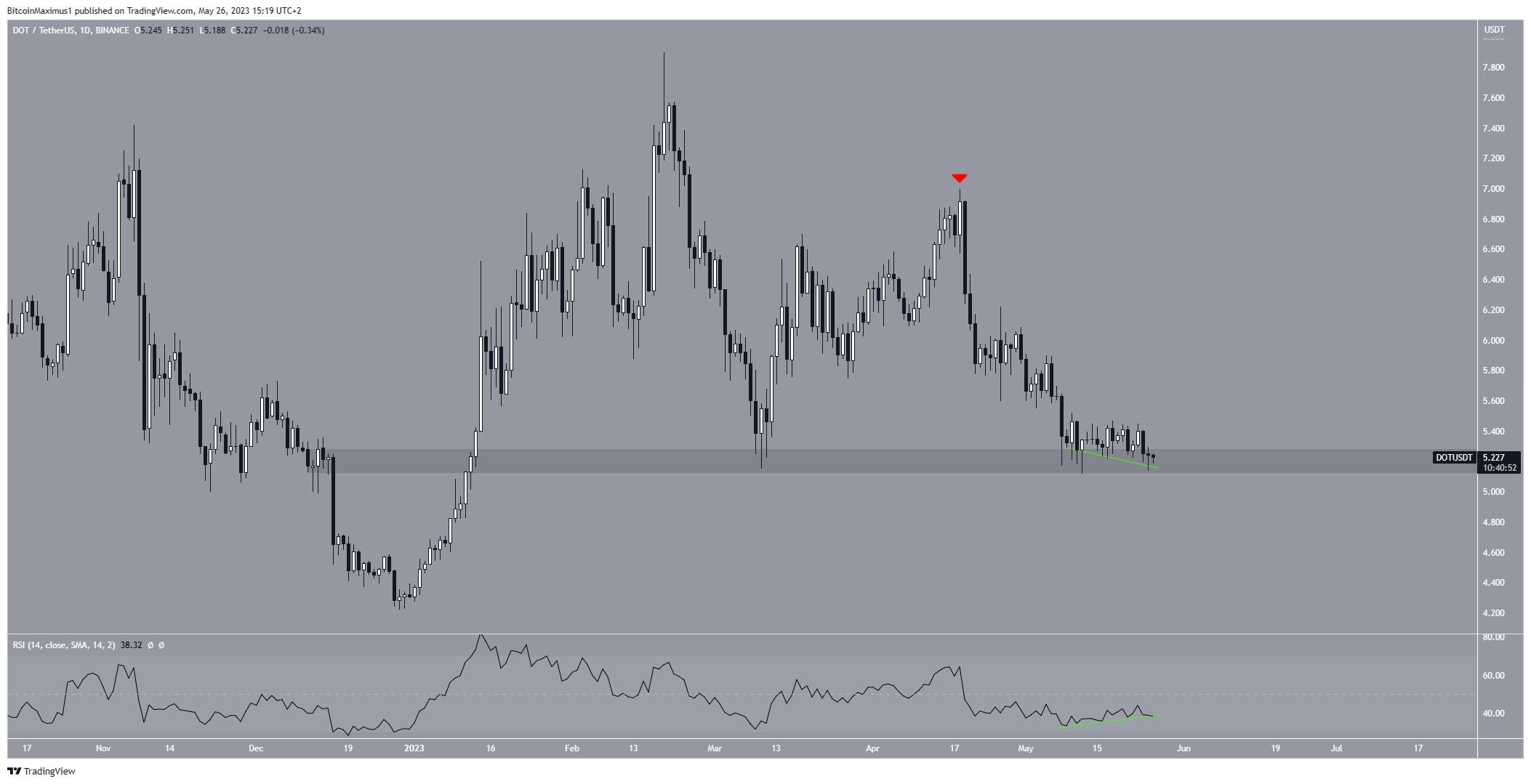

The Polkadot (DOT) price has remained inside a long-term support level without experiencing significant volatility since the beginning of May.

However, there are bullish signs in both the price action and RSI which suggest that a bounce is forthcoming.

Polkadot Price Hovers Above Support

The Polkadot price has fallen since reaching a yearly high of $7.90 on Feb. 19. The price created a lower high on April 18 (red icon) before resuming its descent.

On May 12, the price fell to a low of $5.11, inside the main support level of $5.20. It has been trading close to that level since and possibly created a double-bottom pattern on May 25.

The double bottom is considered a bullish pattern, meaning it usually leads to upward movements.

The daily RSI supports the possibility that the price will bounce. By using the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls have an advantage, but if the reading is below 50, the opposite is true. Even though the indicator is below 50, it is increasing. More importantly, the RSI has generated a bullish divergence (green line).

This is a type of occurrence in which a momentum increase accompanies a price decrease. It often leads to bullish trend reversals.

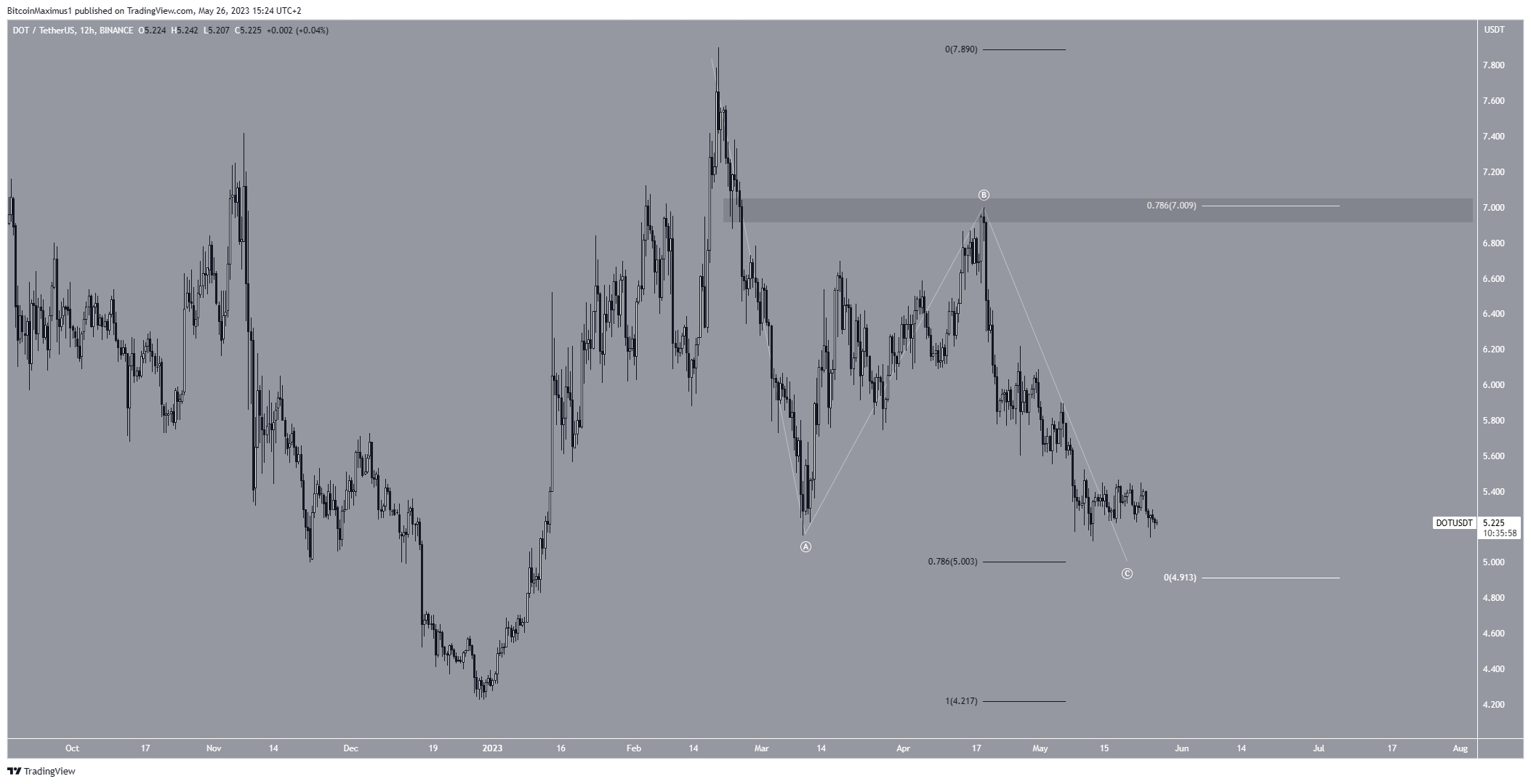

DOT Price Prediction: Wave Count Predicts Bounce

The technical analysis from the short-term six-hour time frame indicates that a bounce is likely to transpire. Technical analysts employ the Elliott Wave theory as a means to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The wave count suggests that the decrease since Feb. 19 is an A-B-C corrective structure (white). In it, waves A:C has had an almost 1:0.786 ratio.

If the count is correct, the DOT price could decrease slightly lower, possibly reaching the 0.786 Fib retracement support level at $5. Then, a significant bounce will be likely, one which could take the price back to the wave B high at $7.

Despite this bullish DOT price prediction, a decisive close below $5 will mean that the trend is bearish. In that case, the DOT price would be expected to decrease to at least $4.20 and possibly lower.

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.