The Dogecoin (DOGE) price is at risk of breaking down from a support line that has been in place for nearly a year. If this occurs, it could cause a sharp plunge.

The Relative Strength Index (RSI) readings from multiple time frames suggest that this breakdown is likely to occur. However, can DOGE go against the odds and initiate a bullish reversal?

Dogecoin Price Uncertainty Reigns Supreme

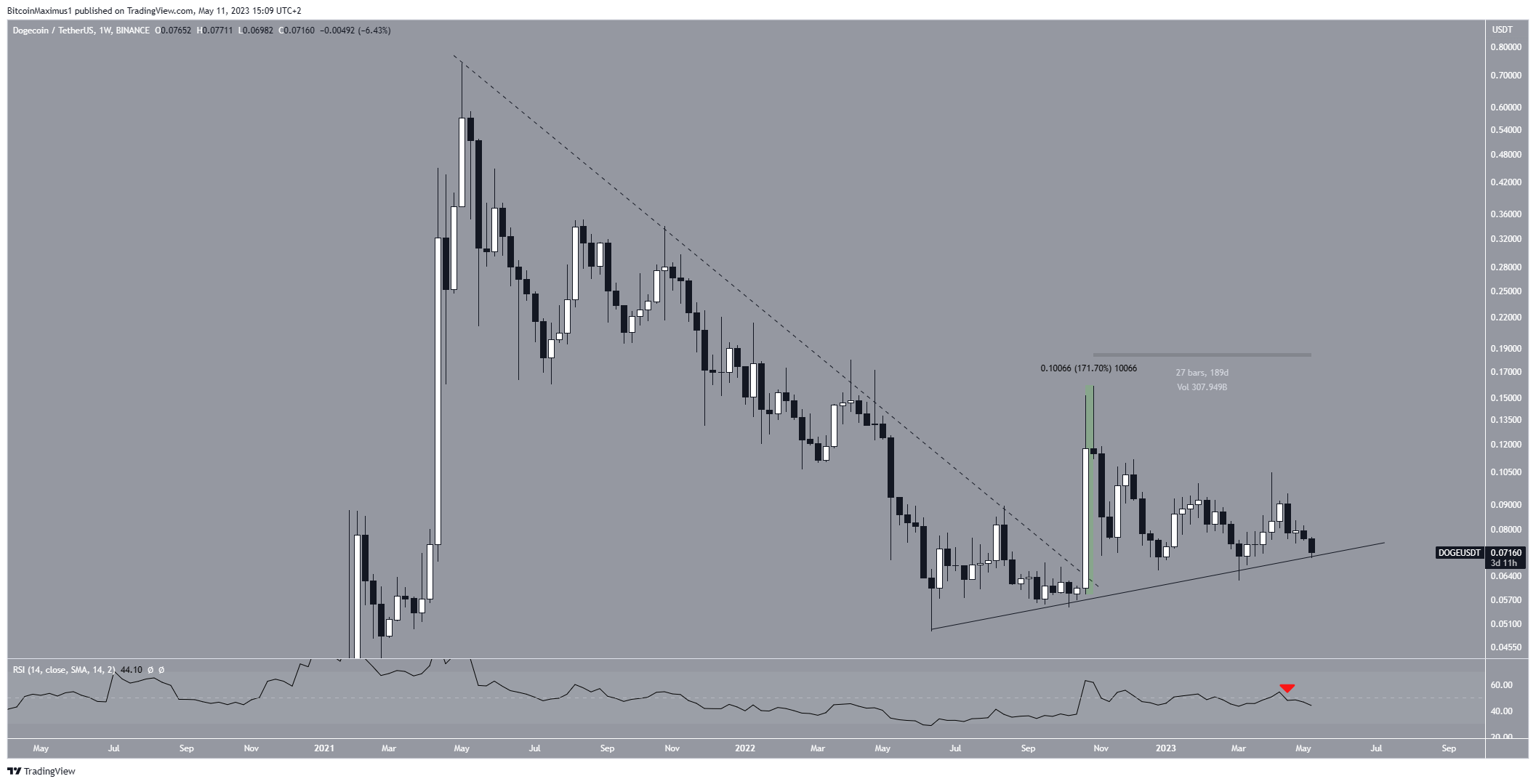

The technical analysis from the long-term weekly time frame does not provide clear signs as to what the Dogecoin future price trend is.

On the bullish side, the price broke out from a descending resistance line (dashed) that had been in place since the all-time high. Breakouts from such long-term structures usually lead to significant increases.

This was the case initially since the DOGE price increased by 170% the week of the breakout, leading to a high of $0.159. However, the price has moved downwards in the 190 days since.

Now, the DOGE price is at risk of breaking down from an ascending support line that has been in place since June 2022.

This is the fourth time that the meme coin reached this support line. Since lines get weaker each time they are touched, an eventual breakdown from the line could occur.

The weekly RSI provides a bearish reading. By using the RSI as a momentum indicator, traders can determine whether a market is overbought or oversold and decide whether to accumulate or sell an asset.

If the RSI reading is above 50 and the trend is upward, bulls have an advantage, but if the reading is below 50, the opposite is true. The RSI is below 50 (red icon) and moving downwards, indicating that the trend is bearish.

DOGE Price Prediction: Breakdown a Matter of Time?

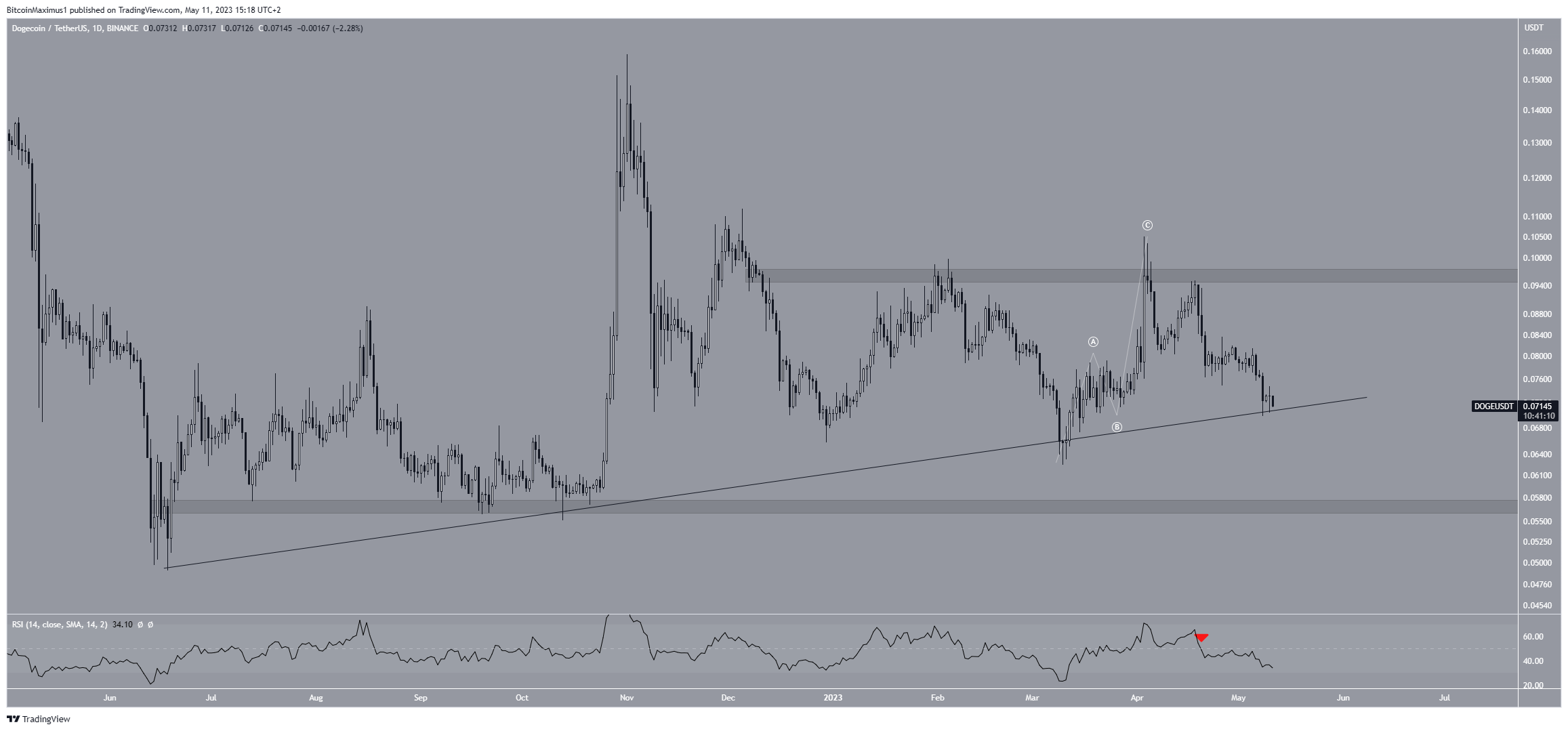

The daily time frame readings support the bearish DOGE price prediction from the weekly one.

The first reason for this comes from the wave count. Technical analysts employ the Elliott Wave theory as a means to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The movement between March and April 10 resembles an A-B-C corrective structure (white). Since the correction has an upward slope, this means that the dominant trend is bearish.

The second reason comes from the RSI. In a similar fashion to the weekly time frame, the RSI is below 50 and falling (red icon). As outlined previously, this is a sign of a bearish trend. Moreover, the DOGE price attempted an unsuccessful bounce during the past 24 hours.

If a breakdown from the line occurs, the price could fall to the closest support area at an average price of $0.057.

However, an upward movement toward $0.095 could occur if a bounce occurs instead.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.