The Central American pro-crypto nation of El Salvador is a step closer to issuing its volcano Bitcoin bonds. The investment vehicle has finally been given regulatory approval paving the way for bond issuance.

On Dec. 12, the National Bitcoin Office (ONBTC) of El Salvador announced that the Volcano Bond has received regulatory approval from the Digital Assets Commission (CNAD).

Bitcoin Bonds Are Go

The office anticipated that the bonds would be issued during the first quarter of 2024. “This is just the beginning for new capital markets on Bitcoin in El Salvador,” it added.

The products will be first listed on the Kazakhstan and El Salvador-regulated Bitfinex Securities platform.

President Nayib Bukele confirmed the news posting “Wen volcano bond?” early Tuesday morning.

The Bitcoin volcano bonds were announced in 2021 shortly after the asset was made legal tender in the country.

The target was to raise $1 billion via the Bitcoin-backed bonds. They would also be seeded by El Salvador’s BTC mining industry which is powered by renewable energy from active volcanoes.

Read more: Top 9 Crypto Friendly Countries For Digital Assets Investors

They were initially planned to launch in March 2022 but had been postponed during the brutal bear market. Crypto legislation passed in November 2022 paved the way for their regulatory approval.

The bonds, now set for early 2024, will last ten years and offer holders a 6.5% return annually.

On Dec. 8, El Salvador launched a Freedom Visa and Citizenship program. The initiative intends to encourage “visionary contributions to El Salvador’s economic development, cultural enrichment, and societal upliftment.”

However, the Tether-backed program is only for whales, requiring a $1 million in BTC or USDT investment to secure the visa and then citizenship.

BTC Investments Break Even

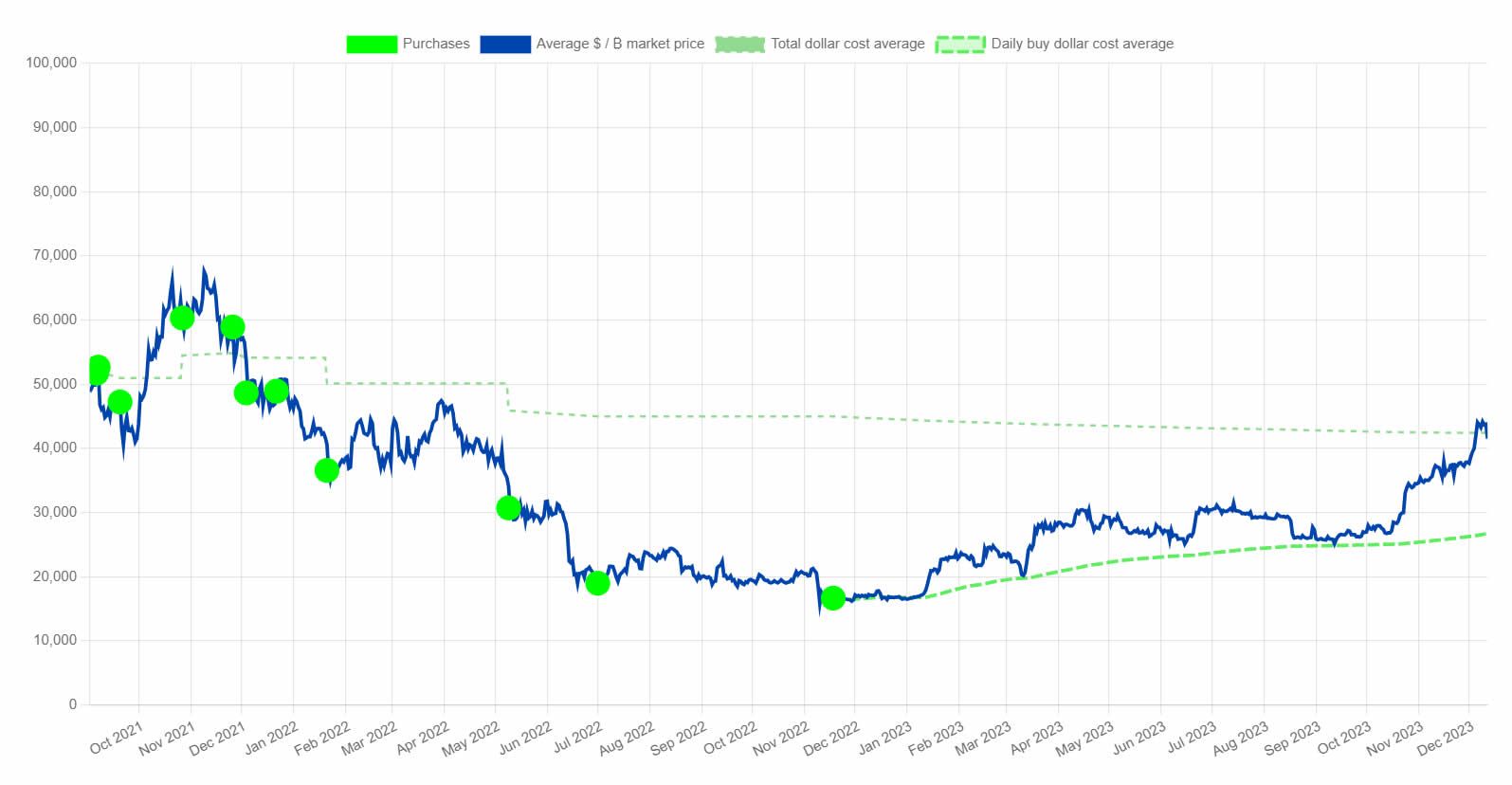

Nayib Bukele has been buying BTC since September 2021. The country now holds 2,770 BTC worth around $115 million.

However, many of the purchases were during the bull run at much higher prices. As a result, the portfolio has been underwater for the past two years.

It finally went back into profit last week when Bitcoin prices tapped $44,000, as reported by BeInCrypto.

Nevertheless, the recent leverage-induced flushout has pushed BTC prices lower and the portfolio is currently down 2.1%.

According to NayibTracker, the dollar cost average price for Bukele’s Bitcoins is $42,436.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.