Ethena (ENA) price has surged 11% as bullish momentum continues to build, with signals indicating there could be more room for growth. The recent spike comes on the heels of a proposal to integrate Ethereal, a decentralized exchange, into Ethena’s reserve management system.

Key technical indicators show that ENA’s upward trend is gaining strength, but it hasn’t yet reached levels that typically signal overbought conditions. With buying pressure continuing to outweigh selling, the trend suggests further upside potential.

Ethereal DEX Could Appear on Ethena Soon

Ethena (ENA) is up 11% after Ethereal, a decentralized exchange (DEX), was proposed for integration into the Ethena Network’s reserve management system, becoming an on-chain venue for spot and derivative trading supporting USDe, Ethena’s synthetic stablecoin.

The proposal, written by user “Fells0x,” suggests distributing 15% of Ethereal’s potential governance tokens to Ethena (ENA) holders. Ethereal aims to deliver centralized exchange-level performance while maintaining self-custody, with features like cross-margin and liquidity automation, and is expected to launch on testnet later this year.

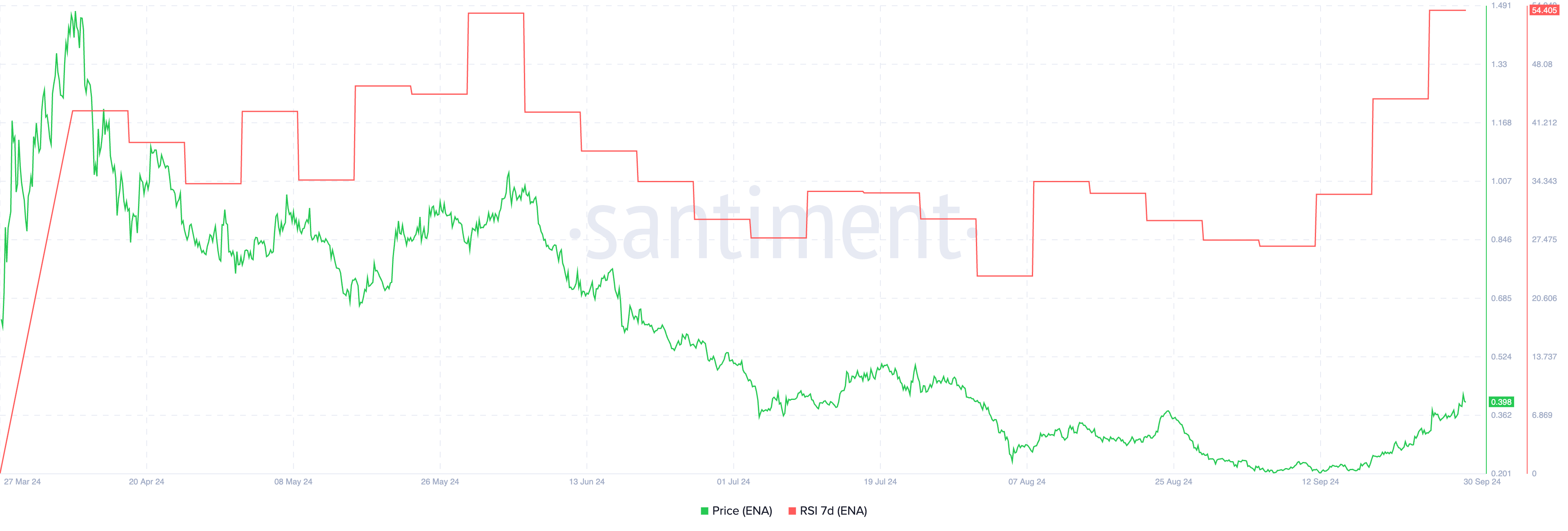

Even with the recent pump in the last 24 hours, ENA RSI still appears to show more room for growth.

Read more: What Is Ethena Protocol and its USDe Synthetic Dollar?

ENA’s 7-day RSI is currently at 54.40, up significantly from 26 just 20 days ago, signaling a strong upward momentum. The RSI (Relative Strength Index) is a popular momentum indicator used to gauge whether an asset is overbought or oversold. Values below 30 indicate oversold conditions, and above 70 suggest overbought territory.

Despite its sharp rise, ENA’s RSI remains well below the overbought threshold, implying that the asset is not yet in an overheated state. This suggests that the recent 11% pump might only be the beginning of a larger upward move, as there’s still room for more gains before ENA reaches overbought levels.

ENA Uptrend Could Be Only Getting Started

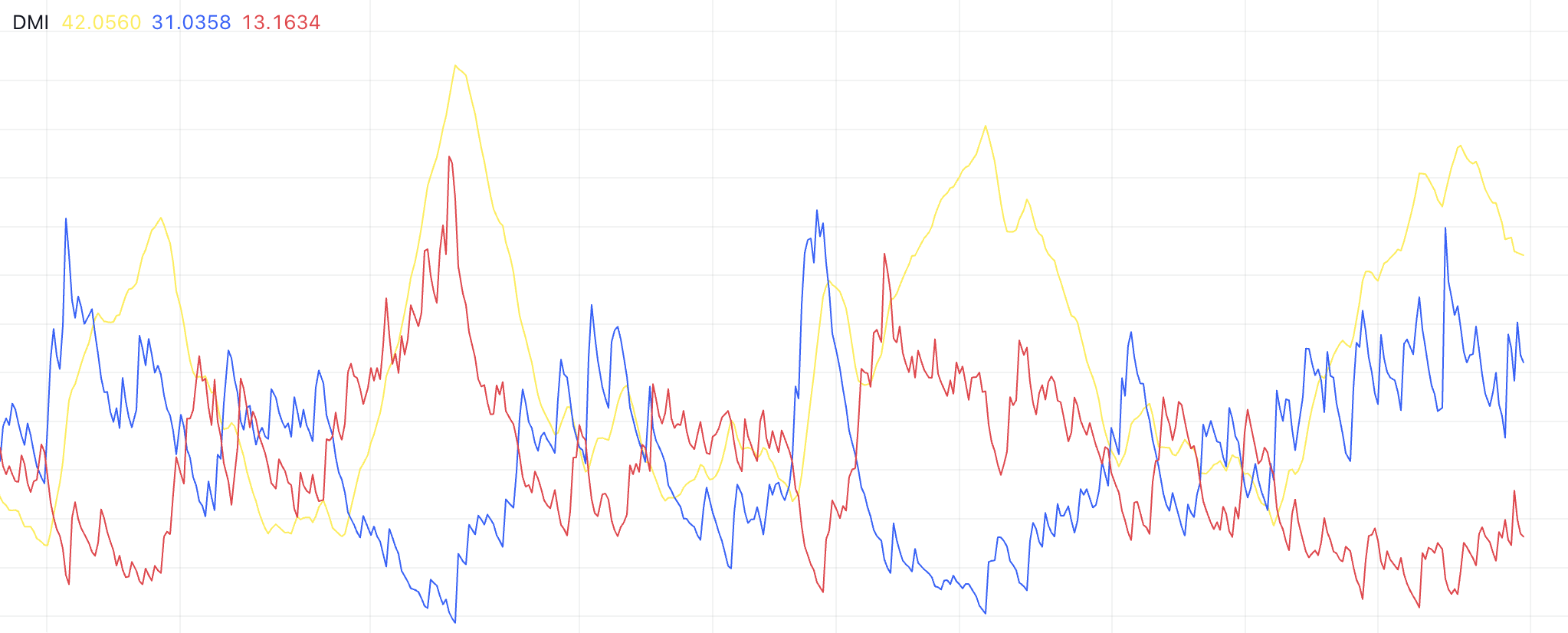

ENA’s DMI shows a strong trend, with the ADX at 42.0560, signaling strong price momentum. The +DI at 31.0358 is significantly higher than the -DI at 13.1634. That indicates that bullish sentiment is dominating over bearish pressure.

This suggests that buying demand for ENA is currently strong and driving the price upwards, making the trend likely to continue.

The Directional Movement Index (DMI) measures both the strength and direction of a trend. The ADX gauges the overall strength of the trend, while the +DI and -DI lines represent the magnitude of bullish and bearish movements, respectively. In this case, the higher +DI reflects strong upward momentum, with the bulls firmly in control.

Given the ADX value above 40, the trend is considered very strong. That means that ENA’s recent gains are likely to persist. This combination of rising bullish momentum and a strong ADX suggests that ENA could experience continued upward price movement in the near term.

ENA Price Prediction: A Potential 66% Rise?

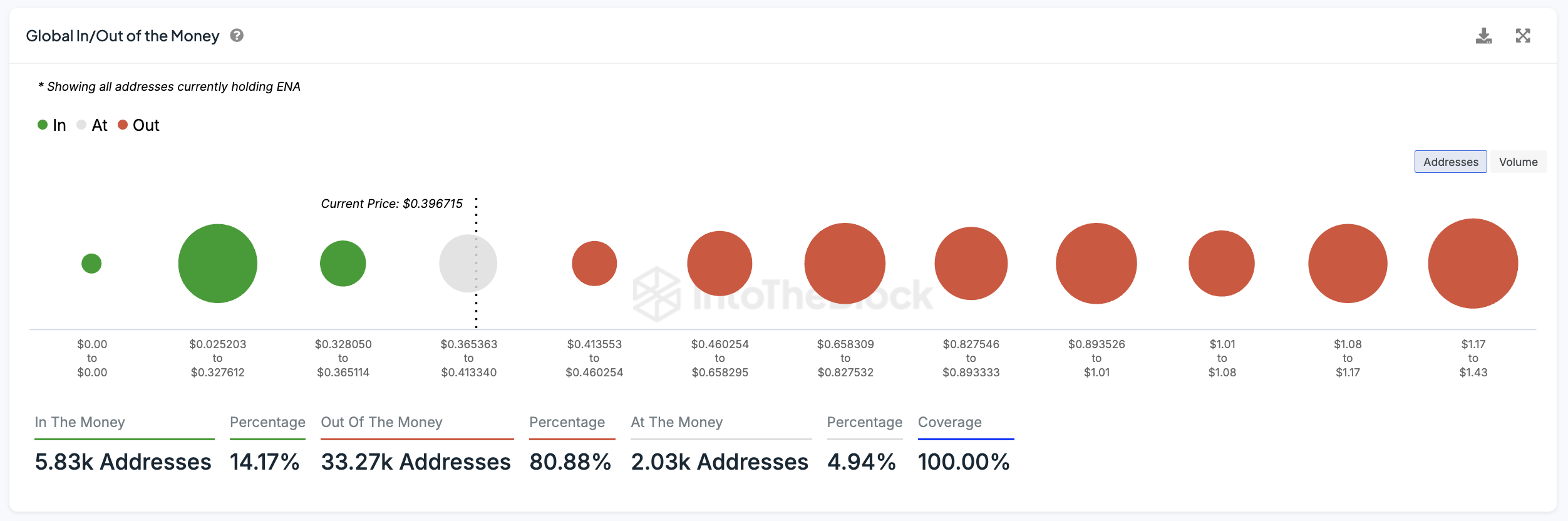

ENA’s price is currently facing relatively weak resistance between $0.41 and $0.46. That suggests that there is room for it to continue rising. Beyond this, another resistance zone exists between $0.46 and $0.65, implying that ENA could potentially surge by up to 66%. This makes a strong case for further upward movement, given the current price action.

The Global In/Out of the Money (GIOM) metric is a tool used to determine the profitability of addresses holding an asset. It analyzes the average buy price of tokens across various wallets to identify areas of support and resistance.

Read more: How To Use Ethena Finance To Stake USDe

When a large number of holders are “in the money” (i.e., profitable), the price tends to face resistance as these holders may sell. On the other hand, areas with “out of the money” holders may act as support, as buyers are less likely to sell at a loss.

On the downside, if the current trend reverses, ENA has a weaker support zone between $0.32 and $0.36. If it fails to hold above $0.32, the price could drop further, potentially testing as low as $0.25. This indicates that while the upward potential is substantial, failure to maintain support levels could result in significant downside risk.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.