Along with the rest of the cryptocurrency market, the Ethereum price decreased sharply on February 24-26. However, the price bounced on a significant support area on February 27 and has been gradually increasing since.

Ethereum (ETH) Price Highlights

- There is support at ₿0.0255 & ₿0.0247.

- There is resistance at ₿0.034.

- The Ethereum price is trading inside a symmetrical triangle.

- It is facing resistance from the 200-hour moving average (MA).

- The long-term outlook is bullish & the short-term outlook is bearish.

Let’s take a closer look at the Ethereum price movement and determine where it is heading to next. Note: This article will only deal with the ETH/BTC pair. For the ETH/USD analysis, click here.$ETH also looks prime for continuation vs $BTC.

— Young And Investing (@QuintenFrancois) March 3, 2020

Retested previous resistance as support. Still waiting for a more convincing bounce though.

Unleash the BEAST pls @VitalikButerin pic.twitter.com/4LIqyd41p7

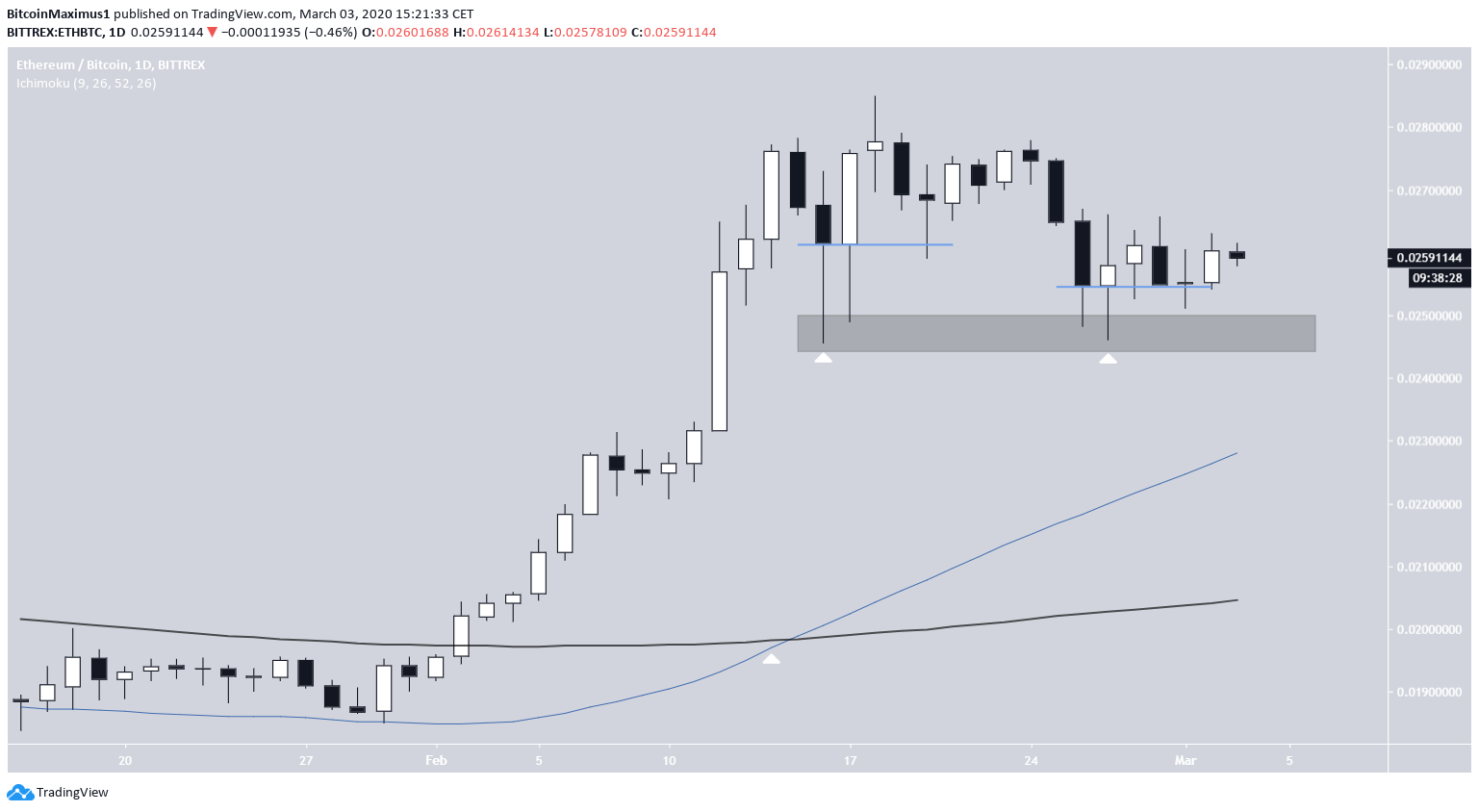

Double Bottom

The first thing to note should be the long-term chart — even with last week’s decrease is extremely bullish. The Ethereum price created the bullish reversal pattern known as a double bottom that was combined with a strong bullish divergence in the RSI. Afterward, it began a strong upward move and broke out above the main resistance area at ₿0.0255. The aforementioned decrease only served to validate this area as support. As long as the price stays above it, the Ethereum trend is considered bullish and a movement towards ₿0.034 is expected.

Daily Ethereum Chart

The daily chart is also bullish but raises some concerns. On a positive note, a bullish cross between the 50- and 200-day moving averages (MAs) has transpired on February 14. However, the price is quite above these MAs. Also, there is virtually zero support all the way down, so a price decrease below the minor support provided by the wicks at ₿0.0247 could trigger a sharp drop. The main reason for the concern comes from the lack of strong bounce once the Ethereum price reached the support area. As evidenced by the horizontal blue lines, the close on the second bounce was lower on the first one — indicative of weakness. A daily close below ₿0.0254 (second line) would be a definitive sign of weakness, suggesting that the price will break down below ₿0.0247.

Short-Term Bearishness

The short-term outlook aligns with the daily chart. The Ethereum price is trading inside a symmetrical triangle, which is considered a continuation pattern. The resistance of the triangle coincided with the 0.618 Fib level, making this a retracement rather than a reversal. Also, the RSI has been rejected thrice at the 50 level. The hourly chart gives a similar view. The Ethereum price was rejected at the range high and the 200-hour moving average.

Therefore, a price decrease towards the range lows at ₿0.025 is expected. The reaction once the price gets there will be helpful in determining if the price will move upwards afterward.

The hourly chart gives a similar view. The Ethereum price was rejected at the range high and the 200-hour moving average.

Therefore, a price decrease towards the range lows at ₿0.025 is expected. The reaction once the price gets there will be helpful in determining if the price will move upwards afterward.

To conclude, the Ethereum price has completed a bullish reversal pattern and broken out above a significant resistance area. However, it has been showing some signs of weakness in the short-term, which suggests the price will decrease to ₿0.025.

To conclude, the Ethereum price has completed a bullish reversal pattern and broken out above a significant resistance area. However, it has been showing some signs of weakness in the short-term, which suggests the price will decrease to ₿0.025.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Valdrin Tahiri

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

Valdrin discovered cryptocurrencies while he was getting his MSc in Financial Markets from the Barcelona School of Economics. Shortly after graduating, he began writing for several different cryptocurrency related websites as a freelancer before eventually taking on the role of BeInCrypto's Senior Analyst.

(I do not have a discord and will not contact you first there. Beware of scammers)

READ FULL BIO

Sponsored

Sponsored