The dYdX (DYDX) price is attempting to break out above the $2.55 resistance area. A doubling of the price could follow if it is successful.

DYDX is the governance token for the eponymous decentralized exchange (DEX) for both margin trading and spot trading. It allows users to contribute to the protocol’s future. Token holders can profit through staking and lower fees when trading, and have the right to propose changes in the protocol.

Despite the FTX bankruptcy and the ensuing crypto crash, the DYDX price increased considerably last week. With all the negativity surrounding other centralized exchanges, coins that are related to DEXs can flourish as traders look for safer places to hold their assets that are not susceptible to a crypto market crash.

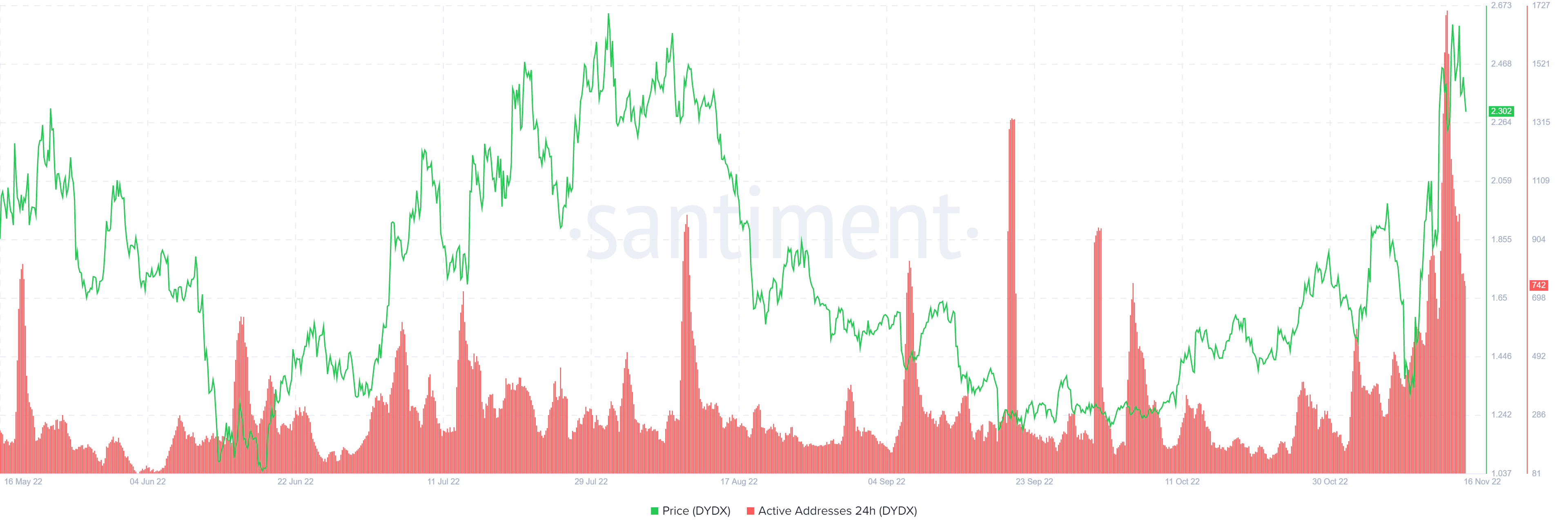

So, DYDX has a chance to become a strong narrative soon, though this will depend on if there will be another wave of centralized exchange liquidations. This is already visible in the number of addresses on the exchange, which spiked sharply (red) after the FTX fiasco.

DYDX Price Makes Third Breakout Attempt

The DYDX token has increased above an ascending support line since June 19. It bounced at it on Sept. 18 and Nov. 19 (green icons). The latter catalyzed the ongoing upward movement and created a bullish engulfing candlestick. There was no positive DYDX news to precede this increase.

On Nov. 14, the price was rejected by the $2.55 resistance area, but is still trading only slightly below it. Combined with the ascending support line, it creates an ascending triangle, considered a bullish pattern.

The daily RSI also supports the possibility of a breakout, since it has moved above 50 after a deviation (red circle).

If a breakout occurs, the closest resistance would be at $5. It would entail a 125% DYDX price increase. Additionally, the triangle’s height projected to the breakout level gives a similar target.

Conversely, the continuation of the rejection would lead to a re-test of the ascending support line. A price breakdown below the ascending support line would invalidate the bullish price prediction.

Will a Breakout Happen?

The technical analysis from the weekly chart supports the continuation of the upward movement.

Firstly, the price has created a double bottom pattern between June and Sept. The double bottom is considered a bullish pattern.

Secondly, the weekly RSI has generated bullish divergence and is moving above 50.

Finally, the price has broken out from a descending resistance line. It created a massively bullish candlestick during the week of Nov. 7 to 16, which validated the previous resistance line as support.

As a result, the weekly chart supports the continuation of the upward movement.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.