Dogecoin (DOGE) price closed May 2023 10% in the red. Despite the rise in daily transactions, fueled by DRC-20 Ordinals, DOGE price has continued to drop. What is behind the bearish DOGE price momentum?

On-chain data reveals that there has been a significant rise in network activity across the Dogecoin ecosystem. However, it appears that the spike in network activity has not translated into price gains.

With Dogecoin transaction fees still on the rise, how much longer will the bears remain in control?

Dogecoin Transactions Have Spiked 8,200%

While Dogecoin has made headlines for the astronomical jump in network activity in May 2023. However, DOGE price has remained on the downtrend.

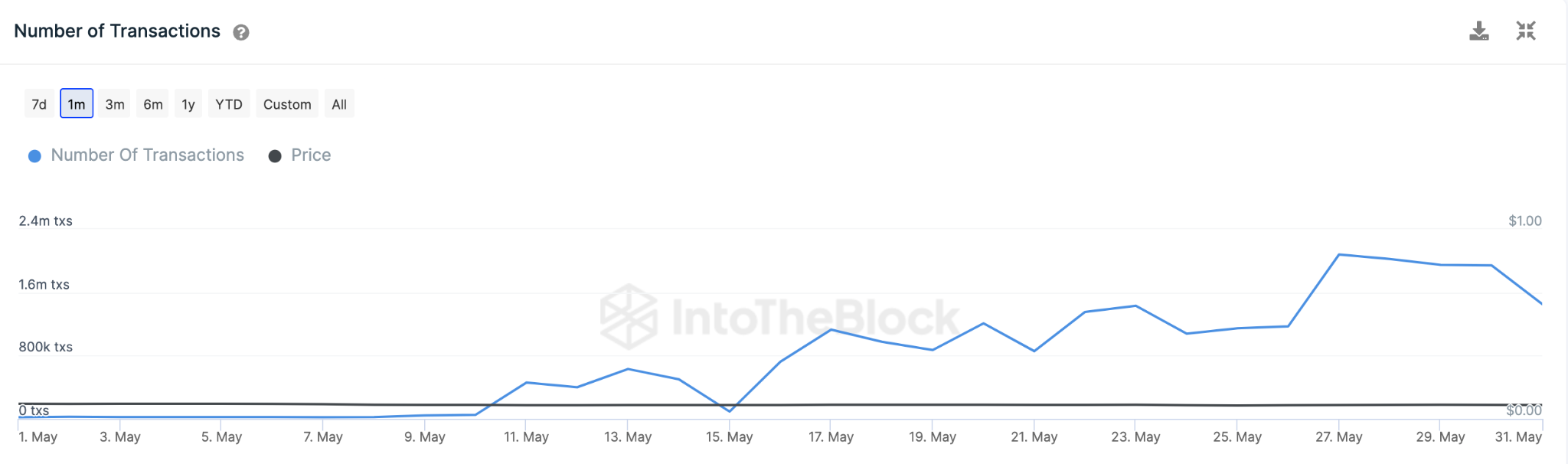

The chart below shows how Dogecoin network activity soared 8,200%, from 19,240 transactions on May 1 to 1.45 million transactions recorded on May 31. Meanwhile, during this period, DOGE price dropped by nearly 10%.

Transaction Count sums up the number of transactions confirmed on a blockchain network during a specific period.

Historically, the Dogecoin price has often increased when there is a sustained spike in transactional activity. Hence, the current divergence between DOGE rice and Transaction Count raises a few concerns.

Whales Activity on the Dogecoin Network Has Dropped

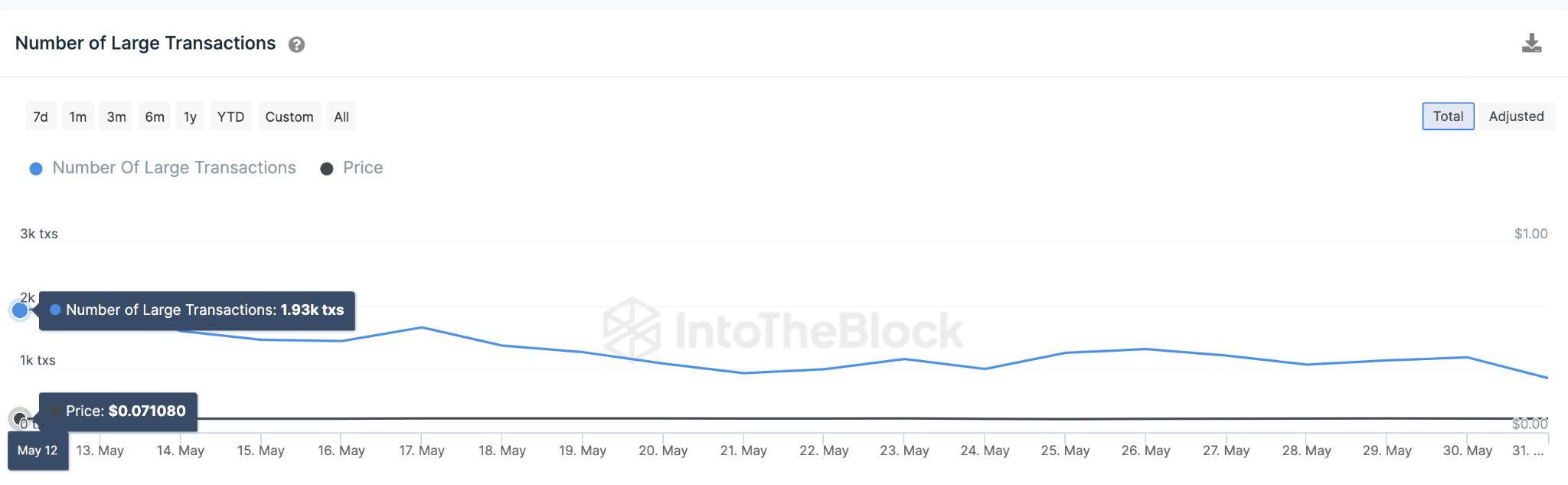

While total transactions on the Dogecoin network have risen, a deeper dive into the on-chain data reveals a significant drop in Large Transactions.

Between May 12 and May 31, Whale transactions dropped 56% from 1,930 to 854 transactions.

This indicates that the majority of the transactions that fuelled the 8,200% spike in Dogecoin network activity are DRC-20 Ordinals transactions. Due to the small sizes of these transactions, they have contributed little economic value.

This provides a plausible confirmation of the bearish price outlook. Whale transactions are critical to the price prospects of DOGE. This is because it provides much-needed liquidity to the market while contributing higher economic value per transaction.

Hence, if the circumstances remain unchanged, DOGE’s price could drop further in the coming days.

DOGE Price Prediction: The Bears Could Push For $0.06

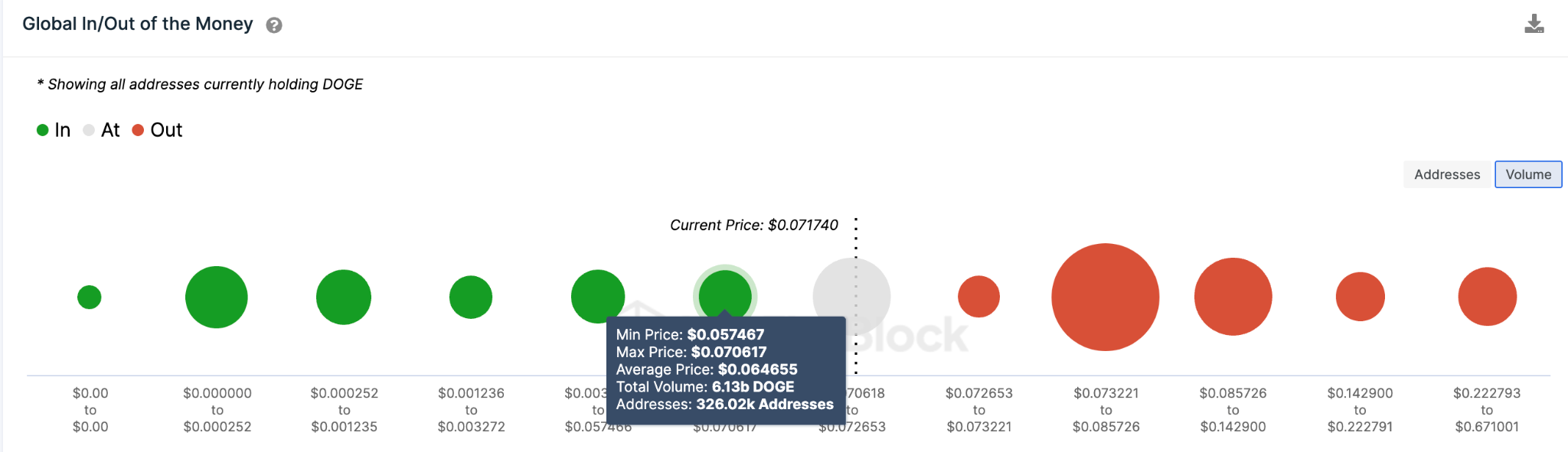

The prolonged decline in whale transactions suggests that DOGE price will likely drop toward $0.06. But, according to IntoTheBlock’s In/Out of the Money Price (IOMAP) distribution data, the DOGE will likely experience some bullish support around $0.065.

At the zone, there’s a buy wall mounted by 326,000 addresses that bought 6.13 billion DOGE tokens at an average price of $0.065

But if that support caves as expected, then DOGE price will likely slump further toward $0.06.

Still, the bulls can negate this pessimistic narrative if DOGE price breaks above $0.08. But as seen above, some of the 547,500 investors that purchased 47.9 billion coins at the average price of $0.08 range could resist.

But if that resistance level fails to hold, the DOGE bulls can push the rally to $0.09.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.