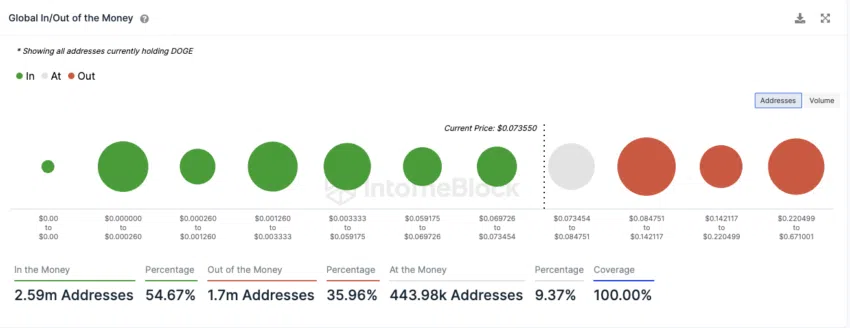

In the past six weeks, the Dogecoin price has experienced a significant recovery of 40%, resulting in more than half of all DOGE addresses returning to a profitable state.

Address Activity Spikes: 22.3% Increase in Just Seven Days

Active addresses have risen by approximately 22.3% in the past seven days. Additionally, new addresses have seen a remarkable increase of around 53.28%. While the number of DOGE addresses without any coins has also grown by 17.47%

Read More: Best Upcoming Airdrops in 2023

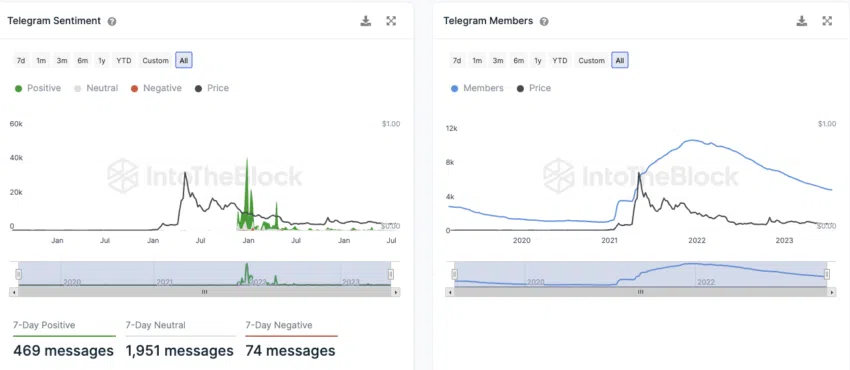

Telegram Sentiment Remains Positive

The sentiment on Telegram remains largely positive, with 469 positive messages and 74 negative messages. However, it’s worth noting that the number of members in the Dogecoin group on Telegram is steadily declining.

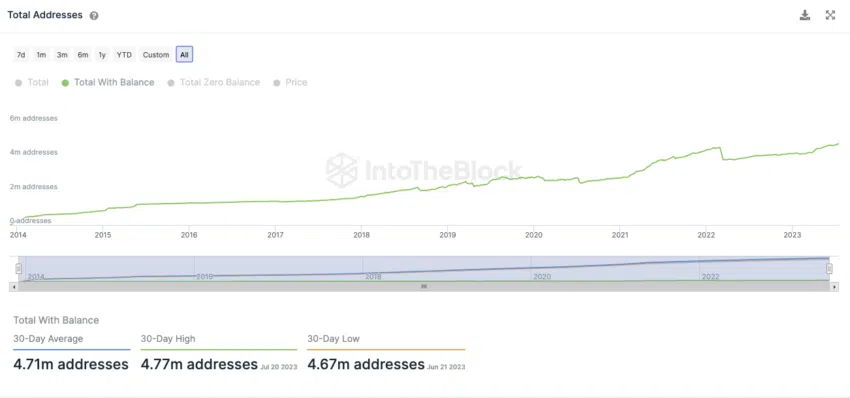

Dogecoin Wallet Growth: More Addresses Join the Flock

Despite the declining number of Telegram members, the total number of DOGE addresses is still showing an upward trend, with an average of approximately 4.71 million DOGE addresses available in the last 30 days.

Read More: Best Crypto Sign-Up Bonuses in 2023

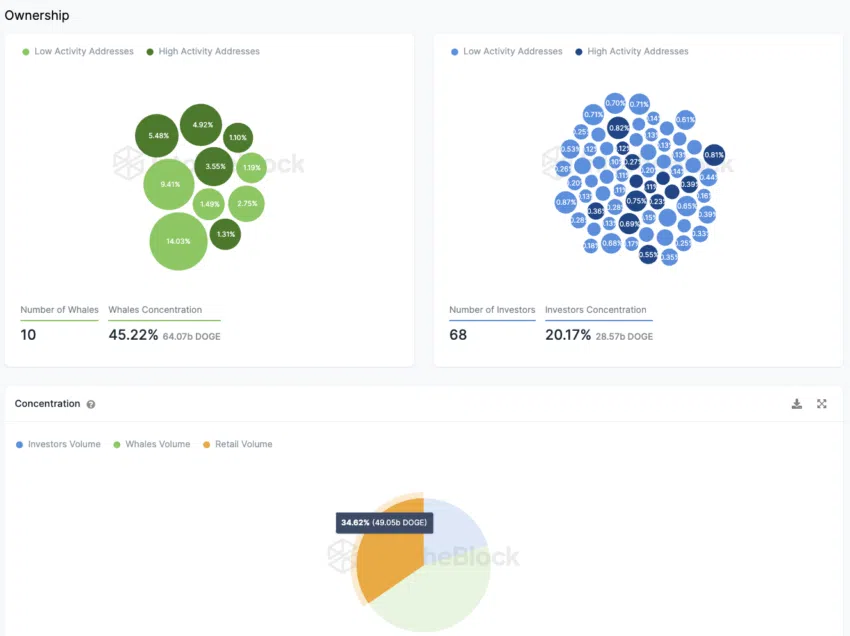

Retail Investors Account for 33% of DOGE Holdings

The distribution of Dogecoin ownership is encouraging, as small investors hold over a third of the tokens, while around 20% of the token supply is in the hands of 68 large investors.

Large investors, categorized as addresses holding between 0.1% and 1% of the Dogecoin supply, make up around 45% of the total tokens and are spread across ten addresses.

On the other hand, whales are addresses that hold more than 1% of the token supply, accounting for approximately 45% of the total Dogecoin supply.

Over 50% of Dogecoin Addresses in Profit

Currently, the majority of Dogecoin addresses, nearly 55%, are in a profitable position. Around 36% of addresses would incur a loss if they were to sell their Dogecoin tokens at the current market price, while approximately 9.4% are at the break-even point.

Dogecoin’s 40% Price Jump: A Remarkable 6-Week Turnaround

Indeed, the Dogecoin price has significantly recovered by approximately 40% in the past six weeks, leading to an increase in the number of addresses that are now in a profitable position once again.

Read More: Top 11 Crypto Communities To Join in 2023