Dogecoin (DOGE) price rally retraced at the $0.091 zone after making a 15% climb in the last 7 trading days. With miners flooding the market in recent weeks, on-chain data reveals that the growing sell pressure could soon take its toll on DOGE price.

Dogecoin has gained 24% since the start of April as Elon Musk teased Starship Launch on Dogecoin’s 4/20 day. The bullish momentum in the Doge community could see an uptick in activity as Elon Musk’s SpaceX plans to launch the first rocket launch the first flight test of a fully integrated Starship and Super Heavy rocket.

Drop in Dogecoin Whale Transactions Detected

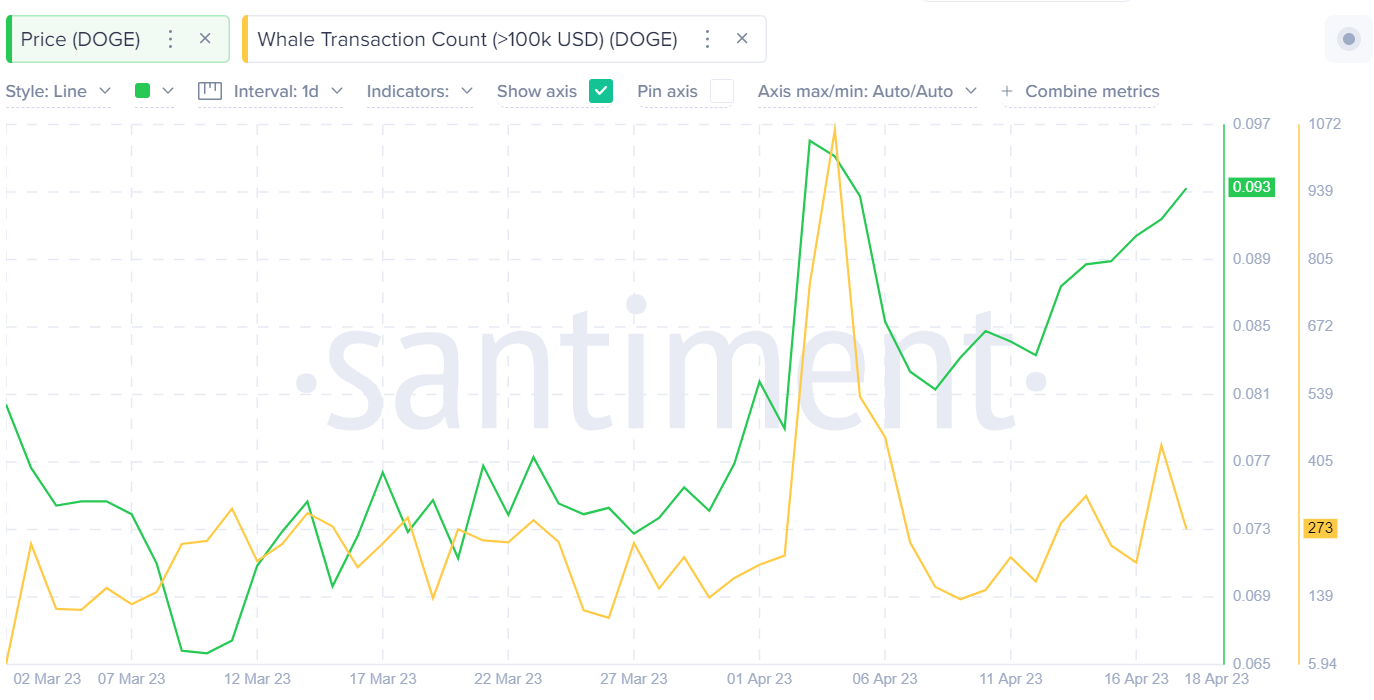

Crypto whales have been fewer bets on DOGE in the past two weeks. Since the recent high on April 4 has been a significant drop off in the number of whale transactions on the network. The blockchain data firm, Santiment, measures whale activity by tracking daily transactions worth $100,000 and above.

Looking at the chart below, daily large transactions involving DOGE have declined from 1,062 on April 4 to 273 transactions at the close of April 18.

When whales reduce their trading activity, it implies that they are losing confidence in the underlying coin’s short-term price prospects. If the whales continue to reallocate funds to other investments, the price of Dogecoin could take a hit in the coming days.

Dogecoin Miners are Flooding The Market

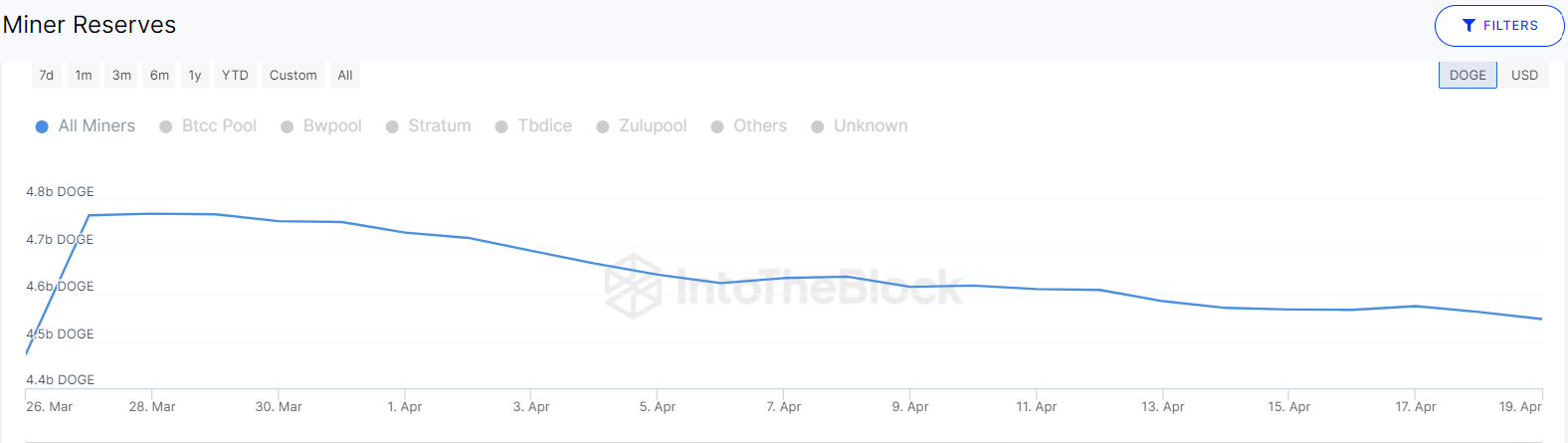

Another critical factor indicating an impending bearish price trend for DOGE is the sell-off frenzy among the miners. Since late March, the has been a persistent decline in Miners’ reserves, a metric that tracks the wallet balances of recognized proof-of-work miners on the Dogecoin network.

Between March 27 and April 19, the Miners sold off 210 million DOGE worth approximately $19.1 million at the current market value of $0.091.

When miners sell off their block rewards, it increases the supply of the cryptocurrency in circulation. Unless it is met with equal demand, the sell-trend among the miners will likely cause Dogecoin price to fall in the coming days.

DOGE Price Prediction: Bears Could Pull Dogecoin Down to $0.082

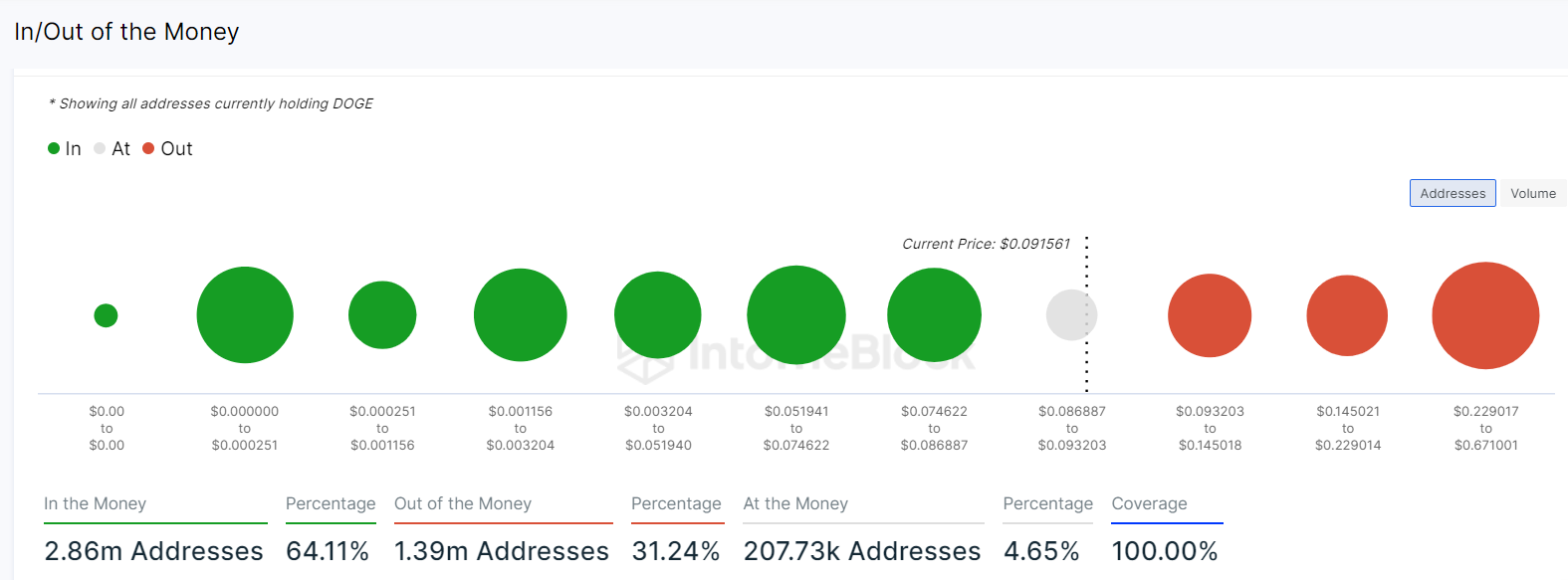

IntoTheBlock’s Global In/Out of Money price distribution provides data-driven intel suggesting that DOGE price is likely to lose its current support at $0.091. Although, the 207,000 addresses that purchased 19.5 billion DOGE coins at that zone could prevent the drop

But, if the bearish scenario continues, Dogecoin holders can expect the price to drop to $0.082. However, DOGE can find a more significant support of 490,000 addresses holding 58 billion coins.

Yet, the bulls may invalidate the bearish market sentiment if the DOGE price can scale back above the $0.093 resistance zone. But as observed above, the 397,000 addresses holding 7.6 billion tokens will likely sell and inadvertently slow down the bullish momentum.

But if the Dogecoin price can manage to breach that $0.093 resistance, holders can expect the rally to head toward $0.12.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.