Bitcoin (BTC) has been stealing the investor spotlight from gold in the last few months, which could impede gold’s price appreciation this year, explains Aakash Doshi, an analyst at Citigroup.

BTC May Be Siphoning Demand From Physical Gold

Doshi points out that investor outflows from gold and inflows toward crypto may pose the biggest threat to the yellow metal’s prominence as the primary hedge against inflation. He cites the “expanding investor base” of digital assets and institutional interest in BTC as the main reason for gold’s drop in value.

“More interestingly, in the last 19 weeks, gold ETFs and Bitcoin posted net weekly flows and asset under management trends in opposite directions on about a dozen occasions,” Doshi notes, using the Grayscale Bitcoin Trust (GBTC) as a proxy for bitcoin’s institutional demand as the cryptocurrency has no approved ETF in the US.

Furthermore, the total investable asset base for the two store-of-value assets has expanded in the last two years. It appears that the correlation between BTC’s inflows and gold’s outflows is too good to be a mere coincidence.

BTC might have suffered a major correction in the past two days, but it’s still up by 532% year-to-date.

Citigroup Reduces Gold Price Target For 2021

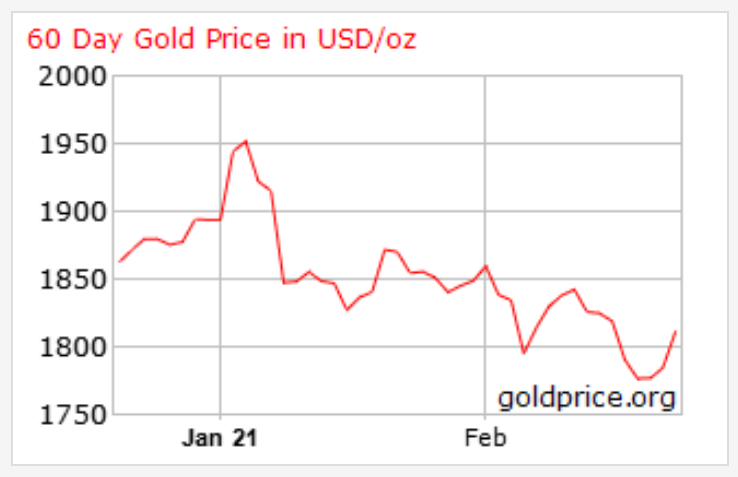

Citigroup initially projected a $2,100 per ounce gold price target for 6-12 months. However, it has recently reduced it to $1,950 due to the Bitcoin-correlated outflows. In fact, gold is currently trading around $1,800, a 5% drop year-to-date.

But that’s not the only reason for gold’s decline. Despite being historically used as a hedge against inflation, the Federal Reserve, Doshi believes, will aggressively suppress inflation this year. Furthermore, he expects more investors to turn to other commodities like oil instead of gold.

World Gold Council Disagrees

The World Gold Council, the gold industry’s market development organization, argues that digital currencies play different roles in a portfolio. Hence, BTC should not be considered a substitute for gold and vice versa. In addition, Bitcoin may pose more risk to one’s portfolio despite being utilized as a hedge against inflation.

“We shouldn’t confuse correlation with causation” in terms of investor money flows, says Juan Carlos Artigas, the council’s head of research.

“It’s not appropriate to just look at two specific figures that are combining different statistics and conclude that the trend is wider,” Artigas added.

Although originally presented as digital cash, Bitcoin has been mostly referred to as digital gold by several crypto pundits due to its capped supply and long-term reliability as a store of value. BTC recently breached the $1 trillion market cap level. However, it still lags behind gold’s massive $12 trillion total market cap figure.