“we want to invite you (young people) to participate in the policy debate that we have.”The debate Lagarde references is about how to best guide the monetary policy and future price stability of the Euro. The video also includes her running through a series of questions,

“well, what matters is the Euro, banknotes, or digital currency? What about climate change and does it impact price stability? What matters is fiscal policy, working hand in hand with monetary policy? How will that be managed in the future? That’s your future.”

The video concludes with Lagarde making a call to action, and giving a plug for a portal called “ECB listens” where people can “comment, share opinions and influence the debate.”Together with President @lagarde, we are joining @UN4Youth and @UNDESASocial on International #YouthDay to celebrate young people and your contributions to policymaking. We want to encourage you to have your say in shaping the future of the euro. Here’s how ⬇️ pic.twitter.com/glSwD6EnLo

— European Central Bank (@ecb) August 12, 2020

Less Than Positive Responses

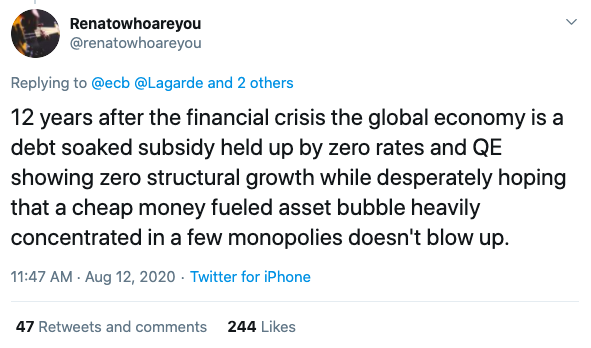

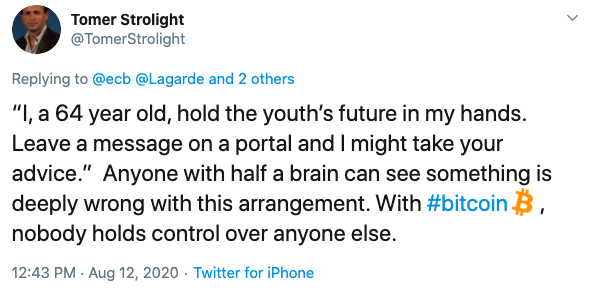

The video was met with a significant amount of skepticism. Twitter responses to the clip showed a predictable level of hostility, with many people voicing support for Bitcoin.

CBDCs Picking Up Steam

Depending on your viewpoint, the ECB video can be seen as a nice gesture, harmless, or insincere and manipulative. However, it may also mark the beginning of a period where central banks are forced to take more action and perhaps push back against decentralized currencies. The ECB has long considered creating a digital version of the Euro. Pressure from the COVID-19 pandemic has forced a deeper examination of a continent-wide CBDC. Notably, the French central bank has already tested the digital Euro in a real-world transaction with Société Générale and is now expanding to other partners. A number of other countries are not far behind. China’s central bank just tested digital wallets intended to support its digital Yuan. The central bank of the Philippines, too, is set for a CBDC trial run and the Japanese government is expanding its CBDC research efforts by announcing a new digital payments director. Some have theorized that the “coming digitization of money,” which includes the launch of CBDCs, could create a “secular tailwind” for Bitcoin. However, this remains an untested hypothesis. Others see a less cooperative future. As the dominant structures that countries use to manage their economies, central banks have singular power, which they are unlikely to give up without a struggle.Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.