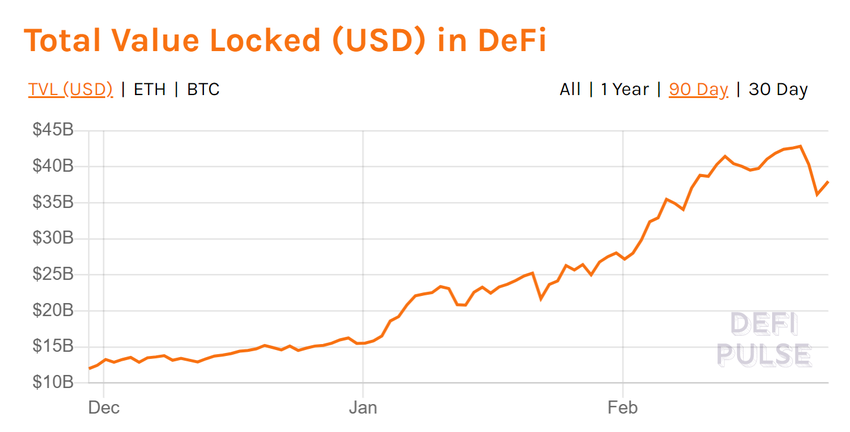

Amid the 2021 crypto bull run, the decentralized finance (DeFi) markets have more than doubled in total value locked (TVL) year to date.

DeFi markets are showing a growth of 143% so far in 2021. This equates to $37.69 billion combining lending protocols, decentralized exchanges, derivatives, payments, and asset protocols.

Growth Dominated by Lending Protocols and DEXs

Among these various sectors, the lending protocol MakerDAO has achieved 16.47% dominance in the market according to data from DeFi Pulse. Maker DAO currently leads the pack with $6.21 billion total value locked.

The other two most prominent lending protocols, Aave and Compound, have nearly $10 billion in combined value locked. Lending protocols have 133% more value locked compared to their values From Jan. 1, 2021.

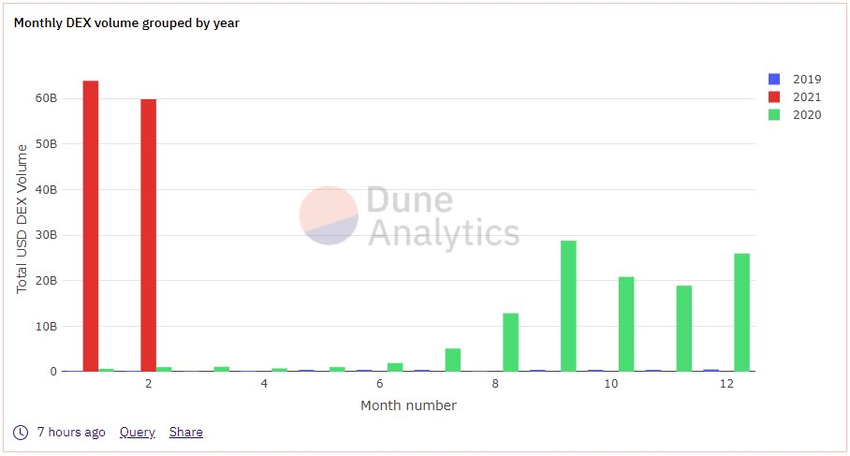

Decentralized exchanges (DEX) are the second-most prominent type of DeFi platforms after the lending protocols mentioned.

As pointed out by Bloqport Insights in a tweet, DEXs have witnessed more than $120 billion in volumes to date in 2021. This is higher than the volumes these exchanges processed in all their years combined before 2021.

At the current rate, DEX volumes are set to reach $67 billion in value by the end of the month. This would surpass the previous monthly all-time high of $63 billion in January 2021.

The dominating DEX is Curve Finance, holding over 30% of the total value locked in all DEXs. Uniswap and SushiSwap, whose competitive saga made big news in September last year, are both honorable mentions.

DeFi Linked to Flagship Cryptocurrency Assets

DeFi is primarily linked to Ethereum as an asset since a majority of protocols and dApps are built on the Ethereum blockchain. However, the market also seems to respond to price changes in Bitcoin as well.

This influence was evident on the most recent price event in the cryptocurrency markets on Feb. 22 — often being referred to as “Bloody Monday.” Along with Bitcoin and nearly every other altcoin, the DeFi market experienced a drop in value as well. The total value locked in the market fell from an all-time high of nearly $43 billion on Feb. 22 to $36.16 billion on Feb. 24.

Although DeFi growth in 2021 seems to be extremely rapid, there are signs pointing towards the possibility of this growth being sustainable. Institutional asset manager, Grayscale Investments have also listed DeFi-related assets like Aave, Cosmos, and Polkadot to expand its portfolio. Even the privacy-focused browser, Brave even announced the launching of its browser-integrated DeFi wallet with access to a DEX that users can trade their assets on.