The Dia (DIA) price fell considerably on Feb. 14, validating the resistance area it had previously broken out from. Similarly, Serum (SRM) did the same with its all-time high resistance area.

However, both of the coins have bounced and should continue increasing in the near future.

DIA Bounces at Support

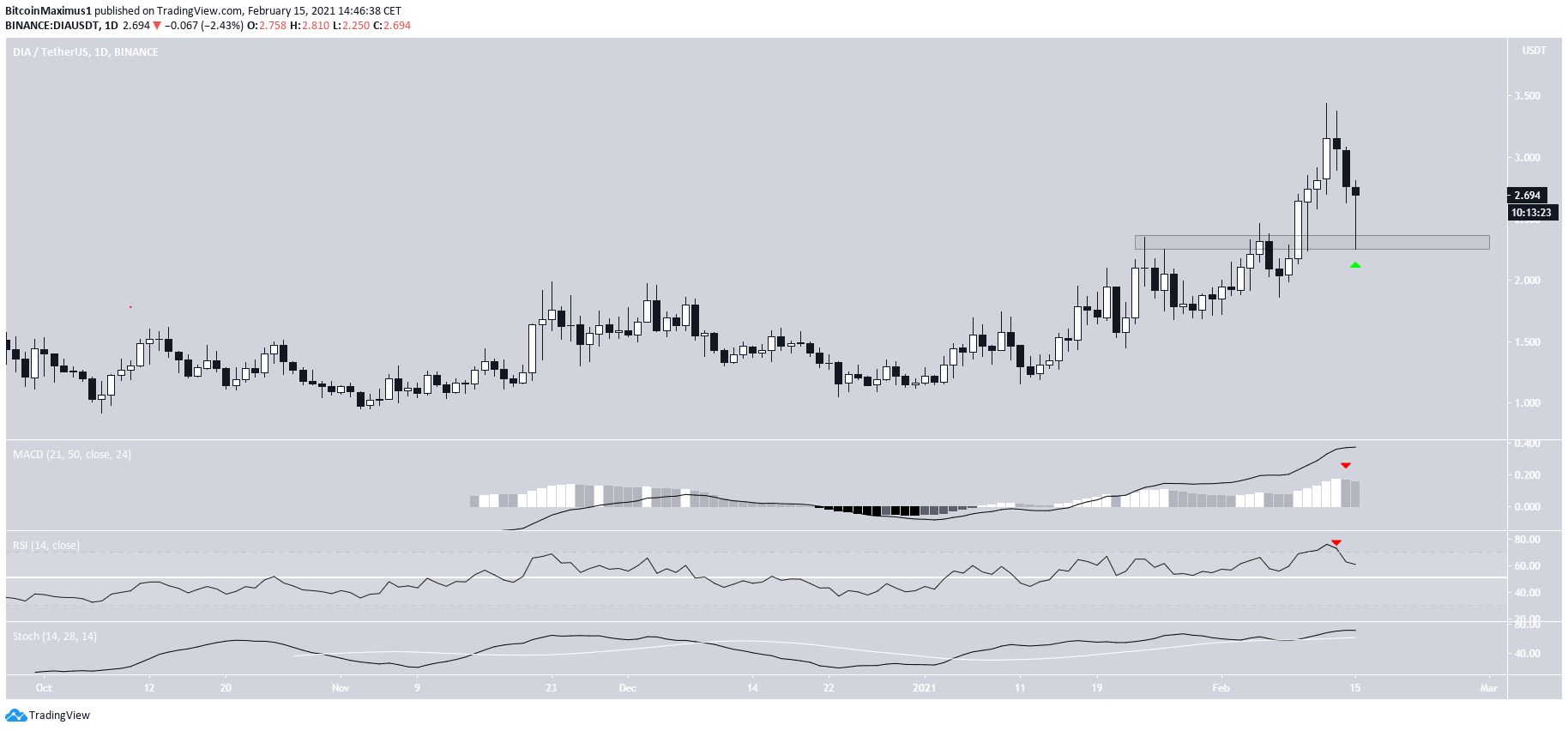

On Feb. 9, DIA broke out from the $2.30 area, which previously had acted as resistance. It reached a high of $3.43 on Feb. 12 before declining to validate the $2.30 area as support. The fall left a long lower wick behind, and DIA is currently trading at $2.70.

Despite some signs of weakness, like the RSI below 70 and one lower momentum bar in the MACD, technical indicators are still bullish. This suggests that DIA is likely to move higher once more.

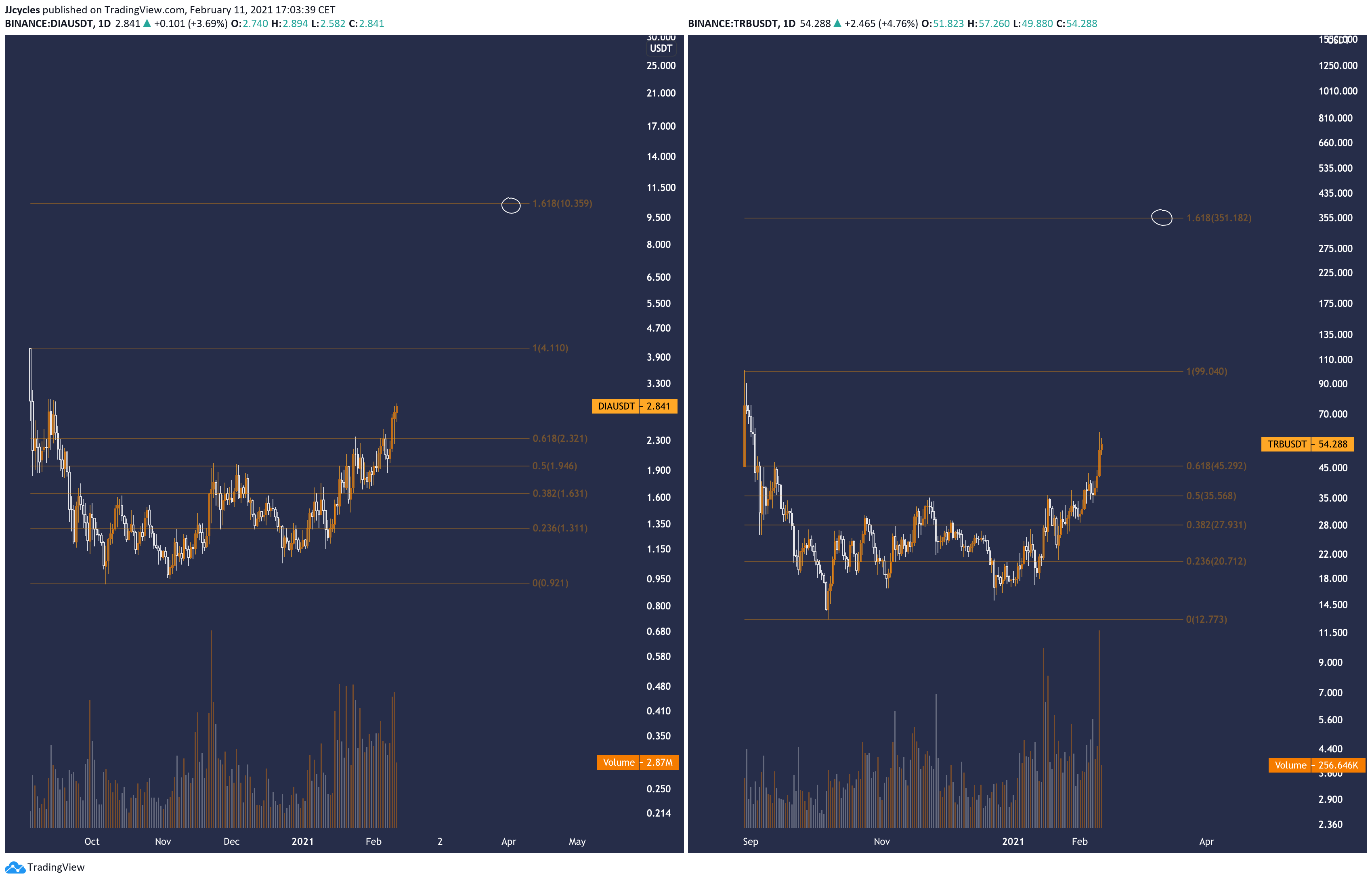

Cryptocurrency trader @JJJCycles outlined a DIA chart, stating that the price should reach a new all-time high and could go all the way up to $11 afterward.

The wave count suggests that DIA has just begun wave five of a bullish impulse that began on Nov. 2020.

It’s possible that yesterday’s decline completed wave four, and DIA will now increase as part of wave five, completing the bullish impulse.

The two most likely targets for the top of this move are between:

- $3.80-$3.90 – found by the 0.618 Fib projection of waves 1-3 and the 1.61 length of wave one.

- $4.74-$4.94 – found by the 1 Fib projection of waves 1-3 and 4.2 external retracement of wave two.

SRM Reaches New All-Time High

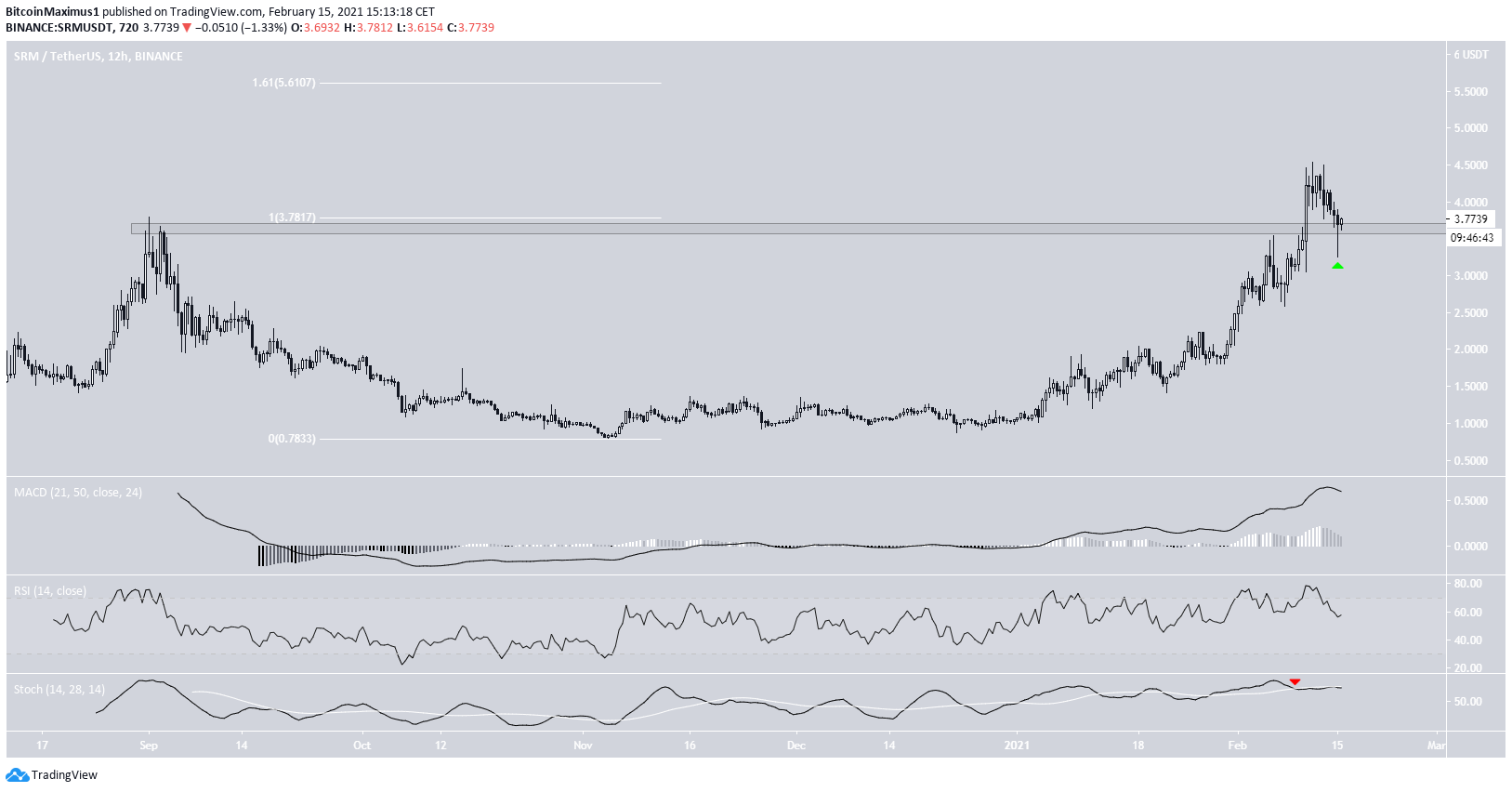

SRM reached an all-time high price of $4.53 on Feb. 11, before decreasing. However, the decrease only took SRM to the previous all-time high resistance area at $3.65, after which it bounced.

Technical indicators provide a mixed outlook.

While the Stochastic Oscillator has made a bearish cross, the RSI has generated hidden bullish divergence, a sign of trend continuation. Furthermore, yesterday’s decline left a very long lower wick in place.

Since SRM is at an all-time high, we need to use a Fib retracement on the most recent downward move to find the resistance area. Doing so gets us to a resistance area of $5.60.

The wave count suggests that SRM has just begun wave five of a bullish impulse which began in Nov. 2020. It’s possible that yesterday’s increase was the bottom of wave four.

The most likely target for the top of the impulse is at $6.90, while the next most likely target is the previously outlined $5.60 resistance area.

Conclusion

To conclude, both DIA and SRM should continue their upward movement towards their closest respective resistance areas. Since SRM is at an all-time high, it may increase at an accelerated rate.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.