DOGS, the recently launched meme coin on the Telegram-associated TON blockchain, could be ready to bounce. Since its launch, the token has lost 32% of its value.

With growing market interest in meme coins, DOGS has shown signs of resilience, making it one of the top 100 cryptocurrencies to keep an eye on.

Data Shows DOGS Buyers Are Back

DOGS, launched on August 26 following Telegram CEO Pavel Durov’s arrest in France, saw a highly volatile Token Generation Event (TGE) where over 400 billion tokens were distributed to users.

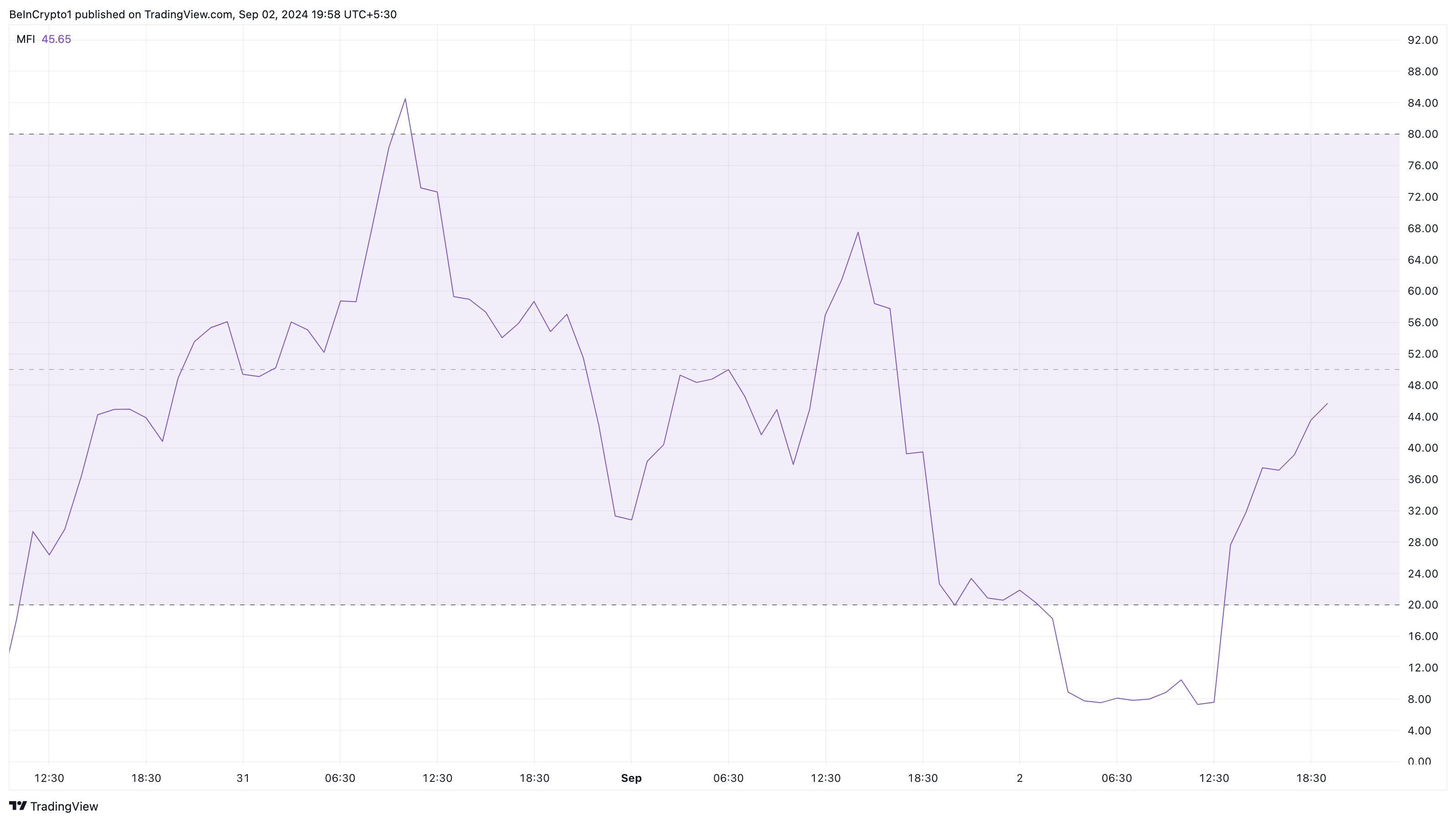

The heavy selling pressure caused DOGS’ price to drop from $0.0017 to $0.0010. However, analysis of the hourly chart shows a notable increase in the Money Flow Index (MFI), indicating rising capital inflow into the cryptocurrency.

The MFI is a technical indicator showing the level of capital inflow into a cryptocurrency. When it decreases, it implies a rise in selling pressure. An increase, on the other hand, indicates otherwise.

Read more: What Are Telegram Mini Apps? A Guide for Crypto Beginners

In DOGS’ case, the decreasing price alongside a rising Money Flow Index (MFI) suggests that selling pressure is easing, and buyers are stepping in, creating a bullish divergence. This formation typically indicates that the price could be poised to rise.

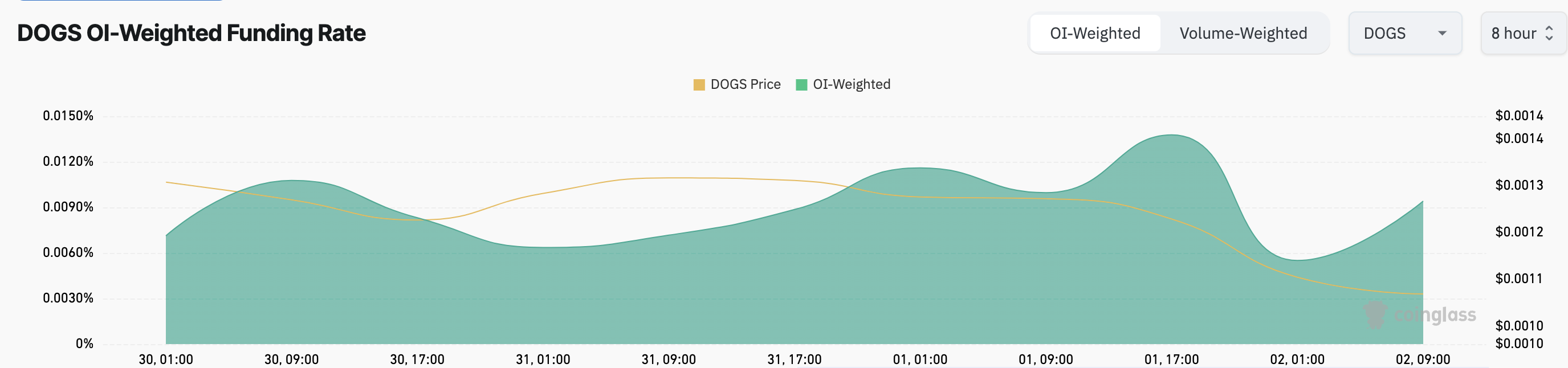

Additionally, the derivatives market shows similar optimism, as evidenced by the increasing funding rate. A higher funding rate suggests that buyers (longs) are paying sellers (shorts) to keep their positions open, signaling broader bullish sentiment. Conversely, a negative funding rate would indicate bearish expectations.

Given the rising funding rate and recent price action, it appears that DOGS may be on the verge of a move toward its overhead resistance.

DOGS Price Prediction: The Meme Coin Looks Ready to Retest $0.0012

Further analysis of the hourly chart suggests that DOGS could be approaching price discovery, a process driven by supply and demand where buyers and sellers determine the token’s fair value.

After the sharp drop from $0.0012, it seems sellers are losing momentum, with bulls defending the $0.0010 support level. Holding this support is crucial for a potential recovery.

Read more: Which Are the Best Altcoins To Invest in September 2024?

If DOGS maintains its position, a return to $0.0012 could be the next move. However, if it fails to hold $0.0010, the token might drop to new lows.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.