largely driven by spot ETF hype.

On Dec. 4, Ryan Sean Adams from Bankless declared “ETH price at $2,200 is hilarious.”

“Everyone out here trading ‘what ifs’ this cycle when Ethereum has fundamentals,” he added.

He noted that Ethereum now makes $2.7 billion in annualized profits and is “the only profitable chain.” Moreover, it has a P/E ratio of 98, slightly more than Amazon’s P/E ratio of 75.

A price-to-earnings ratio is a valuation used to compare a company’s current share price to its per-share earnings. In this case, Ethereum is making much more revenue than the asset price reflects.

RSA added that there were entire chains that were buyers of blockspace – layer twos.

Read more: How to Buy Ethereum (ETH) and Everything You Need to Know

Other fundamentals include the deflationary issuance of Ethereum. According to ultrasound.money, the supply has declined by 293,240 ETH since the Merge in September 2022.

Moreover, Ethereum “bond holders” or validators are earning 5.3% per year with ETH being known as “the internet bond.”

Ethereum also ticks the ESG boxes being proof-of-stake and not requiring huge amounts of energy.

Finally, he noted that the asset is also likely to get a spot ETF, further driving demand.

“Ethereum is likely to get a spot ETF – it’s likely only BTC and ETH will achieve this status this cycle opening the door to trillions in locked capital inflows.”

ETH Price Outlook

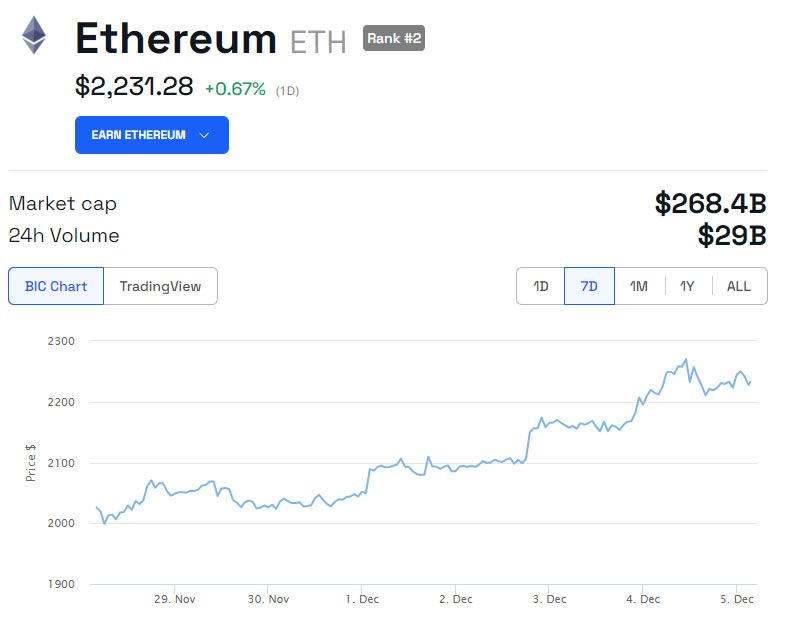

Ethereum prices are hovering around $2,233 at the moment having remained flat on the day. Furthermore, the asset hit a 2023 high of $2,270 on December 4 and has made around 10% over the past week.

ETH has returned to May 2022 prices but has been slower than Bitcoin to get there having only just broken out of 18 months of consolidation.

Fellow network advocate Anthony Sassano commented:

“ETH will explode upwards to $10k+ leaving sidelined investors stuck in fiat and shitcoins,”