Bernstein analysts suggest that DeFi may perform well if the Federal Reserve cuts US interest rates. International liquidity and rate differentials may prove key for crypto.

These predictions contradict mounting concerns that rate cuts will harm investment in Bitcoin and Ethereum.

Rate Cuts Might Spell Trouble

As the US economy continues its doldrums of perceived inflation and cost-of-living increases, pressure is rising to cut Fed interest rates. Three Democratic Senators called for “aggressive” measures, Bloomberg reported Monday, citing Capitol Hill rumors that impending rate cuts may be light.

In their letter, Senators Elizabeth Warren, Sheldon Whitehouse, and John Hickenlooper called for a 75-point rate cut to “mitigate potential risks to the labor market.” The cuts’ exact terms are disputed between different factions, but it’s extremely likely that some form of them will pass.

In the eyes of the crypto community, however, these proposed cuts are more controversial. Surveys from Bitfinex claim that Bitcoin’s price may bounce immediately upon rate cuts, but its data suggests that signals ultimately turn bearish in the aftermath.

Maruf Yusupov, CEO of Deenar, told BeInCrypto that the current macroeconomic trends have triggered a major distinction between Bitcoin and gold.

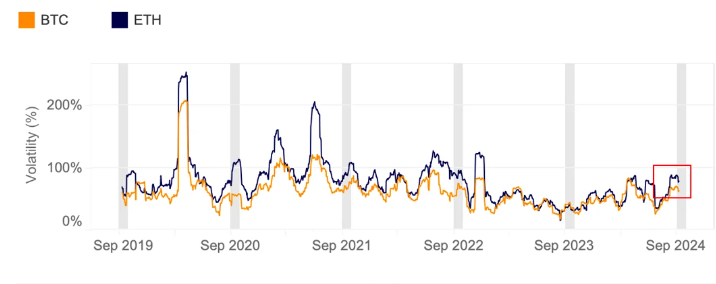

“While Bitcoin has dropped as low as $57,578.35 amid an intense burst of volatility, the price of gold has maintained a positive growth to $2,579.21. The reasons for this Bitcoin trend are not far-fetched and are hinged on the uncertainty surrounding the potential Interest rate cut from the US Federal Reserve. Despite the potentially positive prospect of this cut for the broader market, investors are still cautious of general uncertainty,” Yusupov said in an exclusive interview.

Indeed, lowered interest rates incentivize new investment in US markets, but they also signal overall weakness. Bitcoin is perceived as a risk-on asset, and therefore, rate cuts could have unintended consequences. Overall, investment goes up, but the market shuns riskier assets.

“Another major trend between both assets is the slump in their key ETF products over the past month. Investors are majorly taking bets to preserve their capital at a time when there are signs of economic turmoil. The limited volatility of Gold has made it an attractive alternative in the push to hedge against the underlying uncertainty. This pivot has seen the Bitcoin ETF product shed off the intense capital recently, with BlackRock surprisingly joining the outflow trend,” Yusupov explained.

Read more: How To Get Paid in Bitcoin (BTC): Everything You Need To Know

Additionally, September is generally a weak month for the stock market, independent of these cuts. For crypto markets, these challenges may prove daunting.

Bernstein’s Bullish Narrative

However, a report from analysts at Bernstein is painting a rosier picture. Analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia claimed that DeFi as an industry is able to take advantage of new opportunities.

Specifically, global traders can provide liquidity on decentralized markets for USD-backed stablecoins. In this way, DeFi can take advantage of US-specific market conditions and earn yields from the dollar’s performance.

This sentiment echoes some of Arthur Hayes’ August 2024 commentary on rate cuts. Specifically, he paid special attention to interest rate differentials between the US and other currencies, especially the yen. Global traders can utilize these differentials using DeFi to open up new profits.

“With a rate cut likely around the corner, DeFi yields look attractive again. This could be the catalyst to reboot crypto credit markets and revive interest in DeFi and Ethereum,” claimed Bernstein’s analysts.

Read more: Top 11 DeFi Protocols To Keep an Eye on in 2024

These predictions have spurred Bernstein to add Ethereum-based liquidity protocol Aave to its portfolio. Specifically, the firm added Aave at the expense of two derivative protocols, GMX and Synthetix, which were removed.

This clearly signals two market trends that Bernstein anticipates. First of all, lending markets and international liquidity may prove the key to long-term gains. Second, despite recent poor performance, it’s betting on Ethereum and protocols built on its blockchain.

So far, many factors are still in the air. If rate cuts take place at all, they could be between 25 and 75 points. Nonetheless, Bernstein’s bold predictions can help build optimism in the space.