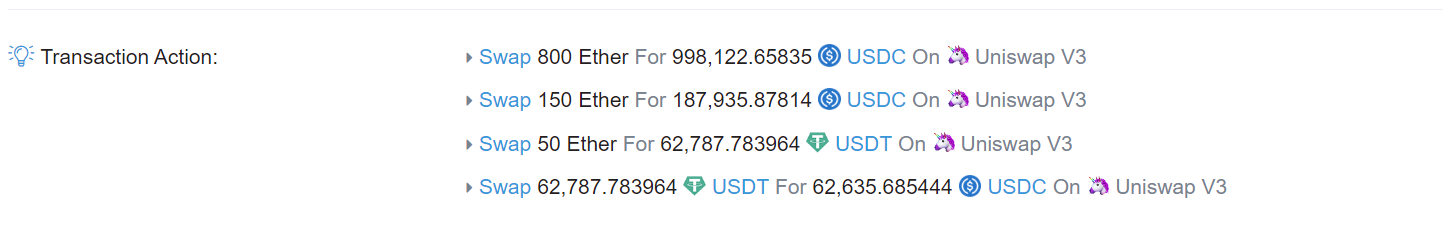

On-chain data reveals that Ethereum co-founder Vitalik Buterin reportedly dumped 3,000 ETH at $1,250.30 on DeFi protocol Uniswap V3 two days ago.

Buterin’s transaction history, recorded on Etherscan, shows that he received 5,000 ETH in two payments from the same address just before sending 3000 ETH to the DeFi protocol. Uniswap is an automated market maker that currently has almost $3.6 billion in ETH locked in various dApps and DeFi protocols, according to DeFi Llama.

Vitalik joins investors pulling back from crypto

Buterin later converted his 3,000 ETH to the stablecoin USDC, which could suggest that he expects the ETH price to go lower in the aftermath of the collapse of FTX, formerly the world’s fifth-largest crypto exchange.

USDC is a stablecoin pegged to the U.S. dollar. Stablecoins offer users of decentralized finance an opportunity to earn a yield on their crypto assets. They also shield holders from the volatility of other cryptocurrencies.

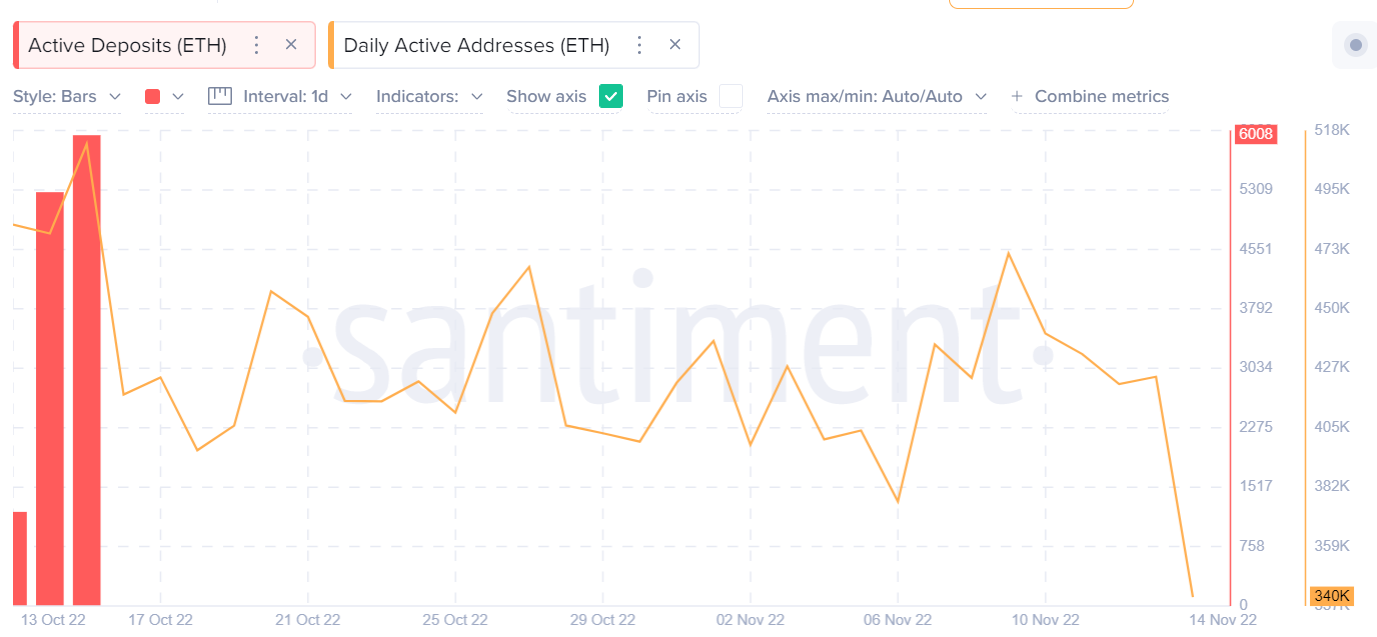

On Nov. 14, 2022, on-chain data from Santiment suggested that active ETH deposits increased while the number of daily active users decreased on Ethereum, suggesting that rumors of a lack of confidence in the crypto space were causing traders and investors to pull back.

In May, Buterin transferred 30,000 ETH out of his wallet, causing speculation of a bearish reversal in the price of ETH, which was trading at $2,086. It turns out that he sent the funds to a wallet he used for charitable donations.

The Ethereum Foundation sold 20,000 ETH to Kraken shortly after ETH reached an all-time high of $4,891 on Nov. 16, 2021. They also cashed out 35,000 ETH to Kraken five months earlier around a similar peak. Renowned crypto trader Edward Morra pointed these out and rhetorically asked whether the Ethereum Foundation knew something others didn’t since the price of ETH fell 40% less than two months later.

Volatility likely to continue as confidence is restored

While Bitcoin fell below $16,000 as the FTX fiasco shook crypto to its core, after falling to $1,073, Ether managed to create a support zone at $1,000-$1,200. It’s difficult to tell whether ETH’s bottom is in. It last saw a bottom of $880 on June 18, 2022. There is currently much uncertainty in the centralized exchange industry, many of whom are scrambling to prove their credibility as the reality of the failure of FTX sinks in.

Buterin said the FTX collapse was particularly damaging to the crypto markets because FTX painted itself as a trustworthy entity. While the Terra stablecoin collapse damaged the crypto industry, Terraform Labs didn’t go to great lengths to paint itself as a transparent protocol. Therefore, its failure, while catastrophic, was not entirely unexpected.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.