ETHA Lend is a protocol-agnostic yield optimizer packed with features, launched on its Mainnet on July 15, 2021, to efficiently interact universally with DeFi platforms.

ETHA Lend launched its Mainnet on the Polygon POS Chain. The Mainnet includes a discovery algorithm, smart wallet, two eVaults, the ETHA lending market, and the ETHA token.

Why Polygon

Launching on Polygon was a strategic decision for ETHA Lend to further enhance the benefits of their users. Higher scalability, interoperability, and gas cost optimization were the core of this decision.

How ETHA Lend is trailblazing

ETHA Lend is in no way following in the footsteps of other protocols. Some of the highlights are:

- ETHA Lend’s discovery algorithm is 700 times faster than it was before an API update

- The ETHA Lend smart wallet has automated features

- Users can save on gas fees through the smart wallet

- Wallet delegation

- Through eVaults, risk-averse users receive optimal and sustainable yields with maximized stability

- Minimizing the impact of short-term volatility on its discovery algorithm

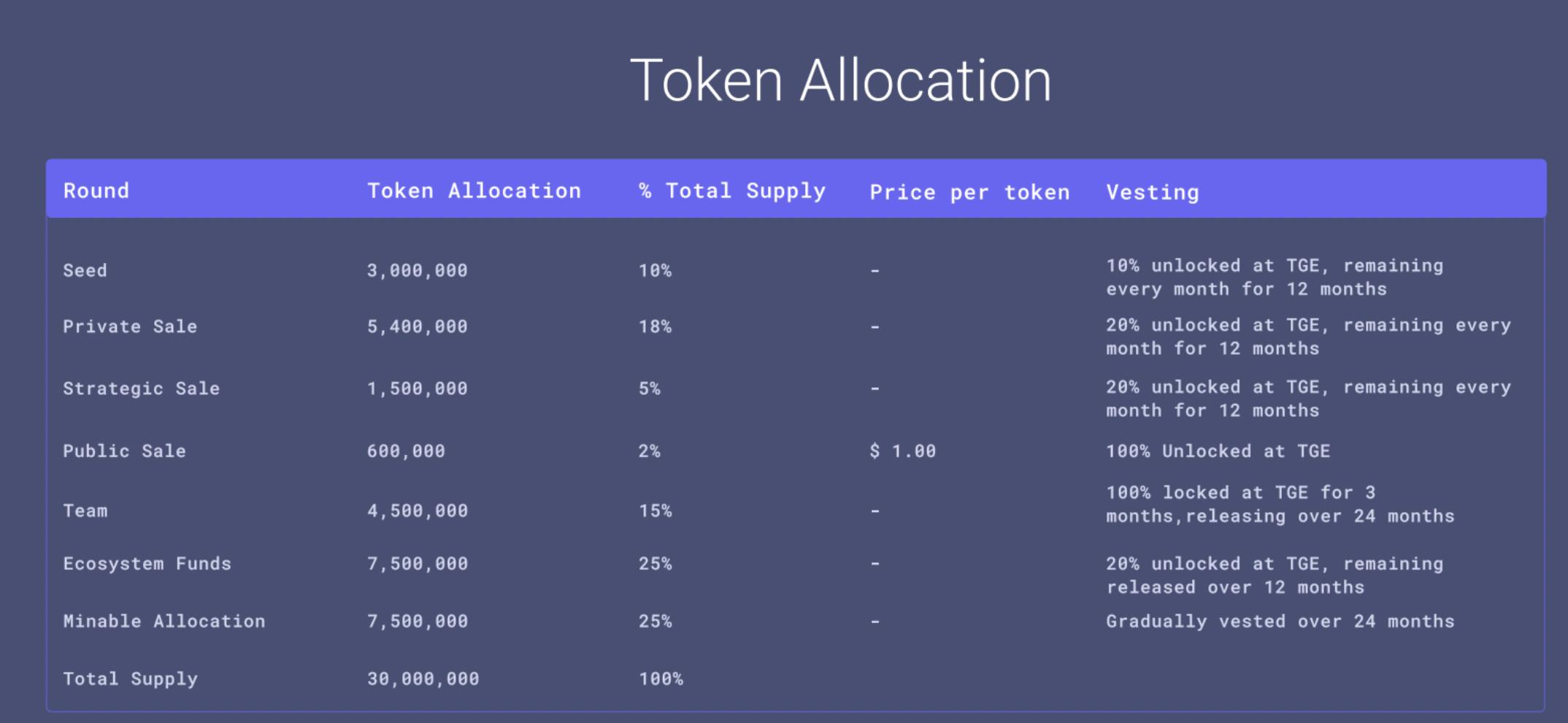

Tokenomics

ETHA Lend’s utility and governance token is ETHA.

“$ETHA is a future governance and utility token with value accrual mechanisms, to reward long-term liquidity providers through platform fees and discounts,” says the ETHA Lend website.

Mainnet features

Discovery algorithm

Prior to an API update done earlier this year, ETHA Lend’s discovery algorithm would take 45 seconds to calculate an asset allocation for an asset greater than one million U.S. dollars for yield optimization.

For assets less than one thousand U.S. dollars, this process would take 10 seconds.

Post update, ETHA Lend’s discovery algorithm takes less than a second to respond. To break it down, the discovery algorithm, in under a second, factors in the volatility of assets present, past yields, and budget of the asset provided and then calculates the asset allocation.

ETHA Lend provides algorithmically driven optimal yields that are processed 700 times faster. Regardless of the asset size, the calculation will be done in less than a second.

ETHA smart wallet

The ETHA smart wallet is non-custodial, meaning users have full control over their funds due to its decentralized nature.

Holding an ETHA smart wallet is beneficial to the user experience because of the perks involved, like being able to save on gas fees.

How the smart wallet works

An ETHA smart wallet will need to be created when users engage with the protocol for the first time. This is an essential part of the user experience and is only required once.

Once a user has visited the protocol, they won’t need to pay approval fees to authenticate their identity or allow transactions when visiting new dApps or protocols that they haven’t visited previously. ETHA Lend has done this to allow users to save on gas fees essentially.

It has also been designed this way, so users save time when making repeat transactions, ultimately enhancing the user experience and making it intuitive. Users are also able to make multiple transactions with different assets all at once.

The ETHA Smart Wallet can directly interact with smart contracts of assets to perform batching. By chaining the multi-level transaction and eliminating the need for the router, gas fees are significantly less.

Wallet delegation:

Users can delegate their ETHA Smart wallet to others for a more accessible DeFi yield experience.

eVaults

ETHA Lend has two eVaults that launched on the Mainnet: wETH eVault and wBTC eVault.

The team will expand on their eVault range, in terms of strategies, functionality, and LP pair deployment. The future eVaults will be released in various phases.

- both eVaults use a unique stable asset strategy to protect a person’s assets from being subjected to high volatility

Portfolio rebalancing

ETHA Lend’s portfolio rebalancing is reactive to parameters, which is again a unique strategy for a DeFi yield optimizer.

ETHA lending market

The ETHA lending market gives users algorithmically driven yields. Using their own data and algorithm, ETHA Lend ensures user protection from fluctuating hourly APY. ETHA Lend has a hybrid lending rate model.

“We are all aware that the supply rate is one of the most important factors that drive the DeFi lending market. The supply rate is also an extremely volatile element. E.g., the supply rate for DAI on AAVE fluctuates anywhere between 4% to 13% throughout the day. This creates a very volatile or unstable condition for lenders and borrowers,” said ETHA Lend.

To minimize the impact of short-term volatility on the discovery algorithm output, ETHA Lend implemented the below formula:

1/24 * rate_24_hours_ago + 2/24 * rate_23_hours_ago + … + 24/24 * rate current.

“This is a perfect configuration to protect our users from a volatile market and provides a more consolidated lending curve,” ETHA Lend concluded.

Currently, there are four pools within the lending market: MATIC, DAI, USDC, and USDT. Each offers an extremely high APY along with daily rewards in 500 ETHA tokens per pool.

Keep your eye on ETHA Lend

ETHA Lend consistently interacts with its community to generate feedback. This feedback is taken and applied to improve the overall user experience.

By listening to what is being said, engaging with members, and facilitating change that is actually wanted, ETHA Lend has created a dynamic community built on trust and consensus.

Being a newbie in the crypto space is an overwhelming experience at the least and ETHA Lend has created a space of inclusivity.

Making improvements in line with the community’s needs, creating an open dialogue on social media, and an atmosphere of inclusivity, ETHA Lend is leaps and bounds ahead of many of the crypto “giants.”

ETHA Lend is undoubtedly making exciting moves in the crypto space with its Mainnet features.

Stay in the loop with ETHA Lend on Twitter, Telegram, Discord, and Reddit.