In recent years, China has actively promoted the adoption of the digital yuan (e-CNY) in pilot regions, lauding its security, anonymity, and control features. However, with its expanding usage, the digital yuan has unwittingly become a tool for illicit activities and scams, with numerous cases of fraud and money laundering cropping up across different regions.

On January 9, the Shanghai High Court unveiled the first-ever case of “run-score” fraud involving the digital yuan central bank digital currency (CBDC) in Shanghai. Criminals leveraged the digital yuan’s exchange function to swiftly empty an ATM within two hours.

Digital Yuan ‘Run-Score’ Scam Comes to Light

This alarming incident has underscored the imperative need for revisiting and strengthening the regulatory framework surrounding the digital yuan to curb potential money laundering risks and enhance supervisory measures.

In May 2023, Shanghai’s Yangpu district witnessed a heist masterminded by a criminal named Wang. Utilizing more than ten mobile phone numbers to register digital currency accounts, Wang executed a rapid series of 30 transactions in just two hours, totaling 123,000 yuan. His actions effectively drained the ATM. Wang was part of a broader network engaged in “run-score” operations, exploiting digital yuan accounts for various illicit purposes.

The group’s leader, Xiao, orchestrated the heists by coordinating associates to determine withdrawal amounts. They would procure virtual currency from merchants Gong and Huang. Once provided with digital yuan account details and passwords by associates, these details were transmitted to “runners” like Wang. Subsequently, “runners” would withdraw cash from bank branches via ATM machines.

Between May and June 2023, Xiao’s syndicate successfully siphoned over 10 million yuan from more than 900 digital yuan accounts. 800,000 yuan stemmed from victims of telecom network fraud.

Criminals are capitalizing on the public’s enthusiasm for digital yuan trials, devising fraudulent schemes to purloin personal information and funds. Various regions have reported instances of money laundering related to the digital yuan. In Kunming, a man used digital yuan to buy gift cards in a remote fraudster money laundering scheme.

Read more: Digital Rupee (e-Rupee): A Comprehensive Guide to India’s CBDC

Adoption Growing Pains

Experts argue that bolstering anti-money laundering regulations for digital yuan transactions is essential. Current regulatory mechanisms, customer identification protocols, and reporting systems fall short in effectively combating money laundering.

Recommendations include defining obligations and responsibilities for operating institutions and partners in anti-money laundering efforts, enhancing monitoring capabilities for suspicious transactions, and adopting technology solutions like smart contracts for enhanced security and auditing.

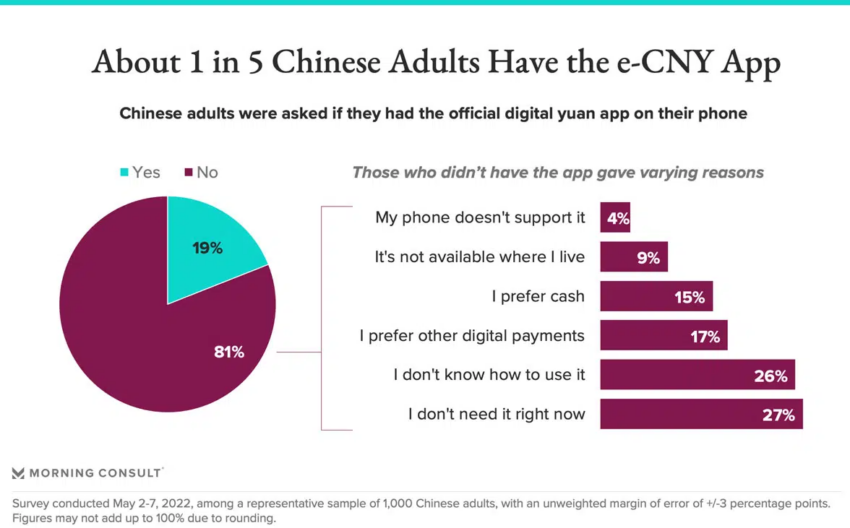

While the digital yuan presents opportunities for illicit activities, its adoption rate appears to be strong. Former PBOC governor Yi Gang revealed statistics. Its total transactions reached 950 million with a cumulative value of 1.8 trillion yuan by June 2023. Furthermore, 120 million wallets have been opened. This signifies its potential for global adoption and challenging the supremacy of the US dollar.

Others, like PointPay CEO Vladimir Kardapoltsev, do not agree that adoption rates are all that strong. However, he feels that there is still room for growth:

“China’s digital currency (CBDC) e-CNY has been used for transactions worth $250 billion over 1.5 years since its creation. However, this figure represents only 0.16% of China’s entire money supply. Currently, e-CNY is primarily used for domestic retail payments, with low adoption among the population. Nevertheless, the project is only 1.5 years old, and there is still much ahead!”

The digital yuan’s journey is not without challenges. Its goals include countering Western sanctions, expanding overseas adoption of the Chinese currency, and gradually diminishing the dominance of the US dollar.

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.