Between Feb 24-26, the ETH price was subject to a significant decrease and has since been trading in a range between ₿0.0251-₿0.0263.

Ethereum (ETH) Price Highlights

- The price is trading in a range between ₿0.0251-₿0.0263.

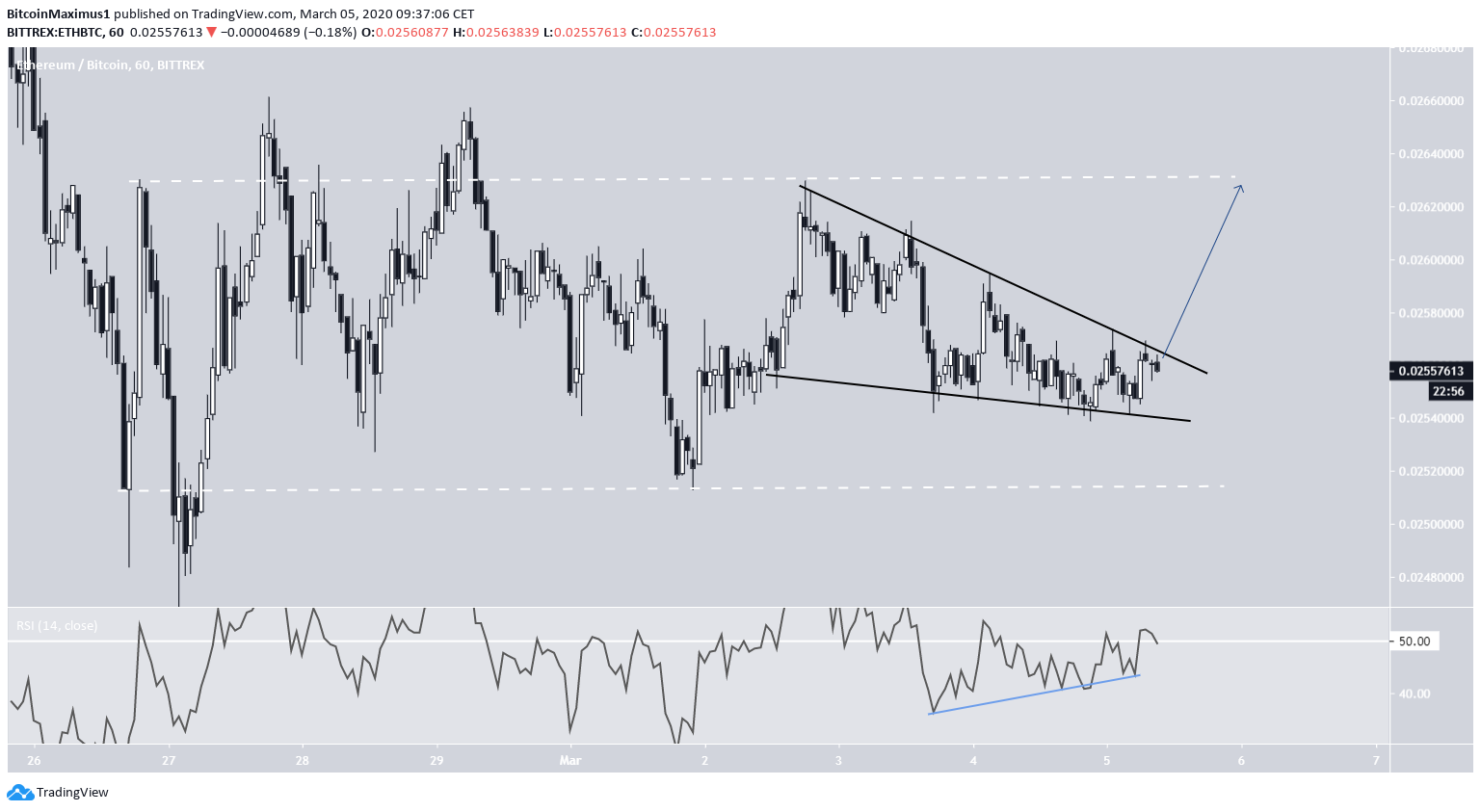

- It is trading inside a short-term descending wedge.

- There is strong support at ₿0.0253 and ₿0.0225.

- The price is trading inside a longer-term symmetrical triangle.

Trader and analyst @VentureCoinist tweeted an Ethereum chart, stating that while he is unsure about the future ETH/USD price movement, he believes that the ETH/BTC pair will head lower, a movement that is likely to commence after ETH breaks down from its current pattern.

Have no idea what to expect on the $ETH dollar pair but relative to Bitcoin, it still looks like it wants to move lower. pic.twitter.com/ww77AmSd0S

— Luke Martin (@VentureCoinist) March 4, 2020

Note: This is a short-term analysis. For the longer-term version, please click here.

Descending Wedge

Since Feb 26, the Ethereum price has been trading in a range between ₿0.0251-₿0.0263. It reached the resistance line on March 2 and has been decreasing since.

The decrease has taken the form of a descending wedge, which is considered a bullish reversal pattern. In addition, there is bullish divergence developing inside this pattern.

These signs add up to an eventual breakout that would take the price to the top of this range.

However, the tweet outlines a symmetrical triangle instead of a wedge, albeit at a higher time-frame. Let’s zoom out in order to take a look at it and determine if this short-term increase will cause a breakout from the longer-term triangle.

Symmetrical Triangle

The six-hour chart reveals that the proposed breakout would likely take the price all the way to the resistance line of the symmetrical triangle, but not necessarily cause a breakout.

Since the triangle is considered a neutral pattern and is succeeding a price decrease, the expected movement would be a breakdown.

This is supported by the fact that each successive bounce from the ₿0.0253 support area has been weaker, as evidenced by the lower-highs created.

If the proposed breakdown happens, it would mean that ETH would fall below the ₿0.0253 support area and head lower towards the next support area at ₿0.0225.

A breakout above the resistance line would invalidate this possibility.

To conclude, the Ethereum price has created a descending wedge, out of which it looks likely to break out of. However, this is expected to be a short-term movement, and Ethereum is expected to break down from its longer-term pattern afterward and reach the support area outlined above.