The Shapella hard fork will activate on the Sepolia testnet at 4 p.m. UTC on Feb. 28, 2023, to test validator staking withdrawals as tests continue on the previous Zheijang testnet.

According to the Ethereum Foundation, the Shapella hard fork, a combination of Shanghai and Capella execution and consensus layer forks, will go live on Sepolia at epoch 56832.

Ethereum Sepolia Testnet Only Allows Approved Validators

Sepolia is the second-last testnet before the Shanghai upgrade is deployed on the Ethereum mainnet to enable validator withdrawals and other features.

Presently, consensus layer clients Lodestar, Nimbus, Prysm, and Teku and execution layer implementations, Besu, Erigon, go-ethereum, and Nethermind, are ready for Sepolia.

After Sepolia, developers will activate Shapella on Goerli before the Shanghai upgrade goes live on Ethereum’s mainnet. Developers have set March 2023 as a tentative launch window for Shanghai.

Sepolia, a private testnet, allows developers to test smart contract functions using a special testnet currency called Sepolia ETH. According to the testnet’s GitHub repository, Sepolia merged with a permissioned consensus layer called Bepolia. This merge means that only approved entities can operate validator nodes on Sepolia’s new consensus layer.

In contrast, Goerli is a public testnet that allows developers to test application functions without risking real ETH.

Enabling withdrawals is the next upgrade to the Ethereum network after developers completed the so-called Merge in September last year.

The Merge changed Ethereum’s consensus mechanism from the energy-intensive proof-of-work method to proof-of-stake by merging Ethereum’s execution layer with a new consensus Beacon chain. The Merge replaced miners with validators as those responsible for securing Ethereum.

Rather than proving that they used computing power to correctly guess a special number in a transaction block known as a nonce, as miners do, validators lock up 32 ETH in a staking contract on the Beacon chain or send less than 32 ETH to a staking pool or an institutional staking service, for a chance to secure the network and earn ETH rewards.

Presently, the Ethereum network has 512,657 validators who have staked over 16 million ETH (roughly $26 billion).

Liquid Staking Protocols Will Likely See Major Inflows After Withdrawals Are Activated

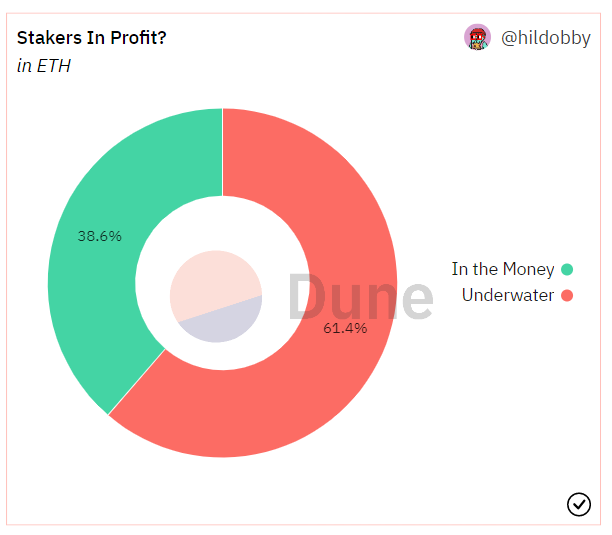

According to a Dune Analytics dashboard by hildobby, only a fraction of Ethereum stakers is currently in profit. That is, those stakers for whom the price of ETH when they staked it was higher than the current ETH price. Aspiring validators could stake ETH on the Beacon chain since Dec. 2020.

Some stakers who weren’t willing or able to lock up 32 ETH staked funds in decentralized protocols offering a liquidity token having the same value as ETH. These liquidity tokens, awarded 1:1 for each deposited ETH, could generate additional yield in other decentralized finance protocols.

The largest of these pools is Lido, a liquid staking protocol with a total value of $8.72 billion locked.

After the Shanghai upgrade, developers will limit daily withdrawals of staking rewards to 57,600 daily. This daily limit ensures that too many validators don’t exit at once and compromise the network’s security. It also reduces the chances of a selloff that could depress ETH’s price. Validators wishing to withdraw must wait in an ‘exit queue’ before entering a withdrawal period, which could take hours to months.

These limitations will likely increase interest in liquid staking protocols, which offer the dual benefit of ETH staking rewards and third-party yields. Furthermore, as concerns increase around a small group of validators who control the network, decentralized pools like Lido, its competitor RocketPool, and several others may see major inflows in the coming months.

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.