ENA, the native token of Ethena, an Ethereum-based synthetic dollar protocol, has experienced an impressive 30% surge over the past 24 hours. Discussions surrounding a new governance proposal primarily drive this rally.

The proposal aims to introduce a fee switch mechanism for ENA holders, which would allow them to benefit directly from the platform’s fees. The possibility of this becoming a reality in the near term is fueling speculation and driving up demand for ENA.

Ethena Receives New Proposal

On Wednesday, crypto market maker Wintermute posted a new governance proposal on Ethena’s governance forum. It sought to introduce a fee switch for ENA holders.

According to Wintermute, the protocol has generated significant revenue. However, the holders of its staked Ethena governance token (sENA) do not directly benefit from this revenue. This has created a disconnect between them and the protocol’s growth.

To fix this, Wintermute proposed allocating a portion of the protocol’s future revenue to sENA to address this issue. According to the market maker, this would incentivize sENA holders to contribute to the protocol’s growth and ensure their participation in its success.

The allocation of protocol revenue to sENA requires meeting specific conditions, such as achieving a target level of USDe circulation and protocol revenue.

ENA Reacts Strongly

The discussion around the Ethena Fee Switch proposal has led to an uptick in ENA’s demand over the past 24 hours. With a 30% price growth, it ranks as the market’s top gainer during the review period.

Notably, a corresponding surge in trading volume has accompanied the price uptick. Over the past 24 hours, this has totaled $482 million, skyrocketing by 61%.

When a surge in trading volume accompanies an asset’s price rally, It indicates strong market interest and confidence in the asset’s price movement. This combination suggests that the price movement is not driven by a small group of traders or speculative actions but rather by a broader demand.

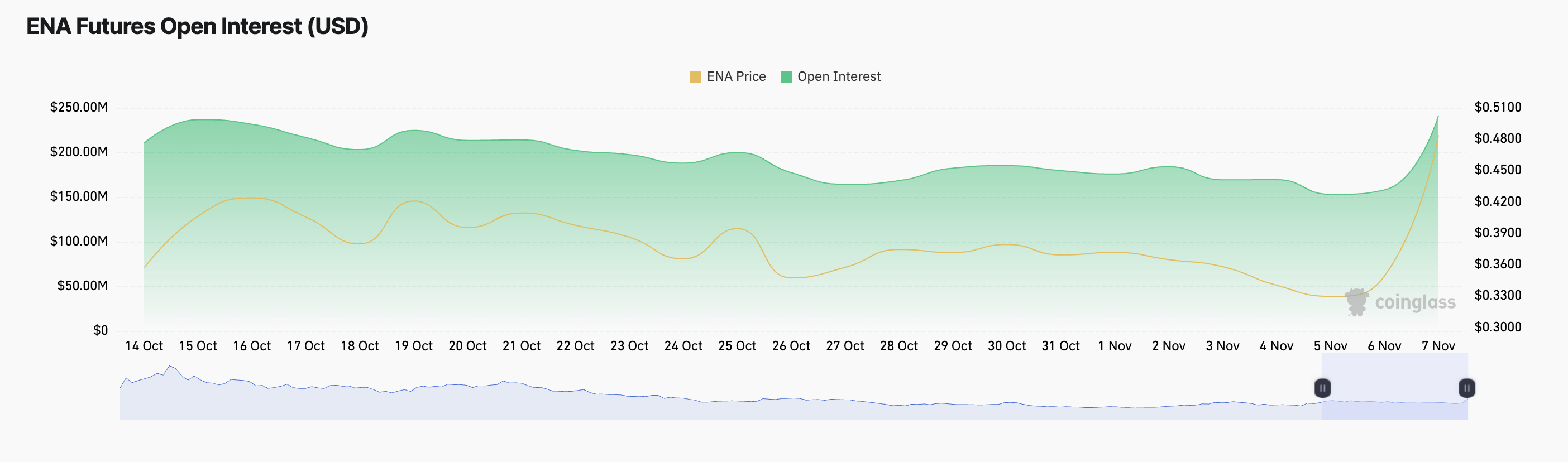

Furthermore, ENA’s open interest (OI) has also grown. According to Coinglass data, it has spiked by 54% over the past 24 hours.

Read more: What Is Ethena Protocol and its USDe Synthetic Dollar?

Open interest refers to the total number of outstanding contracts — whether futures, options, or other derivative instruments — that have not been settled or closed. When open interest surges, new positions are opened, which signals increased market participation and confidence. Rising open interest, particularly during a price rally, suggests that investors are entering the market with new capital, indicating that the rally is supported by strong interest.

ENA Price Prediction: The $0.47 Price Level Is Key

ENA currently trades at $0.51. Its double-digit price hike has propelled it past the critical resistance level of $0.47. It could flip it into a support floor if buying pressure is sustained. If this occurs, ENA’s price will likely rally toward $0.70.

Read more: How To Use Ethena Finance To Stake USDe

However, this bullish projection will be invalidated if, upon retesting the $0.47 price level, it fails to hold as support. In such a case, ENA’s price could drop to $0.32.